Cryptocurrency Exchange Review: Security, Fees & Features Compared

When diving into cryptocurrency exchange review, a systematic look at how an exchange protects funds, charges users, and builds its product. Also known as exchange analysis, it helps traders separate hype from real value.

One of the first things a solid review tackles is exchange security, the set of measures like cold storage, two‑factor authentication, and insurance that keep assets safe. Security influences exchange reputation and determines whether you’ll sleep well after a big trade. Next up, a review breaks down trading fees, the percentage or flat costs applied to spot, futures, and margin orders. Fees directly affect profitability, so a clear fee table is a must‑have in any cryptocurrency exchange review. Finally, the assessment looks at platform features—advanced charting, API access, and copy‑trading tools—that shape the user experience.

What to Look for in an Exchange Review

An effective review connects three core ideas: security, cost, and functionality. First, exchange reviews encompass security analysis because without strong protection, even the best features mean nothing. Second, exchange reviews require fee breakdowns as traders need to know how fees eat into returns. Third, regulatory compliance influences exchange reputation, especially as jurisdictions tighten rules around KYC and AML. When these elements line up, the review gives you a realistic picture of whether the platform fits your trading style.

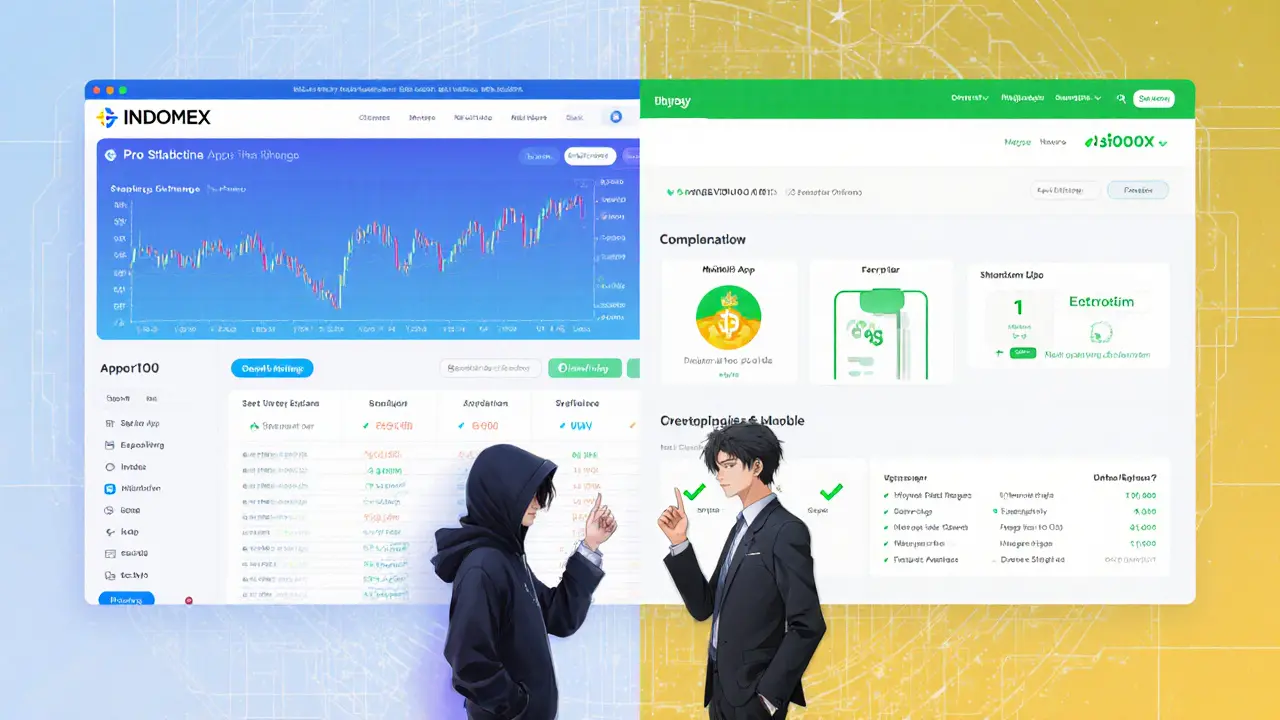

Our collection below shows how different platforms stack up. You’ll find deep dives into Bitunix, CRXzone, SAFEX, and others, each evaluated on the same security, fee, feature, and compliance criteria. Whether you’re a beginner hunting low fees or an experienced trader needing advanced futures tools, the reviews give actionable takeaways you can apply right away.

Ready to see how each exchange measures up? Scroll down to explore detailed analyses, compare key metrics, and find the platform that matches your goals.