Cellana Finance Slippage Calculator

Estimate how much your trade could be affected by slippage on Cellana Finance. Based on article data showing 2-5% slippage for trades over $500 due to low liquidity ($5k-$10k daily volume).

Cellana Finance isn’t another copy-paste DEX. It’s a bold experiment built on the Aptos blockchain, trying to fix what’s broken in decentralized exchanges. Most DEXes like Uniswap or PancakeSwap reward liquidity providers with a fixed slice of trading fees and constant token emissions. But those emissions often flood the market, dragging token prices down. Cellana Finance says: let users decide where rewards go. That’s the core idea behind its ve(3,3) model - and it’s the first of its kind on Aptos.

How Cellana Finance Works (Without the Jargon)

Think of Cellana like a community-run investment fund. Instead of the platform deciding who gets rewarded, token holders vote. You lock your CELL tokens for a set time - say, 4 weeks or 2 years - and you get a veNFT in return. This isn’t just a receipt. It’s your voting power. The longer you lock, the more weight your vote carries. And you can trade, split, or merge these veNFTs like digital assets.

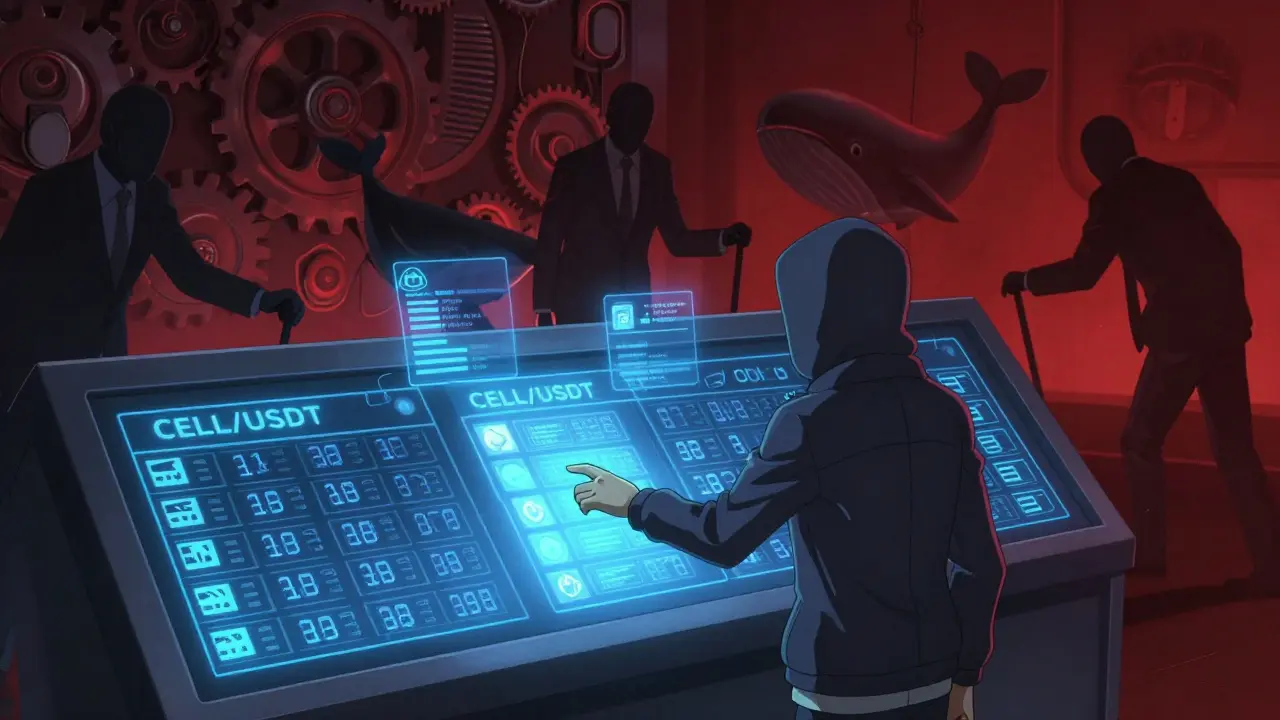

Now, here’s the kicker: you get to choose which liquidity pools on Cellana get the protocol’s emissions. Want to boost a new Aptos DeFi project? Vote for its pool. Think a popular pair like CELL/USDT is underfunded? Shift rewards there. The system is designed to align incentives - if you hold CELL, you benefit when the pools you vote for grow. It’s not just staking. It’s governance with skin in the game.

Behind the scenes, Cellana runs on Move, Aptos’ security-focused programming language. Unlike Ethereum’s Solidity, Move treats digital assets like physical objects you can’t accidentally destroy. It’s why Cellana claims stronger protection against exploits. Transactions are fast and cheap - around $0.0001 per trade - thanks to Aptos’ high throughput. You’ll need a wallet like Petra or Pontem to interact with it. No KYC. No middlemen. Just direct access.

What You Can Do on Cellana Finance

Right now, Cellana offers the basics you’d expect from a DEX:

- Swap tokens - trade 18 different cryptocurrencies across 24 trading pairs

- Provide liquidity - deposit pairs like CELL/USDT or APT/USDC and earn a share of trading fees

- Stake CELL - lock tokens to earn veNFTs and voting power

- Vote on rewards - direct where protocol emissions go

There’s no limit orders yet. No fiat on-ramps. No mobile app. You can’t buy CELL with a credit card. You’ll need to first get CELL on an exchange like Bitget or Tapbit, then transfer it to your Aptos wallet. That’s a barrier for newcomers. But for users already deep in the Aptos ecosystem, it’s a streamlined experience.

Tokenomics: The Good, The Bad, and The Risky

Cellana’s token, CELL, had a wild ride. It launched in February 2024 at $0.005. By March, it hit $0.116 - a 23x gain. Then it crashed. As of December 2025, CELL trades at $0.003045, down over 97% from its peak. Market cap sits at just under $1 million. That’s not a failure - it’s a warning.

Why did it drop so hard? Two big reasons:

- Concentrated supply - Only 7.38% of the 1.08 billion CELL tokens went to public sale. The rest was allocated to private investors, team, and ecosystem funds. That means a small group holds most of the voting power - the exact thing the platform claims to fight.

- Low liquidity - Daily trading volume hovers around $5,000-$10,000. For comparison, Raydium on Aptos does over $10 million daily. Low volume means big slippage. If you try to trade $500 or more, expect 2-5% price impact. That’s not viable for serious traders.

Worse, users report that the promised 5% minimum APY from voting rewards rarely materializes. One Reddit user locked 10,000 CELL for 4 weeks and earned just 0.85% - far below expectations. The veNFT system sounds powerful, but in practice, it’s hard to predict returns. And with low liquidity, even the best vote might not move the needle.

How Cellana Compares to Other DEXes

Here’s how Cellana stacks up against its closest rivals on Aptos:

| Feature | Cellana Finance | Raydium (Aptos) | Merkle Trade |

|---|---|---|---|

| Trading Pairs | 24 | 89 | 67 |

| 24h Volume | $5,000-$10,000 | $10M+ | $6M |

| Tokenomics Model | ve(3,3) - Community voting | Fixed fee + CAKE-like rewards | Fixed fee + staking |

| Fiat On-Ramp | No | Yes (credit card) | No |

| Limit Orders | No (planned Q1 2026) | Yes | Yes |

| Market Share (Aptos DEXes) | 8.3% | 42.1% | 24.7% |

Cellana wins on innovation. It’s the only DEX on Aptos letting users control emissions. But it loses on usability. Raydium has more pairs, higher volume, and lets you buy crypto with a card. Merkle Trade offers limit orders and better liquidity. Cellana’s edge is theoretical - if you believe community governance will eventually win, it’s worth watching. But if you want to trade, Raydium is the clear choice.

Real User Experiences - What People Are Saying

Trustpilot has 17 verified reviews. Average rating: 3.1/5. Here’s what users actually say:

- Praise: "Easy to use if you already have an Aptos wallet." "Telegram support replies fast."

- Complaints: "veNFT value jumps around with no logic." "Slippage on trades over $500 is brutal." "Promised 5% APY, got 0.8%."

On Reddit, a user named DeFiSkeptic88 described seeing one liquidity pool get 92% of emissions despite having only 35% of the actual liquidity. That’s not democracy - that’s coordinated voting by large holders. It’s exactly what Cellana’s model was meant to prevent. The system assumes rational, decentralized behavior. Reality? It’s still early, and whales are playing the game.

Is Cellana Finance Safe?

Technically, yes - but with caveats.

The platform uses multi-signature wallets for treasury control and has undergone third-party audits. The Move language reduces smart contract risks. But audits don’t guarantee safety - they just check for known bugs. And there’s no insurance fund. If something goes wrong, you lose your funds.

Regulatory risk is real too. The SEC hasn’t taken action on DeFi governance tokens yet, but Cellana’s voting system could be seen as a security. If regulators decide veNFTs are investment contracts, the whole model could be challenged. That’s not a problem today - but it’s a ticking clock.

Who Should Use Cellana Finance?

Cellana isn’t for everyone. Here’s who it’s for:

- Early Aptos adopters - You’re already using Petra or Pontem. You believe in Aptos’ long-term potential.

- DeFi theorists - You care about tokenomics. You want to test if community governance can beat fixed reward models.

- Small investors with patience - You’re willing to lock tokens for months, accept low returns, and wait for adoption to grow.

It’s NOT for:

- Traders - Slippage and low volume make it unusable for anything above $200 trades.

- Beginners - The veNFT system is confusing. You’ll need 2-3 hours just to understand how voting works.

- Those seeking returns - The APY is unreliable. Don’t count on it.

The Bottom Line: High Risk, High Speculation

Cellana Finance is a fascinating idea. It’s trying to solve a real problem in DeFi: unsustainable emissions. But it’s still a prototype. The technology works. The concept is smart. But adoption is stuck. Liquidity is thin. Token supply is concentrated. User returns are disappointing.

Analysts are split. Stanford’s Dr. Elena Rodriguez calls it "technically sound." Messari’s Michael Chen warns of "concentration risk." The Aptos Foundation thinks it has a 65% chance of surviving five years. Messari says 30%.

Right now, Cellana is less of a platform and more of a bet - a bet that community governance will eventually outperform top-down models. If you want to support that vision, you can stake a small amount. But don’t invest money you can’t afford to lose. And don’t expect returns. This isn’t a place to make money. It’s a place to participate in an experiment.

If Cellana adds limit orders, boosts liquidity, and opens fiat on-ramps in 2026, it could grow. But right now? It’s a niche tool for a niche crowd. And that’s okay - if you know what you’re getting into.

Is Cellana Finance a good place to earn high APY on my tokens?

No. While Cellana promises voting rewards, actual APY has been far below expectations. Users report earning as little as 0.85% over 4 weeks, even after locking large amounts of CELL. The platform’s whitepaper mentioned a 5% minimum, but that hasn’t materialized. Returns are unpredictable and tied to low liquidity pools, making it unreliable for income seekers.

Can I buy CELL tokens with a credit card?

No, Cellana Finance does not offer direct fiat on-ramps. You must first buy CELL on centralized exchanges like Bitget or Tapbit using USD or other fiat. Then, transfer it to your Aptos wallet (Petra or Pontem) to interact with the DEX. This adds steps and fees for new users.

What’s the difference between CELL and veNFT?

CELL is the native token you can trade and hold. veNFT is a non-fungible token you receive when you lock CELL for a period of time. The veNFT represents your voting power - the more CELL you lock and the longer you lock it, the stronger your vote. You can trade veNFTs on secondary markets, but they’re not the same as CELL tokens.

Is Cellana Finance safer than Uniswap or PancakeSwap?

Technically, yes - because it runs on Aptos using the Move language, which has built-in security features like resource safety and zero-knowledge proofs. However, safety also depends on liquidity, audits, and community size. Uniswap has been battle-tested for years with billions in TVL. Cellana has less than $1M in market cap and minimal trading volume, making it far riskier in practice despite better code.

Why is Cellana’s trading volume so low?

Low volume comes from low liquidity and lack of incentives for traders. Most users are stakers or voters, not active traders. Without limit orders, fiat on-ramps, or marketing, there’s little reason for large traders to use Cellana. Raydium and Merkle Trade dominate Aptos because they offer better tools and deeper order books. Cellana’s volume won’t grow until it solves these issues.

Should I invest in Cellana Finance’s CELL token?

Only if you’re comfortable with high risk and long-term speculation. CELL has lost over 97% of its peak value and shows no signs of recovery. The tokenomics are flawed - most tokens are held by insiders. It’s not a buy-and-hold asset. Think of it as funding an experiment, not investing in a product. Never invest more than you can afford to lose.

Jonathan Sundqvist

December 9, 2025 AT 00:36Thomas Downey

December 10, 2025 AT 08:39Jerry Perisho

December 11, 2025 AT 09:03Krista Hewes

December 12, 2025 AT 08:44Noriko Robinson

December 12, 2025 AT 09:57Mairead Stiùbhart

December 12, 2025 AT 22:44ronald dayrit

December 14, 2025 AT 16:03Josh Rivera

December 14, 2025 AT 21:33Neal Schechter

December 16, 2025 AT 00:50Madison Agado

December 16, 2025 AT 02:52Tisha Berg

December 17, 2025 AT 12:21Billye Nipper

December 19, 2025 AT 06:01Roseline Stephen

December 19, 2025 AT 18:39Jon Visotzky

December 20, 2025 AT 05:33Isha Kaur

December 20, 2025 AT 14:41Glenn Jones

December 21, 2025 AT 16:23Tara Marshall

December 21, 2025 AT 22:19Nelson Issangya

December 22, 2025 AT 03:18Joe West

December 23, 2025 AT 23:41Richard T

December 24, 2025 AT 15:46jonathan dunlow

December 25, 2025 AT 04:53Mariam Almatrook

December 26, 2025 AT 12:45rita linda

December 27, 2025 AT 20:19Jonathan Sundqvist

December 29, 2025 AT 10:50