Crypto Trading Penalty Calculator

Potential Penalty Result

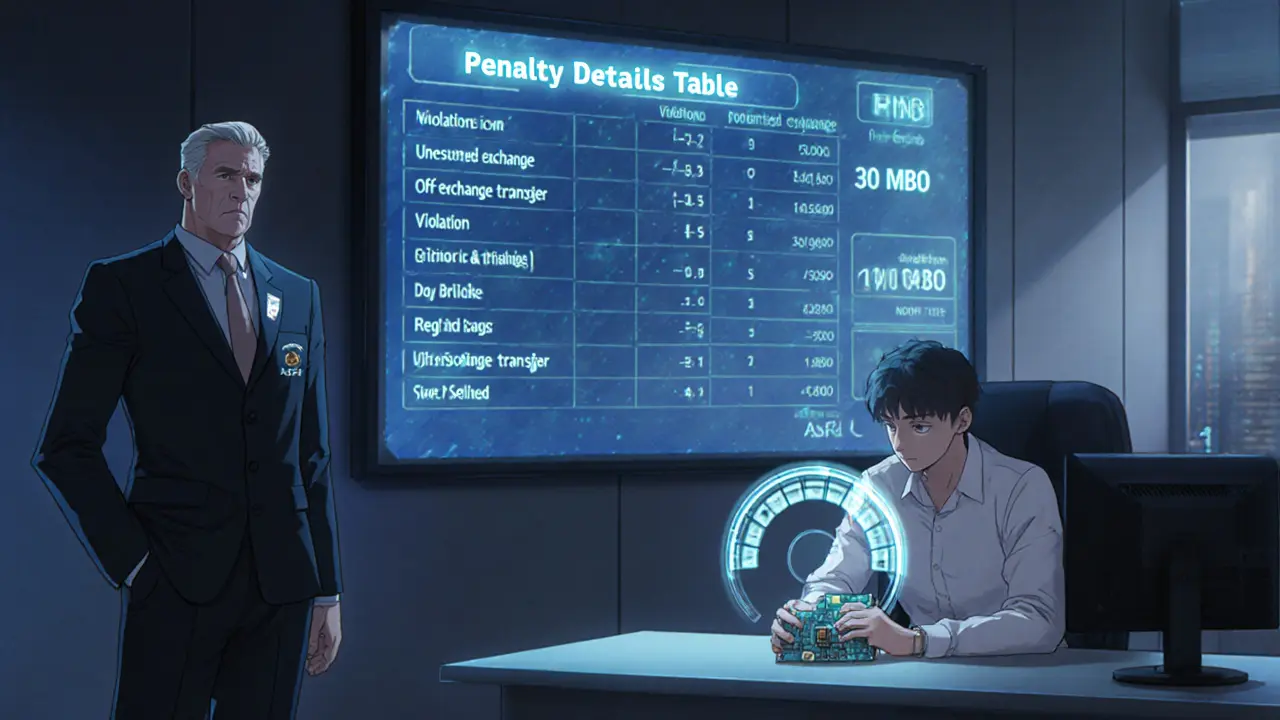

Penalty Details Table

| Violation | Enforcing Authority | Possible Sanction |

|---|---|---|

| Unregistered exchange or service provider | ASFI | Fine up to 200 MBO (≈ US$28k) + mandatory shutdown |

| Off-exchange transfer without bank mediation | BCB | Administrative fine (10-50 MBO) + asset seizure |

| Failure to report daily transactions | BCB/Financial Investigations Unit | Fine per missed report (5 MBO) + heightened monitoring |

| Money-laundering or sanctions-list breach | Financial Investigations Unit | Criminal charges, imprisonment up to 5 years, plus asset forfeiture |

| Incorrect corporate tax filing on crypto earnings | Tax Authority | Penalty 20% of owed tax + interest |

Bolivia’s stance on crypto has swung from a hard ban to a tightly‑controlled regime in just a few years. If you’re buying, selling, or holding digital assets there, the biggest risk isn’t a vague “illegal” label-it’s slipping outside the authorized banking and exchange channels that the Central Bank now insists on.

Quick Takeaways

- Trading crypto is legal only through licensed banks or registered electronic‑payment providers.

- Violating the authorized‑channel rule can trigger administrative fines, seizure of assets, and possible criminal charges.

- Individuals face no capital‑gains tax, but businesses (mining, staking, crypto‑related services) pay a 25% corporate income tax.

- Bank reporting is daily; failure to report can add hefty penalties for the institution and its customers.

- Penalties are determined case‑by‑case, but the framework focuses on compliance rather than punishing legitimate users.

Crypto trading in Bolivia is a financial activity that is allowed only when it flows through authorized banks or licensed electronic‑payment instruments (EPIs). The shift began with Board Resolution N°082/2024, which repealed the 2014 prohibition and laid out today’s compliance roadmap.

How the Regulatory Landscape Changed

Back in 2014 the Central Bank of Bolivia (BCB) slapped a blanket ban on all crypto activity, citing concerns about financial stability and the boliviano’s integrity. The ban lingered for a decade with no publicly disclosed fine schedule.

June2024 was a turning point. Board Resolution N°082/2024 lifted the ban, introduced the concept of Electronic Payment Instruments (EPIs), and tasked three bodies with oversight:

- Central Bank of Bolivia (BCB) - primary regulator.

- Financial System Supervisory Authority (ASFI) - supervises financial intermediaries.

- Financial Investigations Unit - monitors illicit flows.

Since then, crypto transaction volume has exploded-up 630% in one year, from US$46.5million to US$294million in the first half of 2025, according to the BCB.

What Activities Are Allowed

Under the 2025 framework you can:

- Own and trade stablecoins such as USDC or USDT.

- Settle invoices or payroll in stablecoins, but only via a licensed bank.

- Use registered EPIs (e.g., Binance’s localized service) for peer‑to‑peer transfers.

What you cannot do:

- Pay for goods or services directly with crypto outside the authorized channel.

- Operate an exchange or wallet service without registration.

- Move crypto through offshore platforms without reporting.

Penalty Structure Overview

The law now targets non‑compliance rather than the act of holding crypto. Below is a concise table that captures the main violations, the bodies that enforce them, and the typical range of sanctions.

| Violation | Enforcing Authority | Possible Sanction |

|---|---|---|

| Unregistered exchange or service provider | ASFI | Fine up to 200MBO (≈US$28k) + mandatory shutdown |

| Off‑exchange transfer without bank mediation | BCB | Administrative fine (10-50MBO) + asset seizure |

| Failure to report daily transactions | BCB/Financial Investigations Unit | Fine per missed report (5MBO) + heightened monitoring |

| Money‑laundering or sanctions‑list breach | Financial Investigations Unit | Criminal charges, imprisonment up to 5years, plus asset forfeiture |

| Incorrect corporate tax filing on crypto earnings | Tax Authority (Servicio de Impuestos Nacionales) | Penalty 20% of owed tax + interest |

Numbers above are drawn from public statements and the 2024‑2025 regulatory guidance; the exact fine amount often depends on the transaction size and repeat‑offender status.

Tax Implications You Should Know

Individuals who trade crypto for personal gain do not face a dedicated capital‑gains tax. That makes casual buying and selling relatively low‑risk from a tax perspective.

Businesses, however, sit in a different bucket. Mining, staking, or providing crypto‑related services are classified as commercial activity and attract a 25% corporate income tax (CIT). Failing to report those earnings can add a 20% penalty on the unpaid tax, plus interest.

Remember: the boliviano remains the only legal tender for tax filings, so any crypto‑derived profit must be converted through a licensed bank before being declared.

Compliance Checklist for Traders and Businesses

- Register your exchange or crypto service with ASFI before launching.

- Route every crypto transaction through a BCB‑approved bank or an authorized EPI.

- Submit daily transaction reports to your bank; the bank will forward them to the BCB.

- Screen counterparties against international sanctions lists (the bank handles this, but you must cooperate).

- If you run a crypto‑related business, calculate corporate income tax on net crypto earnings and file quarterly.

- Keep detailed records (wallet addresses, transaction timestamps, counterparties) for at least five years.

Real‑World Example: Banco Bisa’s Stablecoin Custody Service

In October2024, Banco Bisa launched a custody service for USDT. The bank handles KYC, daily reporting, and conversion to bolivianos for payroll. A client who tried to bypass Banco Bisa and move USDT via an unregistered offshore wallet was flagged by the bank’s monitoring system, reported to the Financial Investigations Unit, and faced a 30MBO fine plus a temporary freeze on the account. The case underscores how quickly the authorities act when the authorized‑channel rule is ignored.

Enforcement Mechanics and Consumer Protection

Every licensed bank runs an automated screening tool that cross‑checks incoming crypto transfers against the United Nations sanctions list and the U.S. OFAC list. Suspicious Activity Reports (SARs) are filed daily with the Financial Investigations Unit.

The government also runs public‑awareness campaigns to educate users about scams, phishing, and the importance of using registered EPIs. These campaigns aim to protect consumers rather than punish them, but they reinforce the message that off‑channel activity will attract scrutiny.

International Cooperation and Future Outlook

Bolivia signed a Memorandum of Understanding with ElSalvador’s National Commission for Digital Assets (CNAD) in early 2025. The deal focuses on sharing best practices for AML monitoring and developing a regional oversight framework. This collaboration suggests future tightening of cross‑border enforcement, especially for transactions that touch multiple Latin‑American jurisdictions.

Analysts expect the penalty regime to become more granular as the BCB refines its risk‑based approach. Expect clearer fine schedules, tiered penalties based on transaction volume, and perhaps a licensing fee model for high‑frequency traders.

Frequently Asked Questions

Is it illegal to own Bitcoin in Bolivia?

Owning Bitcoin is not illegal, but you cannot trade it on an unregistered platform or use it for payments outside the authorized banking channels.

What happens if I send crypto directly to a friend’s wallet without a bank?

The transaction is considered an off‑exchange transfer. The bank that holds your account must report it, and you could face an administrative fine of 10-50MBO plus possible asset seizure.

Do I need to pay tax on crypto profits?

Individuals have no specific capital‑gains tax on crypto. However, if you run a crypto‑related business, profits are taxed at a 25% corporate rate, and failure to report triggers a 20% penalty on the owed tax.

How do I register a crypto exchange with ASFI?

You must submit a formal application that includes KYC procedures, AML policies, technical infrastructure details, and proof of partnership with a licensed bank. The process typically takes 60‑90 days for approval.

Can I pay my salary in USDT?

Yes, but only through a licensed bank that offers a stablecoin custody service, such as Banco Bisa. The bank will convert USDT to bolivianos for tax and legal‑tender purposes.

Sophie Sturdevant

February 4, 2025 AT 00:29Activate a robust AML/KYC protocol now; the ASFI fines can hit up to 200 MBO, so integrate automated monitoring to stay ahead of the regulatory curve.

Remember, early compliance saves you from mandatory shutdowns and preserves operational liquidity.

Nathan Blades

February 9, 2025 AT 23:15When you dissect the Bolivian crypto regulatory landscape, the first insight is the sheer breadth of authority involvement, spanning ASFI, BCB, and the Financial Investigations Unit.

Each body enforces its own penalty regime, which means a single misstep can cascade into multi‑agency enforcement.

For example, an off‑exchange transfer without bank mediation triggers an administrative fine from the BCB ranging from 10 to 50 MBO, plus the risk of asset seizure.

If that same transaction also violates AML statutes, the Financial Investigations Unit can levy criminal charges with up to five years behind bars.

Layered compliance, therefore, isn’t just a buzzword; it’s a survival strategy in a jurisdiction that treats crypto as both a financial instrument and a potential conduit for illicit flows.

Start by mapping every transaction type to its corresponding reporting requirement, then embed that map into your accounting software.

Automated daily reporting to the BCB can shave off the 5 MBO per missed report penalty and demonstrate good faith to regulators.

On the tax side, the Tax Authority’s 20% surcharge on owed tax plus interest can balloon quickly if you underreport crypto earnings.

Consider conducting a quarterly tax reconciliation to lock in the correct tax base before the fiscal year closes.

From an operational perspective, maintaining a dedicated compliance officer who speaks Spanish and understands MBO conversion rates can prevent costly conversion errors.

Don’t overlook the importance of a legal counsel with experience in Bolivian financial law; a well‑drafted compliance charter can be the difference between a fine and a shutdown order.

In practice, many firms have adopted a “sandbox” approach, piloting new crypto services in a low‑risk environment before full rollout.

This mitigates exposure and provides a data‑driven case study for regulators if they request documentation.

Finally, cultivate a transparent relationship with the Central Bank of Bolivia – regular briefings can signal proactive cooperation and may soften punitive measures.

In sum, a multi‑layered, technology‑enabled compliance framework turns what looks like a punitive landscape into a manageable operational reality.

Staying ahead of enforcement cycles keeps your business resilient and ready for future regulatory evolution.

Jan B.

February 15, 2025 AT 19:15Compliance with the ASFI fine schedule requires accurate MBO conversion and timely reporting to avoid shutdowns.

emmanuel omari

February 21, 2025 AT 15:15Bolivia’s AML framework aligns with FATF recommendations, meaning that off‑exchange transfers are scrutinized under both the BCB’s financial supervision and the FIU’s anti‑money‑laundering mandate; failure to mediate through a bank signals a breach that can trigger asset seizure and steep fines.

Richard Herman

February 27, 2025 AT 11:15Seeing these penalties as a roadblock overlooks the opportunity to build trust with local authorities; transparent reporting can actually attract partnerships with Bolivian financial institutions that value regulatory rigor.

Sidharth Praveen

March 5, 2025 AT 07:15By integrating an automated transaction logger today, you’ll sidestep the daily 5 MBO fine and set a foundation for scalable growth in the region.

katie littlewood

March 11, 2025 AT 03:15The crypto ecosystem in Bolivia is like a vibrant tapestry woven with threads of innovation, regulation, and cultural nuance, and each thread-whether it’s the ASFI’s hefty 200 MBO ceiling or the BCB’s variable fine structure-adds both color and tension to the overall picture.

When you stare at the penalty table, don’t just see numbers; picture the real‑world impact on a startup trying to launch a decentralized exchange in La Paz, juggling conversion rates, compliance software, and a passionate community of users eager for financial inclusion.

Imagine the relief of a founder who, after implementing a daily reporting bot, avoids the repetitive 5 MBO slap on the wrist and instead channels that capital into liquidity pools that benefit traders.

Conversely, envision the nightmare of a company that ignores the tax authority’s 20 % surcharge, only to watch its balance sheet hemorrhage funds as interest compounds.

These scenarios illustrate that the legal scaffolding isn’t merely punitive-it can be a catalyst for disciplined growth if you treat it as a strategic partner rather than a hindrance.

So, let the penalty calculator be your compass, guiding you through the regulatory fog and pointing you toward the safe harbors of compliance.

Parker Dixon

March 16, 2025 AT 23:15That calculator is a lifesaver 🚀 – just punch in the amount, pick the violation, and you instantly see the cost, which makes budgeting for compliance a breeze.

Remember to keep your crypto wallet logs synced with your accounting software; otherwise you’ll get hit with those surprise fines.

Stay proactive and the regulators will appreciate your transparency 👍.

Stefano Benny

March 22, 2025 AT 19:15Honestly, these penalties are just bureaucratic noise; most firms operate under the radar and never see a fine, so you could ignore the calculator and focus on market share.

Bobby Ferew

March 28, 2025 AT 15:15I feel the weight of those numbers sinking in, and it’s unsettling how quickly a simple oversight can snowball into a hefty sanction that drains resources.

celester Johnson

April 3, 2025 AT 12:15One must recognize that willful non‑compliance reflects a deeper ethical lapse; the Bolivian statutes are clear, and any entity that sidesteps them demonstrates a lack of corporate responsibility that should be called out.

Prince Chaudhary

April 9, 2025 AT 08:15It’s essential to respect the local financial ecosystem while innovating; engaging with the BCB early can foster a collaborative environment that benefits both regulators and entrepreneurs.

John Kinh

April 15, 2025 AT 04:15Skipping compliance is a shortcut to disaster.

Mark Camden

April 21, 2025 AT 00:15From a principled standpoint, adhering to the established legal framework is not merely a regulatory requirement but a moral imperative that upholds the integrity of the financial system and protects stakeholders from undue harm.

Evie View

April 26, 2025 AT 20:15The harsh reality is that ignoring these penalties will cripple any crypto venture, and the suffering caused by reckless disregard is a direct consequence of selfish ambition.

Somesh Nikam

May 2, 2025 AT 16:15Let’s treat the penalty calculator as a training tool; by regularly reviewing potential fines, you’ll build a habit of vigilance that keeps your operations clean and your team confident.

MARLIN RIVERA

May 8, 2025 AT 12:15The data clearly shows that entities with robust compliance frameworks suffer 30 % less financial loss from regulatory actions, reinforcing the notion that a disciplined approach is statistically advantageous.

Debby Haime

May 14, 2025 AT 08:15Keep the momentum going! Integrating compliance checks into your daily workflow transforms a potential obstacle into a catalyst for sustainable growth.

Andy Cox

May 20, 2025 AT 01:29The penalty table reads like a checklist; use it to gauge risk levels and adjust your strategy accordingly.