Back in 2021, if you wanted to trade obscure altcoins like Grin or Beam, Bittrex was one of the few places you could do it. With over 250 cryptocurrencies listed, it was a magnet for early adopters and serious hodlers. But today, Bittrex doesn’t trade anything. Not Bitcoin. Not Ethereum. Not even Dogecoin. The platform is gone - not just offline, but legally in liquidation. If you still have funds on Bittrex, you’re not alone. Nearly 247,000 users are waiting to get their money out, and the clock is ticking - because every month you wait, you lose 1% of your balance.

What Was Bittrex?

Bittrex launched in 2014 by three former Microsoft cybersecurity engineers. Their goal wasn’t to become the biggest exchange. It was to be the safest. They built a system with military-grade security: 95% of user funds stored in cold wallets, spread across multiple secure data centers. Biometric access, multi-signature keys, real-time fraud detection - it was all there. And it worked. For nearly a decade, Bittrex never had a single major hack. That’s rare in crypto. Most exchanges get breached. Bittrex didn’t.It wasn’t flashy. No futures trading. No leverage. No staking rewards. No fiat on-ramps beyond USD via bank transfer. But if you cared about holding altcoins long-term and didn’t want to worry about your coins vanishing, Bittrex was a top choice. It listed coins early - TRON, EOS, Chainlink before most others - making it a favorite among traders hunting for the next big thing.

Why Did Bittrex Shut Down?

The problem wasn’t security. It was regulation.In 2019, New Jersey’s securities bureau ordered Bittrex to stop operating because it was selling unregistered securities. That was a warning. Then came the SEC. By 2022, Bittrex was paying $29 million in penalties for serving users in prohibited jurisdictions. Meanwhile, Coinbase was lobbying regulators. Bittrex refused to play the game. They chose compliance over growth. That meant no expansion. No new markets. No partnerships.

Operating in the U.S. cost Bittrex $47 million a year just to stay legal. Coinbase spent $29 million. The math didn’t add up. By late 2022, Bittrex was losing 18% of its revenue. In April 2023, they shut down U.S. operations. Six months later, Bittrex Global - their international arm - stopped trading. By December 2023, all trading was frozen. Withdrawals only. And then, in February 2025, the liquidation process officially began.

What’s Happening Now?

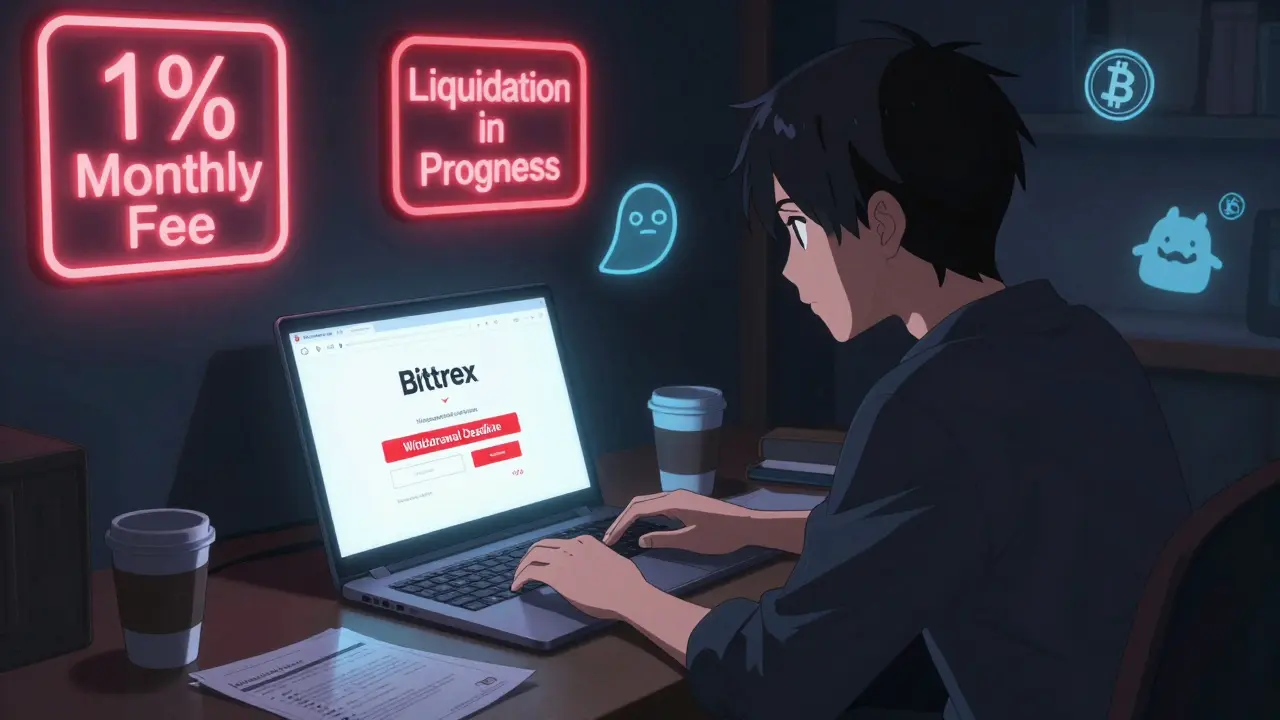

As of January 2026, Bittrex doesn’t exist as a functioning exchange. Two legal entities are being wound down: Bittrex Global GmbH in Liechtenstein and Bittrex Global Ltd. in Bermuda. ALPS Trust Ltd. is managing the liquidation. They’ve reopened withdrawals for users in Liechtenstein - about 18,200 people have already pulled out over $147 million. But there’s a catch.Since February 25, 2025, if you haven’t withdrawn your funds in 30 days, you’re charged a 1% monthly fee on every asset you hold. Minimum $50 per asset, per month. So if you have 1 BTC and 10 ETH sitting there, you’re losing $50 on Bitcoin and $50 on Ethereum every 30 days. That’s $100 gone. In six months? $600. In a year? $1,200. And your balance keeps shrinking.

Users in Bermuda are still stuck. 41,000 people with $89 million in assets are waiting for court approval to even start withdrawing. No timeline. No guarantee.

How to Get Your Money Out

If you still have funds on Bittrex, here’s what you need to do right now:- Log in to your account at bittrexglobal.com (yes, the site still works for withdrawals).

- Check your dashboard. If you see a message about "mandatory re-verification," do it immediately. You’ll need to upload a government ID and a selfie holding it.

- Go to the withdrawal section. Select the asset you want to withdraw.

- Enter your external wallet address. Double-check it. No reversals.

- Submit the request. You’ll get a confirmation email.

- If you haven’t withdrawn since December 2023, you’re likely being charged the 1% monthly fee. Withdraw everything now - even if it’s a small amount. Don’t wait.

Support is slow. Tickets take 3-5 days to respond. Use Zendesk ticket #25873 if you’re stuck. Reddit’s r/BittrexGlobal has active threads with updated withdrawal tips. People are getting their money out - but only if they act fast.

What About the Fees?

Before the shutdown, Bittrex had one of the fairest fee structures in crypto. Maker fees started at 0.25%, taker at 0.30%. If you traded over $500,000 a month, you paid just 0.10%. No hidden fees. No deposit charges. Withdrawals were free, no matter the coin or amount.Now? The only fee that matters is the 1% monthly penalty. It’s not a service fee. It’s a penalty for not acting. The liquidators aren’t trying to make money. They’re trying to force users to withdraw. If you don’t move your funds, they keep eating away at your balance. And once your balance hits zero from fees, you’re out of luck.

How Bittrex Compared to Other Exchanges

At its peak, Bittrex had 257 coins listed. Coinbase had 50. Kraken had 120. That made Bittrex the go-to for niche tokens. But liquidity? Weak. Average daily volume was $1.2 billion in late 2022. Bitfinex did $15.8 billion. Binance? Over $100 billion. If you were day trading, Bittrex was too slow. Order execution took 1.2 seconds. Bitfinex did it in 0.001 seconds.Customer support was terrible. The Block gave it a 2.8 out of 5. Most tickets took 72 hours to answer. Reddit threads were full of people stuck for weeks with frozen accounts. One user waited 47 days just to get verified - and lost $18,500 in trading opportunities.

But here’s the irony: Bittrex’s security became the gold standard. BitGo, a top custody provider, copied Bittrex’s cold storage design. Now they manage $90 billion in assets with zero breaches. Bittrex didn’t survive as a company - but its safety model did.

What This Means for You

Bittrex’s collapse isn’t just about one exchange. It’s a warning. Crypto exchanges are fragile. Even the most secure ones can vanish overnight if regulators turn against them. If you’re holding crypto on an exchange today, ask yourself: Is this platform actively trading? Or is it just a digital vault waiting to be shut down?Use exchanges that are transparent, regulated, and growing - not ones that quietly fade away. And never leave funds on an exchange longer than you have to. Bittrex users learned this the hard way. Their coins were safe. But their money wasn’t free.

Will Bittrex Come Back?

No. Bittrex Global has confirmed: there are no plans to relaunch. The company is being dissolved. The domain will eventually expire. The servers will be turned off. All that’s left is the slow, messy process of returning money to users.Deloitte estimates 95% of assets will be recovered by Q3 2026 - but 12% of users might lose everything because of those monthly fees. If you’re one of them, it’s not because the exchange stole your money. It’s because you waited too long.

Final Advice

If you have funds on Bittrex: withdraw everything you can - today. Don’t wait for a better time. There won’t be one. If you’re still holding other coins on other exchanges, move them to a personal wallet. Use hardware wallets like Ledger or Trezor. If you don’t know how, learn. It’s not hard. And it’s the only way to truly own your crypto.Bittrex gave users security. But it didn’t give them control. And in crypto, control is everything.

Bill Sloan

January 14, 2026 AT 19:38Callan Burdett

January 16, 2026 AT 15:35Bharat Kunduri

January 18, 2026 AT 13:32ASHISH SINGH

January 18, 2026 AT 19:56Nishakar Rath

January 18, 2026 AT 22:29Andre Suico

January 19, 2026 AT 10:21Chidimma Okafor

January 20, 2026 AT 20:49Pramod Sharma

January 22, 2026 AT 15:01nathan yeung

January 22, 2026 AT 21:04Jason Zhang

January 23, 2026 AT 12:35Katherine Melgarejo

January 24, 2026 AT 15:35Patricia Chakeres

January 24, 2026 AT 18:45Alexis Dummar

January 25, 2026 AT 19:40kristina tina

January 27, 2026 AT 00:05Michael Jones

January 27, 2026 AT 10:05Stephanie BASILIEN

January 27, 2026 AT 20:07Hailey Bug

January 28, 2026 AT 14:12Dustin Secrest

January 29, 2026 AT 09:03