Binance Country Restriction Checker

Enter your country name to check Binance's service availability and restrictions.

Restriction Status

Restricted Services

How to stay compliant

Always check Binance's official Country Availability page for the most current information. Complete required KYC steps if you're in a high-risk jurisdiction.

Country not found

We couldn't find your country in our database. This may mean the country is unrestricted or the data isn't available. Please check Binance's official Country Availability page for the most current information.

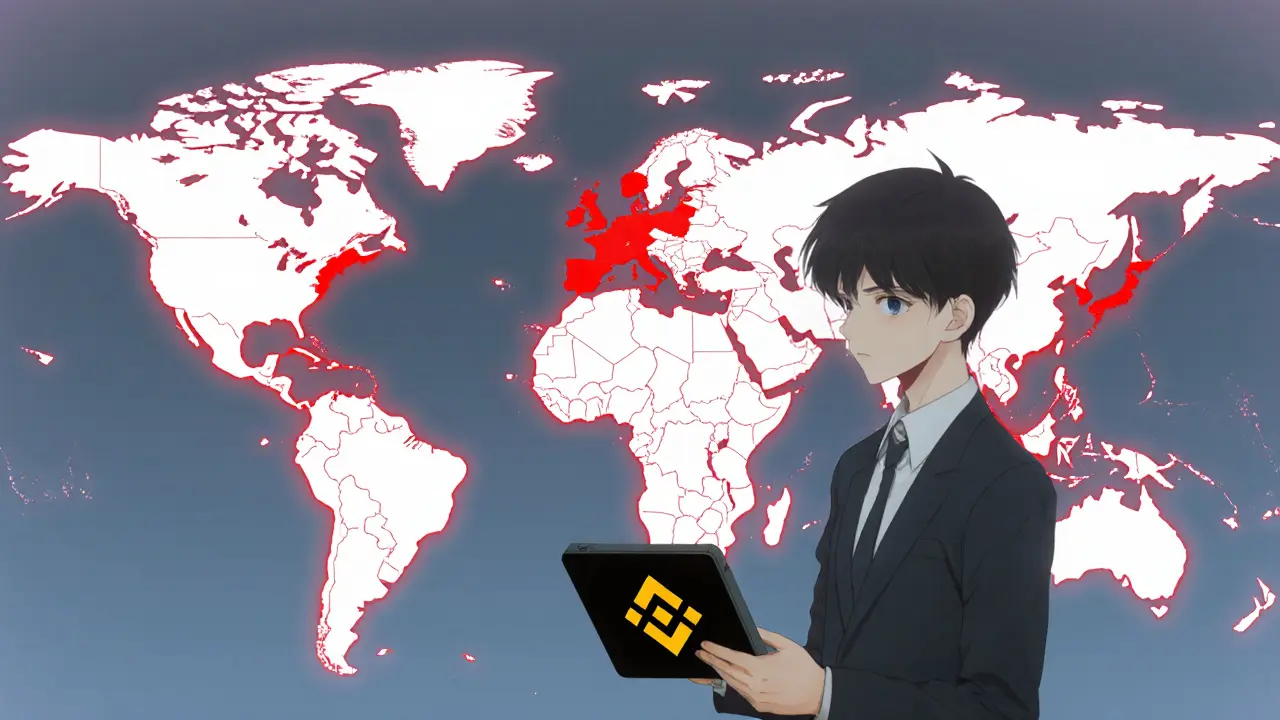

As of October 2025, Binance’s global footprint is a patchwork of permissioned services, outright bans, and partial suspensions. If you’re wondering whether you can trade, stake, or use futures on Binance from your country, this guide lays out every jurisdiction where Binance limits or blocks crypto activity, why those limits exist, and what you can do if you’re caught in the grey zone.

Key Takeaways

- Six countries face a total Binance ban because of international sanctions.

- Another twelve are under a complete digital‑asset prohibition, meaning no crypto exchange can legally operate.

- Fifty‑two nations allow Binance but restrict specific products such as futures, lending, or Web3 wallets.

- Service‑specific bans (e.g., Binance Futures) affect over 40 countries, most of them in the EU.

- To stay compliant, always check Binance’s Country Availability page and use the platform’s KYC verification steps for high‑risk jurisdictions.

Restriction Categories Explained

Binance groups its regulatory hurdles into three clear buckets. Understanding the bucket your country falls into tells you what you can (or cannot) do on the platform.

| Category | Number of Countries | Typical Restrictions | Examples |

|---|---|---|---|

| 1 - Full Operational Ban | 6 | All Binance services blocked; account termination possible. | Cuba, Iran, North Korea, Syria, Crimea (Ukraine), non‑government‑controlled areas of Ukraine |

| 2 - Total Digital‑Asset Ban | 12 | Local law prohibits any crypto‑related activity, regardless of exchange. | Afghanistan, Algeria, Bangladesh, Bolivia, China, Egypt, Iraq, Kuwait, Morocco, Nepal, North Macedonia, Tunisia |

| 3 - Partial/Service‑Specific Restrictions | 52 | Some Binance products unavailable (e.g., futures, lending, Web3 wallet). | United States, United Kingdom, Netherlands, Canada, Nigeria, Belgium, Australia, Japan, India |

Complete List of Restricted Countries

Category1 - Full Operational Ban

- Cuba (sanctions since Binance’s launch in 2017)

- Iran (U.S. OFAC sanctions added 2018)

- North Korea (DPRK, sanctions 2018)

- Syria (U.S. sanctions 2018)

- Crimea region of Ukraine (EU/US sanctions 2014, enforced 2019)

- Non‑government‑controlled areas of Ukraine (added 2022 after Russian invasion)

Category2 - Total Digital‑Asset Ban

- Afghanistan (Taliban decree, 2022)

- Algeria (Finance Law18‑04, 2018)

- Bangladesh (Digital Security Act, 2018)

- Bolivia (Central Bank Circular001‑2014)

- China (ban on trading & mining, September2021)

- Egypt (Central Bank ruling, 2020)

- Iraq (Central Bank warning, 2022)

- Kuwait (Central Bank Circular7/2022)

- Morocco (Foreign‑Exchange Regulations, 2017)

- Nepal (NRB directive, 2017)

- North Macedonia (ban 2023)

- Tunisia (ban 2018)

Category3 - Partial or Service‑Specific Restrictions

These countries still host Binance accounts, but a range of products are disabled. Below is a quick snapshot; detailed product tables follow.

- United States - Binance exited in 2019; only Binance.US operates with state‑by‑state limits.

- United Kingdom - FCA revoked permissions in February2023; lending and staking unavailable.

- Netherlands - Market exit July2023 after €3.3million fine.

- Canada - Full exit October2023; CAD deposits blocked February2024.

- Nigeria - Operations suspended February2024; Naira deposits frozen.

- Belgium - FSMA order halted operations June2023.

- Australia - Futures trading halted July2024 per ASIC.

- Japan - Registered exchange but limited to spot trading; derivatives banned.

- India - Tax regime (2022) and pending RBI guidelines restrict many services.

- Other notable partial bans: South Korea, Singapore, Malaysia, Thailand, NewZealand, etc.

Service‑Specific Restrictions Across the Globe

Even in countries where Binance is allowed, individual services can be blocked. The table below shows the biggest gaps as of August2025.

| Service | Restricted In | Typical Reason |

|---|---|---|

| Binance Futures | All 27 EU members, Norway, Iceland, Liechtenstein, UK, Switzerland, Australia, NewZealand, Canada, UnitedStates | MiCA derivatives licensing requirements |

| Spot Trading (CAD deposits) | Canada (Feb2024 onward) | Local AML/CFT rules and OSC fine |

| Lending & Staking | UnitedKingdom, Germany, France | FCA & BaFin classify as securities |

| Web3 Wallet | NewZealand, Malaysia, Singapore, Thailand | Financial market conduct regulations |

| Binance Earn | UnitedStates (via Binance.US only) | SEC securities registration |

Regulatory Drivers Behind the Restrictions

To make sense of the patchwork, it helps to know which regulators are pulling the strings.

MiCA (the EU’s Markets in Crypto‑Assets regulation) went live in December2024 and forces any exchange offering derivatives to obtain a specific license. That’s why every EU member state appears on the Binance Futures block list.

FATF (Financial Action Task Force) grey‑listed 23 jurisdictions in 2024, compelling Binance to halt services in places where the Travel Rule could not be met (e.g., Jordan, Morocco, Uganda).

SEC (U.S. Securities and Exchange Commission) demanded that Binance operate only through its U.S. affiliate, Binance.US, after a $4.3billion settlement in July2024. The fallout triggered tighter enforcement in Canada and other North‑American markets.

National bodies like the UK’s FCA (Financial Conduct Authority) and the Dutch AFM (Authority for the Financial Markets) have both revoked or fined Binance for insufficient AML controls, prompting market exits.

How to Verify Your Country’s Status and Stay Compliant

- Visit Binance’s official Country Availability page (usually linked at the bottom of the homepage).

- Enter your country or use the IP‑based geolocation test. The page will instantly tell you which services are enabled.

- If you’re in a “partial restriction” zone, check the “Service Availability” tab for futures, lending, or Web3 wallet specifics.

- Complete the required KYC steps. High‑risk jurisdictions (Turkey, Vietnam, Nigeria, etc.) need video verification - allocate 3‑4 business days.

- Consider using Binance.US or a local partner (e.g., Binance UAE) if your region is blocked but you hold residency in a supported country.

Avoiding Account Freezes and Lost Funds

Users in border regions often get false‑positive blocks. Here are three practical tips:

- Use a local‑issued SIM card. Binance’s geolocation engine (v3.2.1) cross‑checks GPS, IP, and SIM data; a foreign SIM can trigger a restriction.

- Keep your KYC documents up‑to‑date. In high‑risk zones Binance may request additional proof after every withdrawal.

- Maintain a secondary exchange account. CoinTelegraph’s 2025 survey showed 68% of users in partially restricted countries keep a backup wallet to move funds quickly if Binance disables a service.

Future Outlook: What’s Next for Binance’s Global Reach?

Binance’s Q32025 earnings disclosed a $1.2billion spend on compliance, including 14 new regional entities. Yet analysts predict more fragmentation:

- Bernstein Research expects 65% of previously unrestricted markets to require a dedicated local license by 2027.

- MiCA‑aligned licensing costs could top $200million annually for the top three exchanges.

- Regulatory sandboxes announced in nine emerging markets aim to test “light‑touch” crypto rules, but they won’t restore full Binance services immediately.

In short, if you live in a country on the restricted list, keep an eye on local regulator updates and consider diversifying across compliant platforms.

Frequently Asked Questions

Is Binance completely banned in my country?

Check the official Country Availability page. If your country appears under Category1 or Category2, all Binance services are blocked. For Category3, only specific products may be unavailable.

Can I use Binance.US if I live in the United States?

Yes, but only in the 51 states that Binance.US currently supports. New York, California, and a handful of others are excluded due to state‑level securities rules.

Why is Binance Futures unavailable in the whole EU?

The EU’s MiCA regulation requires a separate derivatives licence. Binance has not obtained that licence in any EU member, so futures are blocked across all 27 countries.

What should I do if my account was frozen after a regulatory change?

Open a support ticket referencing the latest regulator notice, provide any requested KYC updates, and consider withdrawing to a non‑restricted wallet while the issue is resolved.

Are there alternatives to Binance in restricted countries?

Local exchanges that have obtained the necessary licences are the safest bet. In Africa, Bitpesa and Luno are popular; in Latin America, Bitso and Mercado Bitcoin serve many users.

Melanie Birt

October 13, 2025 AT 01:04Always double‑check Binance’s official Country Availability page before you start trading – the site updates the list in real time. If you spot your country in the “Partial/Service‑Specific Restrictions” column, make sure the services you need (like Futures or Staking) are still enabled. A quick KYC verification often lifts the “high‑risk” flag, so don’t skip that step. Keep an eye on local regulator announcements; they can change the status overnight. 😊

Lady Celeste

October 13, 2025 AT 17:44This whole “global compliance” circus is just Binance trying to look legit while losing users.

Ethan Chambers

October 14, 2025 AT 10:24While many are busy lamenting the EU’s MiCA rollout, the real issue is Binance’s inability to secure a proper derivatives licence. The platform’s patchwork approach feels less like a strategic expansion and more like a desperate patch‑up. If you’re based in Europe, expect futures to stay offline until the regulatory gears turn. It’s a classic case of ambition outpacing execution.

Carol Fisher

October 15, 2025 AT 03:04It’s infuriating to see a United‑states‑born company bow to foreign pressure and abandon its own citizens. 🇺🇸💪 We should champion domestic innovation instead of surrendering to every new sanction, especially when the bans hurt everyday traders. The moral of the story: protect your own market before you run away.

gayle Smith

October 15, 2025 AT 19:44From a technical standpoint, the implementation of geolocation gating leverages a tri‑layered verification matrix: IP, SIM IMSI, and device fingerprinting. When any of those vectors flag a high‑risk jurisdiction, the API injects a “service‑lock” payload, which cascades into the UI as a red badge. This architecture, while robust, inevitably creates friction for users operating across VPNs or roaming, leading to false positives. The trade‑off between compliance fidelity and user experience is a classic security‑usability dilemma.

mark noopa

October 16, 2025 AT 12:24Binance’s regulatory labyrinth is a textbook illustration of how rapid growth can outpace governance frameworks. When the exchange first launched, it operated under the assumption that cryptographic assets would remain a niche market, free from conventional oversight. However, the surge in mainstream adoption forced regulators worldwide to draft new statutes at an unprecedented pace. In response, Binance adopted a reactive compliance strategy, scrambling to retrofit its services to meet each jurisdiction’s unique demands. This patchwork approach has resulted in a mosaic of restrictions, where some countries enjoy full access while others face outright bans. The underlying cause is not merely legal compliance but also the platform’s desire to retain market share in lucrative regions. By offering localized KYC and AML procedures, Binance attempts to appease regulators, yet these measures often clash with existing financial legislation. Moreover, the company’s decentralised operational model, with regional subsidiaries, adds layers of complexity to enforcement. Each subsidiary must secure its own licences, leading to duplicated efforts and uneven service availability. Users in countries like the United Kingdom have witnessed the removal of staking products due to FCA pressure, while their counterparts in the United States are relegated to a separate entity, Binance.US, with limited functionality. This bifurcation fragments the user experience and creates confusion over which platform holds their assets. From a risk management perspective, the constant regulatory churn has also strained internal compliance teams, who must stay abreast of evolving directives across over 50 jurisdictions. The result is a perpetual state of flux where today’s available service may be tomorrow’s restricted feature. For traders, this unpredictability translates into operational headaches, such as having to migrate funds or adjust strategies on short notice. Ultimately, the sustainability of Binance’s global footprint hinges on its ability to harmonise its compliance architecture, secure comprehensive licences, and regain user trust amidst this ever‑shifting regulatory landscape. 😊

Rama Julianto

October 17, 2025 AT 05:04You’ve nailed the big picture, but let’s cut to the chase: if you’re in a high‑risk jurisdiction, finish your video KYC ASAP or you’ll be blocked before you can even place a trade. Aggressive compliance isn’t a punishment; it’s the only way to keep the platform alive under such scrutiny.

Helen Fitzgerald

October 17, 2025 AT 21:44Don’t let the patchwork regulations discourage you – stay informed, keep your KYC up to date, and you’ll navigate the restrictions like a pro. Remember, knowledge is your strongest trading tool.

Jon Asher

October 18, 2025 AT 14:24Just check the Binance site regularly; they usually post updates when anything changes.

Scott Hall

October 19, 2025 AT 07:04All this compliance stuff can feel overwhelming, but take it one step at a time. A quick look at the “Country Availability” page and a completed KYC usually keep you in the green.

Laura Myers

October 19, 2025 AT 23:44The irony is palpable: Binance, the titan of crypto, now bows to a chorus of regulators, each demanding a slice of its empire, while traders watch the curtain fall on their favorite services.

Sanjay Lago

October 20, 2025 AT 16:24Even with the current restrictions, there’s still a bright horizon – many emerging markets are crafting crypto‑friendly sandboxes that could welcome Binance back with open arms soon.

arnab nath

October 21, 2025 AT 09:04They’re probably using the sanctions as a pretext to control the crypto flow and keep the power in their hands.

Nathan Van Myall

October 22, 2025 AT 01:44It would be interesting to compare how Binance’s restriction model differs from other major exchanges in terms of user impact and regulatory compliance.

debby martha

October 22, 2025 AT 18:24Honestly, the list looks like a copy‑paste from a compliance blog – not much new here.

Ted Lucas

October 23, 2025 AT 11:04Yo, the whole service‑lock cascade is just Binance’s way of saying “we’re playing by the rules” while still pumping out liquidity pools – classic crypto hustle! 🚀

ചഞ്ചൽ അനസൂയ

October 24, 2025 AT 03:44If we view the regulatory landscape as a river, the restrictions are merely rocks shaping the current; traders must learn to flow around them, not fight the water.

Philip Smart

October 24, 2025 AT 20:24Seriously, if Binance can’t get a proper license in the EU, it shows how overblown their “global leader” claim really is.

Jacob Moore

October 25, 2025 AT 13:04Good point – the KYC pressure is intense, but it’s better than having your assets frozen later. Staying ahead of the compliance timeline saves headaches.

Manas Patil

October 26, 2025 AT 04:44From a cultural perspective, many Asian regulators view crypto as a systemic risk, which explains the heightened scrutiny on KYC and AML protocols; this context is crucial when evaluating Binance’s regional strategies.