When you're tired of paying $2 in gas fees just to swap ETH for USDC on Uniswap, BenSwap offers a real alternative - if you're willing to trade inside a smaller ecosystem. Launched in 2024 as the first automated market maker on the SmartBCH blockchain, BenSwap isn’t trying to beat Uniswap. It’s trying to serve a different crowd: people who want near-zero fees, fast trades, and don’t need access to 200,000 tokens - just the ones built on Bitcoin Cash’s sidechain.

How BenSwap Works (And Why It’s Different)

BenSwap runs on SmartBCH, a blockchain that looks and feels like Ethereum but runs on Bitcoin Cash’s network. That means it’s EVM-compatible - so your MetaMask wallet works just fine - but transaction costs are a fraction of what you’d pay on Ethereum. On average, swapping tokens on BenSwap costs $0.002. That’s 99.9% cheaper than Uniswap, where the same trade costs over $1.80 as of January 2026.

It uses the same AMM model as Uniswap: liquidity pools, price curves, and automated trades. But BenSwap added concentrated liquidity in October 2025, letting providers lock funds only within specific price ranges - just like Uniswap V3. This lets you earn more fees with less capital, which is a big deal for small-time liquidity providers.

The platform’s native token, EBEN, does two things: it gives you 0.05% cashback on every trade and lets you vote on protocol changes. It’s not a flashy governance token like UNI or AAVE, but it’s functional. And unlike many DeFi tokens, EBEN has real utility - you earn it just by using the platform.

Performance and Security

BenSwap’s speed is one of its strongest selling points. Transactions confirm in about 15 seconds. That’s faster than most Ethereum-based DEXs and even some centralized exchanges. The platform has been audited by Certik since March 2024 (Report #C2024-0347), and no critical vulnerabilities were found. That’s rare for a project on a lesser-known chain.

They’ve also updated their protocol twice since the audit - most recently in November 2025 - to patch potential flash loan attack vectors. That shows the team listens to feedback and isn’t just launching and ghosting.

But here’s the catch: security on BenSwap doesn’t mean much if the chain itself is fragile. SmartBCH has no institutional backing, no major venture capital, and no big-name partners. It’s powered by Bitcoin Cash miners who want to offer smart contracts. That’s innovative, but also risky.

What’s Available to Trade?

As of January 2026, BenSwap supports 147 token pairs. That sounds like a lot until you compare it to Uniswap’s 10,000+ pairs. Most of the tokens on BenSwap are native to SmartBCH - things like SmartBCH (BCH), EBEN, BitDAO (on SmartBCH), and a few stablecoins like USDC and USDT issued on this chain.

You won’t find Solana tokens, Polygon tokens, or even most Ethereum-based DeFi giants here. If you’re looking to trade SHIB or DOGE, you’ll need to go elsewhere. BenSwap is a closed garden. That’s fine if you’re betting on SmartBCH’s growth. It’s a problem if you want flexibility.

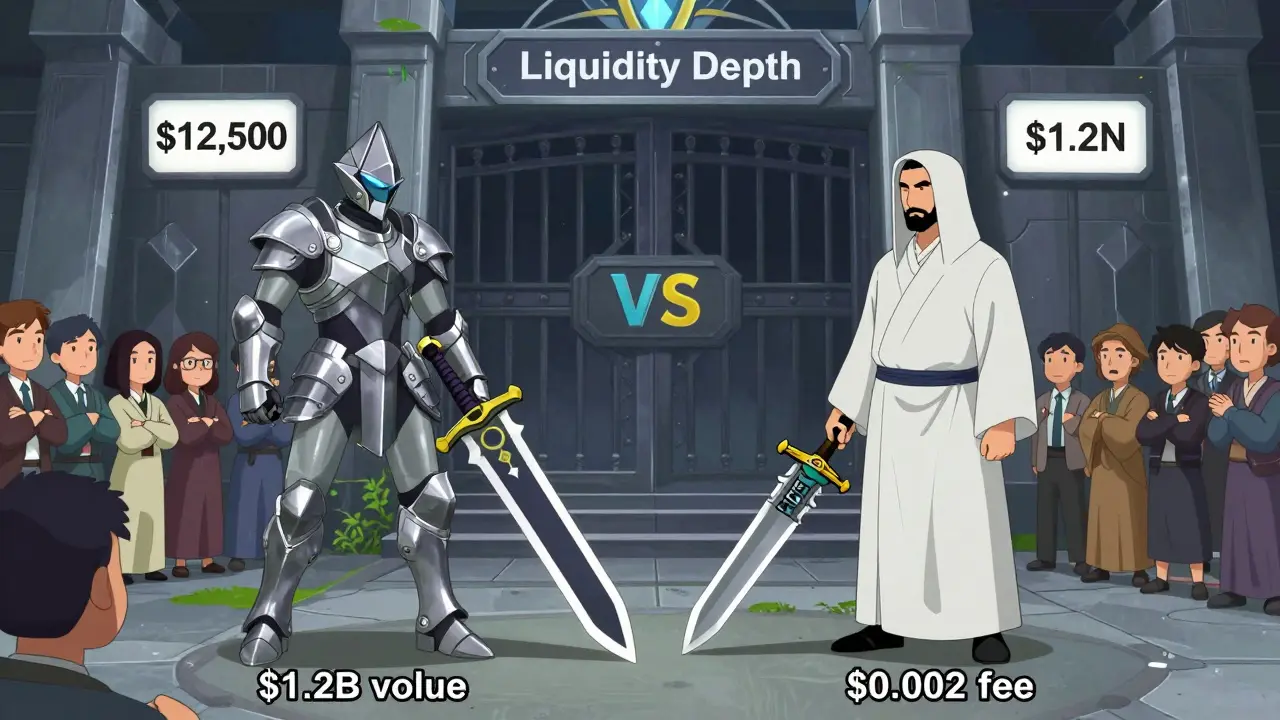

That’s why liquidity depth matters. On top pairs like EBEN/USDC, the order book depth is around $12,500. On Uniswap’s ETH/USDC pair, it’s over $1.2 million. That means if you try to trade more than $500 in a single swap, you’ll likely get hit with 2-5% slippage. Users on Reddit and Trustpilot report failed trades because the price moved too fast during execution. It’s not a bug - it’s a liquidity problem.

Total Value Locked and Market Position

BenSwap has $47.8 million locked in its liquidity pools as of January 31, 2026. That’s 63% of the entire SmartBCH DeFi ecosystem. No other DEX on the chain comes close. The second-place DEX has less than half that amount.

But globally? BenSwap ranks #87 among all DEXs by 24-hour volume, with just $2.1 million traded daily. Uniswap does over $1.2 billion. That’s not a fair comparison - but it shows how niche this is.

Still, within SmartBCH, BenSwap is the clear leader. It has 14,500 monthly active users - 42% of all DeFi users on the chain. That’s a loyal, focused community. If you’re in it, you’re not just a user - you’re part of a movement.

User Experience and Onboarding

Getting started is simple. Connect your MetaMask, Trust Wallet, or any WalletConnect-compatible wallet. No KYC. No sign-up. Just click “Swap” and go. The interface is clean, with no cluttered menus or confusing tabs. Most users complete their first trade in under 8 minutes, according to platform analytics.

The learning curve is moderate. You’ll need to understand slippage, liquidity pools, and gas fees - but BenSwap’s YouTube channel has 17 tutorial videos, and their GitHub docs are thorough. The BenSwap Academy, launched in September 2025, walks you through everything from basic swaps to advanced yield farming.

Support is community-driven. There’s a Telegram group with over 12,000 members and a Discord server with 8,700 active users. But response times average 4.2 hours. Don’t expect live chat support. If you’re stuck, you’ll likely find your answer in the forums.

Pros and Cons

- Pros: Near-zero transaction fees ($0.002 per swap), fast confirmations (15 seconds), cashback on trades via EBEN token, first-mover advantage on SmartBCH, strong audit history, intuitive interface, active development team.

- Cons: Low liquidity for large trades (slippage over 2% on $500+ swaps), limited token selection (only SmartBCH ecosystem), no institutional adoption, high risk if SmartBCH fails, no customer support team, wallet connection issues for 15% of new users.

Who Is BenSwap For?

BenSwap isn’t for everyone. If you’re trading $10,000 a day, you’ll hate the slippage. If you’re holding $500 worth of EBEN and want to swap it for USDC without paying $3 in fees, it’s perfect.

It’s ideal for:

- Bitcoin Cash supporters who want DeFi without leaving the BCH ecosystem

- Small traders who hate high gas fees and don’t need deep liquidity

- Liquidity providers who want to earn fees with minimal capital

- Developers testing DeFi on a low-cost, EVM-compatible chain

It’s not for:

- Traders who need to move large amounts quickly

- Investors looking for exposure to Ethereum or Solana tokens

- Anyone who needs 24/7 customer service

What’s Next for BenSwap?

The team isn’t sitting still. In January 2026, they launched a cross-chain bridge to BNB Smart Chain, letting users move tokens between ecosystems. That’s a big step - it reduces the risk of being trapped on SmartBCH.

EBEN was listed on CoinW on January 28, 2026, with daily volume hitting $1.2 million. That’s a sign of growing interest.

Upcoming updates include perpetual futures with 10x leverage (launching February 15, 2026) and a layer-2 integration with Manta Network in Q2 2026. If these roll out successfully, BenSwap could become a serious player in niche DeFi.

But here’s the reality: BenSwap’s future is tied to SmartBCH. If Bitcoin Cash adoption stalls, or if other Bitcoin layer-2s like Lightning or Rootstock gain more traction, BenSwap could fade. Messari’s risk model gives it a 68% survival chance over the next three years. That’s better than most alt-chain projects - but not a guarantee.

Final Verdict

BenSwap is the best DEX on SmartBCH - no contest. It’s fast, cheap, secure, and well-managed. If you’re already in the SmartBCH ecosystem, it’s your only real choice.

But if you’re new to DeFi and want flexibility, you’re better off starting with Uniswap or PancakeSwap. BenSwap is a specialized tool, not a general-purpose exchange. It’s like buying a diesel truck because you haul heavy loads every day - it’s perfect for that job, but useless if you just need to run to the grocery store.

Use BenSwap if you believe in SmartBCH. Don’t use it if you’re hoping to get rich off a token you found on CoinGecko. It’s a niche platform for a niche audience - and that’s okay.

Is BenSwap safe to use?

Yes, BenSwap has been audited by Certik with no critical vulnerabilities found. Its smart contracts are open-source and have been updated multiple times since the audit to address potential risks. However, safety also depends on the SmartBCH network. If the chain suffers a major attack or loses miner support, your funds could be at risk. Always use a non-custodial wallet and never deposit more than you’re willing to lose.

Can I trade ETH or BTC on BenSwap?

You can’t trade native ETH or BTC directly. But you can trade wrapped versions of these tokens that have been bridged onto SmartBCH. For example, there’s a WBTC token on SmartBCH, and a wrapped ETH token. These are not the same as the real assets on Ethereum or Bitcoin - they’re tokenized representations. Always check the contract address before trading.

How do I get EBEN tokens?

You can earn EBEN by trading on BenSwap - you get 0.05% cashback on every swap. You can also provide liquidity to EBEN pools and earn trading fees. As of January 2026, EBEN is listed on CoinW exchange, so you can buy it directly with fiat or crypto. The total supply is capped at 1 billion tokens, with about 320 million in circulation.

Why is my swap failing on BenSwap?

Most failed swaps are due to low liquidity and high slippage. If you’re trading more than $500, set your slippage tolerance to 3-5%. Also, try swapping during off-peak hours (early morning UTC) when fewer people are trading. Wallet connection issues can also cause failures - switch from MetaMask browser extension to the mobile app if problems persist.

Is BenSwap better than Uniswap?

It’s better only if you care about cost and speed over liquidity and token variety. BenSwap is cheaper and faster, but Uniswap has 100x more liquidity, 10x more tokens, and institutional backing. Use BenSwap for small, frequent trades on SmartBCH. Use Uniswap for larger trades or if you need access to Ethereum’s full DeFi ecosystem.

Does BenSwap have a mobile app?

No, BenSwap doesn’t have a native mobile app. But you can access it through mobile Web3 wallets like Trust Wallet or MetaMask Mobile. Just open the wallet’s built-in browser, go to benswap.org, and connect your wallet. The site is fully responsive and works well on phones.

Can I stake EBEN tokens?

Not directly. EBEN can’t be staked like ETH or SOL. But you can provide liquidity to EBEN/USDC or EBEN/SmartBCH pools and earn a share of trading fees. This is called liquidity mining, not staking. It’s riskier because of impermanent loss, but it’s the only way to earn passive income from EBEN right now.

Brendan Conway

February 3, 2026 AT 10:10Katie Haywood

February 3, 2026 AT 17:02