Biswap Airdrop Guide: How to Claim, Eligibility, Risks and Rewards

When working with Biswap airdrop, a token giveaway that rewards users of the Biswap decentralized exchange. Also known as BSW token distribution, it helps grow the platform’s community and liquidity. The Biswap airdrop ties directly to Biswap token (BSW), the native utility coin that powers fees, staking, and yield farms on the Biswap DEX. To receive the giveaway you also need a Binance Smart Chain (BSC) wallet that can hold BEP‑20 tokens. In practice, the Biswap airdrop encompasses token allocation, eligibility criteria, and claim processes, while requiring users to hold BSW or complete specific tasks such as providing liquidity or swapping assets. This first paragraph sets the stage: the airdrop is a community‑building tool, a marketing incentive, and a way to bootstrap liquidity on an automated market maker platform.

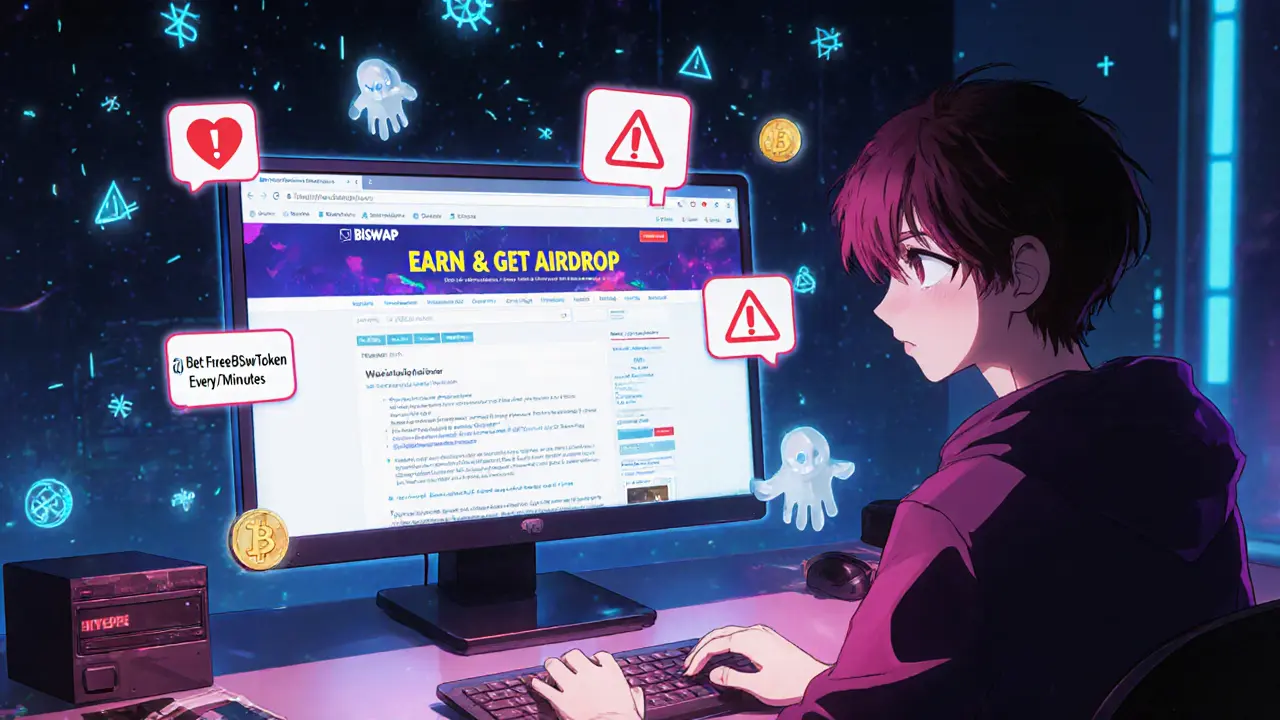

One key related concept is the airdrop mechanism, which decides how many tokens each participant receives based on factors like trade volume, staking power, or referral activity. Another crucial entity is the decentralized exchange (DEX) model; Biswap operates as an automated market maker (AMM) that lets users trade without order books, and the health of its liquidity pools directly influences the size of airdrop rewards. Understanding these entities creates a clear semantic chain: the DEX influences pool size, the pool size feeds the airdrop mechanism, and the mechanism determines token distribution. Besides the technical side, you’ll want to watch out for common pitfalls – fake claim sites, phishing links, and duplicated wallet addresses. The airdrop also interacts with Biswap’s broader tokenomics: BSW holders earn fees, can stake for extra rewards, and may benefit from future governance votes. By grasping how the DEX, the airdrop mechanism, and the BSW token interlock, you can estimate the real value of the giveaway and avoid getting caught in scams.

What to Expect from the Biswap Airdrop Collection

Below you’ll find practical guides that break down each piece of the puzzle. We start with a step‑by‑step walkthrough on setting up a BSC wallet, linking it to Biswap, and navigating the claim page safely. Next, we dive into eligibility – what trade volume thresholds or liquidity provision levels you need to hit, and how referrals can boost your share. A separate article explains how to verify an official airdrop announcement, spot phishing attempts, and protect your private keys. We also cover how the airdrop fits into Biswap’s tokenomics, showing you how staking BSW after the claim can generate extra yield and why a larger liquidity pool can lead to bigger future airdrops. Whether you’re a seasoned DeFi trader looking to boost your BSW holdings or a newcomer curious about token giveaways, the posts ahead give you actionable insight without the fluff. Armed with this context, you’re ready to explore the detailed articles below and decide how to take part in the next Biswap airdrop.