Most companies don’t need to build a bank. But they do need to offer banking features-like payments, accounts, or cards-inside their apps. That’s where BaaS comes in. Banking-as-a-Service lets non-bank businesses embed real financial services without handling compliance, infrastructure, or licensing. The catch? Getting it to work with your existing systems isn’t plug-and-play. It’s a technical puzzle with financial stakes.

What BaaS Actually Does

BaaS isn’t just another API. It’s a licensed financial provider-like Synapse, Marqeta, or Unit-that gives you access to real banking infrastructure through APIs. You don’t hold a bank charter. You don’t manage FDIC insurance. You don’t process ACH transfers yourself. Instead, you use their systems, wrapped in your brand.

Think of it like renting a kitchen instead of building one. You still cook, serve, and manage customers. But the stove, fridge, and health inspections? Someone else handles it. BaaS does the same for banking: account creation, card issuance, payments, fraud monitoring, and even regulatory reporting-all delivered through clean, documented APIs.

Why Integration Is the Hard Part

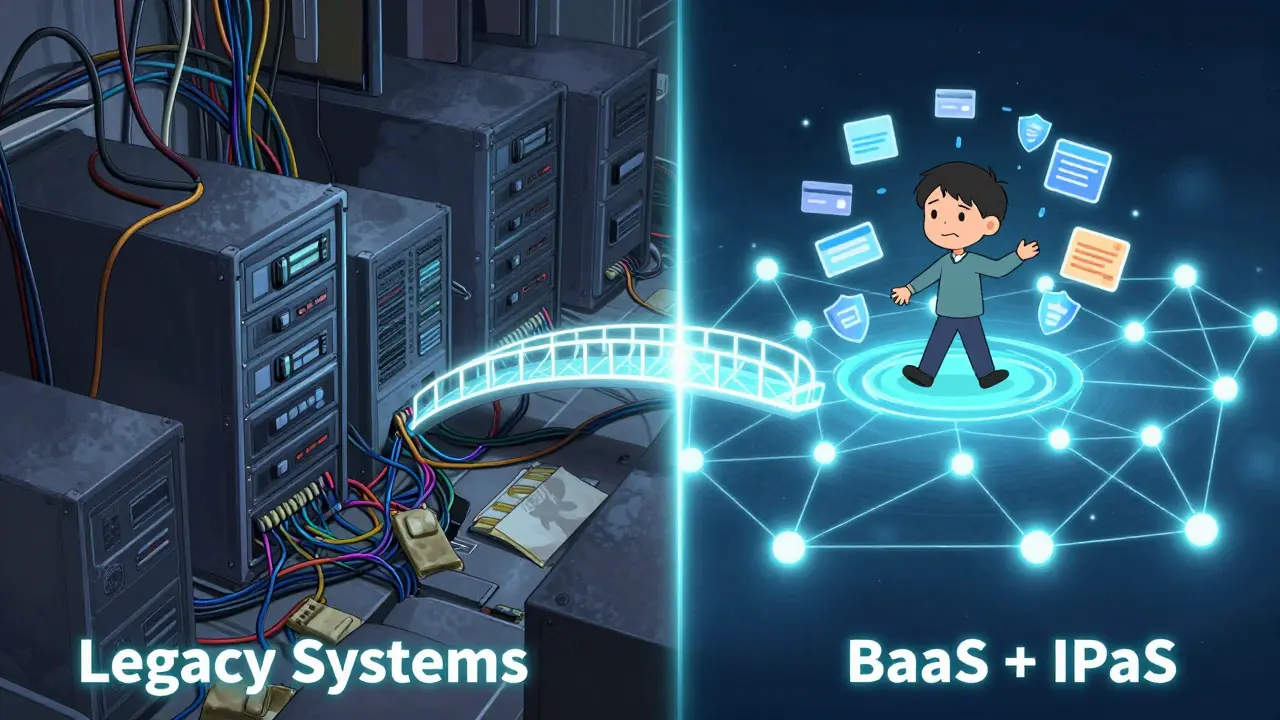

Most businesses already have systems running: CRM, ERP, accounting software, loyalty platforms, mobile apps. These systems weren’t built to talk to banks. They use old protocols, custom databases, or outdated middleware. Connecting them to modern BaaS APIs means bridging decades of tech debt.

Let’s say you run a SaaS platform for freelancers. You want to offer instant payouts to your users’ bank accounts. Your current system stores payment data in a MySQL database. Your invoicing tool talks to QuickBooks via a clunky CSV upload. Your mobile app uses React Native. Your BaaS provider gives you a REST API with JSON responses. Now you have to make all of it work together-without breaking anything.

This isn’t just coding. It’s workflow redesign. You need to map data fields: user_id in your CRM → customer_id in BaaS. Payment status in QuickBooks → transaction ID in BaaS. User phone number → KYC verification input. One mismatch, and money gets stuck or customers get errors.

The Core Integration Patterns

There are three ways BaaS typically connects to legacy systems. Pick the right one-or combine them.

- Data consistency: You’re migrating from one system to another. Old data must match new data exactly. If a user had $500 in your old payment system, they must have $500 in the BaaS account. No rounding errors. No delays. This requires batch syncs and reconciliation scripts.

- Composite services: Your app pulls data from multiple sources. Your dashboard shows a user’s balance from BaaS, their invoices from QuickBooks, and their support tickets from Zendesk-all in one view. This needs real-time APIs and caching to avoid slow load times.

- Multi-step processes: A customer applies for a card. Your app collects ID docs → sends them to BaaS for KYC → waits for approval → creates the card → pushes card details to your billing system → emails the user. Each step must trigger the next. If one fails, the whole flow rolls back or alerts an operator.

Most companies start with composite services. It’s less risky. You keep your old system running while testing the new one. Once it’s stable, you phase out the legacy piece.

Tools That Make It Work

You don’t have to code every connection from scratch. Integration Platform as a Service (iPaaS) tools handle the heavy lifting. These are like automated translators between systems.

Platforms like ApiX-Drive, MuleSoft, or Workato come with pre-built connectors for BaaS providers, Salesforce, NetSuite, and more. You drag and drop blocks: “When payment is created in BaaS, update invoice status in QuickBooks.” No Python scripts. No manual webhook setup.

For custom needs, you might use Node.js or Python with libraries like Express or FastAPI to build lightweight middleware. But even then, you’ll likely use an iPaaS for monitoring and error handling.

Frontend? Use React, Angular, or Vue.js to build user interfaces that pull live balance data from BaaS APIs. Cloud hosting on AWS or Azure gives you scalable APIs, secure storage, and built-in encryption.

Security Isn’t Optional

You’re handling money. And personal data. That means security isn’t a feature-it’s the foundation.

- TLS 1.3 encrypts every API call. No exceptions.

- OAuth 2.0 and OpenID Connect control who can access what. Your app doesn’t store passwords. It uses tokens.

- Encryption at rest protects stored data. Even if a server is breached, the data is useless without the key.

- Webhook signing ensures BaaS notifications aren’t fake. Every incoming event has a cryptographic signature you verify.

Compliance is another layer. If you serve users in the EU, you need GDPR for data privacy. If you’re in the U.S., CCPA applies. For payments, PSD2 mandates strong customer authentication. And AML rules require transaction monitoring and suspicious activity reporting.

Good BaaS providers handle most of this for you. But you still need to audit their compliance certs-SOC 2, ISO 27001, PCI DSS-and make sure your own data handling follows their rules.

Choosing the Right BaaS Provider

Not all BaaS platforms are equal. Here’s what to compare:

| Feature | Synapse | Marqeta | Unit | Plaid |

|---|---|---|---|---|

| Account creation | Yes | Yes | Yes | No |

| Card issuance | Yes | Yes | Yes | No |

| ACH payments | Yes | Yes | Yes | Yes |

| Real-time balance | Yes | Yes | Yes | Yes |

| KYC/AML tools | Yes | Yes | Yes | Yes |

| Pre-built iPaaS connectors | Yes | Partial | Yes | No |

| Best for | Startups, fintechs | Marketplaces, card-heavy apps | Small businesses, embedded finance | Account linking, not banking |

Plaid is great for connecting to existing bank accounts-but it doesn’t issue accounts or cards. Marqeta is strong for physical and virtual cards, especially for marketplaces. Unit is simple and developer-friendly for SMBs. Synapse offers full-stack banking for complex use cases.

What Goes Wrong (And How to Avoid It)

Here are the top three failures-and how to stop them:

- Wrong data mapping: User IDs don’t match between systems. Result: payments go to the wrong person. Fix: Use UUIDs, not auto-incrementing numbers. Sync IDs on creation, not later.

- Unmonitored webhooks: BaaS sends a payment success alert. Your system doesn’t respond. Money is sent, but your app shows “pending.” Fix: Set up alerts for failed webhook deliveries. Log every event. Test with mock data.

- Ignoring rate limits: BaaS APIs have caps. Hit them too hard, and you get blocked. Fix: Implement exponential backoff. Queue requests. Don’t blast 1,000 API calls at once.

Test everything. Use sandbox environments. Simulate network failures. Try sending invalid data. See how your system handles it. BaaS providers give you test keys. Use them.

Where Blockchain Fits In

Blockchain isn’t required for BaaS-but it’s starting to show up. Some providers now offer tokenized assets, crypto settlements, or smart contract-triggered payments. For example, a BaaS provider might let you issue a digital token that represents $10 in credit. When a user redeems it, a smart contract automatically triggers a payout.

This isn’t mainstream yet. But if you’re building for DeFi, Web3, or digital collectibles, blockchain-backed BaaS could give you an edge. For most businesses? Stick to traditional APIs. They’re faster, cheaper, and regulated.

Getting Started: Your 5-Step Plan

- Define your use case: What exact banking feature do you need? Payouts? Cards? Holding balances? Don’t try to do everything at once.

- Choose a BaaS provider: Pick one that matches your scale and compliance needs. Start with a provider that offers free sandbox testing.

- Map your data flows: Write down every system involved. What data moves where? What triggers it? Use a flowchart.

- Build with iPaaS or middleware: Use pre-built connectors where possible. Code only what’s unique to your business.

- Test, monitor, iterate: Launch to 1% of users. Watch logs. Fix bugs. Then scale.

You don’t need a team of 20 engineers. You need one person who understands APIs, one who knows your internal systems, and a provider that does the heavy lifting.

What’s Next?

BaaS is no longer a niche tool for fintech startups. It’s how Shopify lets sellers offer buy-now-pay-later. It’s how Uber drivers get paid instantly. It’s how small businesses accept card payments without a merchant account.

The barrier to entry is gone. The real challenge? Making it work with the systems you already have. That’s where most companies stumble. But if you focus on clean data, secure connections, and incremental testing-you won’t be one of them.

Do I need a banking license to use BaaS?

No. BaaS providers are licensed financial institutions. You act as their partner or white-label client. You don’t hold money or issue accounts yourself-you use theirs under their license. This is the whole point of BaaS: you skip the regulatory burden.

How long does BaaS integration take?

Simple integrations-like adding a payment button-can go live in 2-4 weeks. Complex ones involving multiple legacy systems, custom workflows, or compliance checks take 3-6 months. Most companies underestimate the time needed for testing and data mapping. Plan for 30% longer than your initial estimate.

Can I switch BaaS providers later?

Yes, but it’s expensive. Each provider uses different APIs, data formats, and ID systems. Switching means re-mapping every user, transaction, and card. If you plan to switch, choose a provider with clean, well-documented APIs and avoid proprietary extensions. Use an abstraction layer in your code so you can swap providers without rewriting everything.

Is BaaS cheaper than building my own banking system?

By far. Building a banking system from scratch costs $5M-$20M and takes 2-5 years. You’d need compliance teams, fraud analysts, payment processors, and a bank charter. BaaS starts at $0-$500/month for basic plans. You pay per transaction or per user. The savings aren’t just in money-they’re in time, risk, and focus.

What happens if the BaaS provider goes out of business?

Your users’ money is still protected. BaaS providers partner with FDIC-insured banks. If the BaaS company shuts down, your users’ funds are held in the partner bank’s name and can be transferred to another provider. Always ask: “Which bank holds the funds?” and get a copy of the custodial agreement before signing up.

Jake Mepham

December 21, 2025 AT 21:30BaaS is the secret sauce for startups who want to move fast without getting buried in compliance hell. I’ve seen teams waste months trying to build their own payment rails-only to realize they’re just reinventing Synapse with worse UX. Just plug in, brand it, and go. The real win? Your engineers can focus on what matters: your product, not bank licenses. Seriously, if you’re not using BaaS and you’re not a bank, you’re leaving money on the table.

Craig Fraser

December 22, 2025 AT 09:00Interesting. But where’s the data on churn? Everyone talks about integration ease, but no one mentions how often users get confused when their ‘instant payout’ takes 3 business days because the BaaS provider’s ACH gateway is down. It’s not magic-it’s just someone else’s tech debt you’re outsourcing.

Sybille Wernheim

December 22, 2025 AT 10:45YES. This is the future. I run a freelance platform and we switched to Unit last year. Our payout time went from 5 days to 2 hours. Users cried happy tears. Seriously. One freelancer sent us a meme of a dog in a tuxedo saying ‘I got paid before my coffee cooled.’ That’s the power of good BaaS. Stop overcomplicating it. Just pick one, test it, and go live.

Cathy Bounchareune

December 22, 2025 AT 19:20It’s like swapping your typewriter for a quantum keyboard-you still write the same words, but now they teleport across continents with glitter and a side of regulatory compliance. BaaS doesn’t just connect systems; it rewrites the emotional contract between businesses and their users. No more ‘your payment is processing’ anxiety. Just instant, silent, beautiful money magic. And yes, the API docs are still terrifying-but worth it.

Sheila Ayu

December 24, 2025 AT 17:45Wait-so you’re telling me I don’t need to be a bank to offer bank features?!!! What about the 17 different state laws?!!! And what if someone uses this to launder money?!!! And who’s liable if the webhook fails at 3 a.m. on a Sunday?!!! You’re all just ignoring the legal landmines here!!!

Dan Dellechiaie

December 26, 2025 AT 03:30Look, if you’re still using MySQL for financial data in 2025, you’re not a startup-you’re a time capsule. BaaS isn’t the problem. Your tech stack is. Stop blaming the provider. Fix your middleware. Use Kafka. Use event sourcing. Stop treating payments like a glorified Excel sheet. Also, Plaid isn’t BaaS. Stop lumping them together. You’re embarrassing the industry.

Shubham Singh

December 27, 2025 AT 00:53While your article is well-structured, it lacks critical context regarding jurisdictional fragmentation. In India, for instance, RBI mandates that all embedded finance solutions must be co-branded with a licensed NBFC. Your examples are U.S.-centric and thus misleading for global audiences. A more rigorous approach would acknowledge regulatory asymmetry rather than assuming homogeneity.

Charles Freitas

December 27, 2025 AT 21:51Oh wow. Another ‘BaaS is easy’ post. Let me guess-you’ve never had to debug a webhook that silently dropped 12k transactions because someone used ‘customer_id’ instead of ‘customerId’? Or maybe you think OAuth 2.0 is just a fancy password? This isn’t a guide-it’s a fairy tale for devs who think APIs are magic wands. The real integration takes 6 months, 3 rewrites, and a therapist.

Sarah Glaser

December 29, 2025 AT 20:54Beyond the technicalities, BaaS represents a philosophical shift: from ownership to access. We no longer build systems to control money-we curate experiences around it. The bank is no longer a place; it’s a function. And in that shift, we’re not just changing code-we’re redefining trust. The real challenge isn’t integration. It’s designing interfaces that make users feel safe without understanding how it works.

Grace Simmons

December 30, 2025 AT 05:15Don’t let these tech bros fool you. The U.S. is not the world. If you’re building for Europe, you’re dealing with PSD2, GDPR, and a dozen local payment schemes. BaaS providers don’t magically solve that. You still need local legal counsel. And no, ‘we used MuleSoft’ doesn’t make you compliant. This article reads like American exceptionalism with API keys.

Helen Pieracacos

December 31, 2025 AT 04:04So you’re saying I can outsource my entire financial compliance to a company that’s probably based in a tax haven and has a CEO who’s never heard of my country? Cool. And when they get hacked, who gets sued? My users? My investors? My soul?

Dustin Bright

December 31, 2025 AT 07:18bro this is lit 🤯 i used unit for my side hustle and now my users get paid before their morning coffee ☕️ no more ‘payment pending’ for 3 days 😭 the docs were kinda messy but workato saved me 🙏

Melissa Black

January 2, 2026 AT 05:13Integration patterns are correctly identified but insufficiently nuanced. Composite services require idempotency keys and at-least-once delivery semantics. Data consistency demands reconciliation windows and audit trails. Multi-step processes require state machines, not linear workflows. Without these, you are not integrating-you are gambling with financial data. The article omits these foundational engineering principles.

Naman Modi

January 2, 2026 AT 18:18Plaid is not BaaS. Stop saying it is. You’re confusing people. Also, why are you recommending React for frontend? Use Solid.js. It’s faster. And no, you don’t need AWS. Use Fly.io. Cheaper. And stop using UUIDs. Use Snowflake IDs. Less storage. More scalable. You’re all doing it wrong.

Rishav Ranjan

January 4, 2026 AT 15:07Too long. BaaS = good. Don’t build your own bank. Done.

Steve B

January 5, 2026 AT 18:25One must ask: is the pursuit of embedded finance not a symptom of late-stage capitalism’s erosion of institutional trust? We outsource not because it’s efficient, but because we fear responsibility. The BaaS provider becomes the new priest-blessing transactions, absolving us of moral and legal weight. A beautiful, terrifying architecture of avoidance.

Sophia Wade

January 6, 2026 AT 11:23Imagine a world where your loyalty points become a liquid asset, redeemable for cash, crypto, or a free latte-all orchestrated by a BaaS-powered smart contract. The future isn’t just embedded finance-it’s embedded possibility. The API isn’t a tool. It’s a portal. And we’re just starting to see what’s on the other side.

Brian Martitsch

January 7, 2026 AT 20:55If you’re using Workato, you’re not a developer-you’re a clicker. Real engineers write custom middleware. Also, Synapse is for amateurs. Use Marqeta if you want real card controls. And no, you don’t need a PhD to understand TLS 1.3. If you do, go back to school.

Rebecca F

January 8, 2026 AT 19:50Everyone’s so excited about BaaS like it’s the second coming. But what about the 10 million small businesses who can’t afford the 5k/month enterprise plan? Or the ones in rural areas with spotty internet? You’re building a luxury toy for Silicon Valley while ignoring the people who actually need financial access. This isn’t innovation-it’s exclusion dressed up in API docs.

vaibhav pushilkar

January 10, 2026 AT 08:09Great guide. For beginners, start with Unit. Their sandbox is free, docs are clear, and their support replies in under 2 hours. I helped a client go live in 3 weeks. Focus on mapping user IDs first. Everything else follows. Also, use webhooks with retry logic-don’t trust the ‘success’ response.

SHEFFIN ANTONY

January 11, 2026 AT 17:33Why are you all still using REST? GraphQL would solve half your data mapping issues. Also, BaaS providers are just middlemen. The real power is in blockchain-based settlement layers. You’re all clinging to legacy rails like it’s 2010. Wake up.

Vyas Koduvayur

January 13, 2026 AT 05:28Let me break this down for you. You think you’re saving money with BaaS? You’re not. You’re paying per transaction, per user, per API call, per webhook retry, per compliance audit, per failed sync, per customer support ticket, per legal consultation, per data breach insurance premium, per vendor lock-in penalty, per migration cost when you finally realize you need to switch, and per existential dread when you see your CFO’s face after the first month’s invoice. The ‘$500/month’ plan? It’s a lie. It’s a trap. It’s a financial black hole with a pretty dashboard.

Lloyd Yang

January 13, 2026 AT 05:39I’ve been through this twice. First time, we tried to DIY everything. Lost 6 months and 3 engineers. Second time, we used Synapse + Workato. Got live in 5 weeks. The key? Don’t try to rebuild your whole stack. Just connect the dots. Use iPaaS for the boring stuff. Write code only for the unique parts-like your loyalty logic or custom payout rules. And test like your users’ money depends on it… because it does. Also, get coffee. You’ll need it.

Jacob Lawrenson

January 13, 2026 AT 06:57Just did this for my client’s food delivery app. Now drivers get paid instantly after each delivery. Their faces when they saw the money hit their account? Priceless. 😊 BaaS isn’t tech-it’s empathy. You’re not just moving money. You’re changing lives. And yeah, the API docs are a mess. But it’s worth it.

Jake Mepham

January 15, 2026 AT 06:21And don’t forget: the moment you launch, someone’s going to try to exploit your webhook. Set up alerts. Log everything. Test failure modes. I once had a dev think ‘HTTP 200’ meant success. It didn’t. The BaaS sent a 200 but the payload was empty. Took us 3 days to find it. Don’t be that guy.