When you trade crypto on a decentralized exchange (DEX), you’re not handing your keys to a company. You’re trading directly from your wallet-no middleman, no account freeze, no customer support hotline. Sounds powerful? It is. But it also means DEX security is entirely on you. There’s no bank to call when you send funds to the wrong address. No refund policy if a smart contract gets hacked. And no one to blame but yourself when a 1% slippage setting turns into a $5,000 loss.

In Q1 2025, DEXs handled $1.37 trillion in trades. That’s real money. But $1.48 billion of it vanished in 2024 due to exploits, scams, and user errors. The biggest threats aren’t foreign hackers or government raids-they’re mistakes you didn’t know you were making.

How DEXs Work (And Why They’re Risky by Design)

Unlike centralized exchanges like Coinbase or Binance, DEXs don’t hold your crypto. They run on smart contracts-self-executing code on blockchains like Ethereum, BNB Chain, or Solana. When you swap ETH for USDC, you’re not trading with another person. You’re trading with a liquidity pool-a reserve of tokens locked in code. The price is set by an algorithm, not a human market maker.

This system removes counterparty risk. No exchange gets hacked because the exchange doesn’t exist. But it creates new risks. Smart contracts are code. And code has bugs. In 2024, 63.2% of all DeFi losses came from smart contract flaws, not phishing or stolen keys. Even top platforms like Uniswap v3 and Curve Finance have been exploited. The difference? They’re now spending millions on audits and bug bounties. Most smaller DEXs aren’t.

And here’s the kicker: 68% of DEXs claiming to be fully decentralized still rely on centralized price oracles like Chainlink or Pyth. If those oracles get compromised, the entire DEX can be manipulated. That’s not decentralization. That’s a single point of failure dressed in blockchain clothing.

The Top 5 Ways You Lose Money on a DEX

You think you’re safe because you use MetaMask and never click sketchy links. But most losses happen because users don’t understand what they’re approving.

- Infinite token approvals - You approve a DEX to spend your USDT. You think it’s just for one trade. But if you don’t revoke it, any future app can drain your entire balance. In 2025, 19.3% of users lost funds this way. One Reddit user lost $8,450 because he approved infinite access on Uniswap and forgot to check again.

- Slippage tolerance set too high - Slippage is the difference between the price you see and the price you get. If you set it to 10% to make a trade go through, you’re telling the DEX: “Take up to 10% of my money if the price moves.” That’s not a feature-it’s a trap. A 10% slippage on a $10,000 trade means $1,000 could vanish into thin air.

- Fake DEX websites - Google “Uniswap” and the top result isn’t uniswap.org. It’s uniswap[.]xyz, uniswap[.]io, and uniswap[.]app. These sites look identical. They even have the same logo. But they steal your wallet connection. TRM Labs found 18.3% of all DEX security incidents started with a phishing site.

- Gas fees too low - If you set your gas fee too low, your transaction gets stuck. You can’t cancel it. You have to wait hours-or pay more to replace it. 32.7% of new users experience this. And if you’re on Ethereum, a failed transaction still costs you $1.85 in gas. That’s money down the drain.

- Connecting to malicious apps - You click “Connect Wallet” on a new DeFi dashboard. It looks legit. It says “Earn 14% APY.” But the code behind it? It drains your wallet the moment you approve. Georgia Tech’s 2025 study found 78.4% of new users failed their first trade-not because they didn’t understand crypto, but because they didn’t understand what they were approving.

How DEXs Are Trying to Protect You (And Where They’re Still Failing)

It’s not all doom and gloom. The DEX ecosystem is getting smarter.

Top platforms now use:

- Timelock contracts - Any change to the code (like adjusting fees or adding a new token) must wait 48-72 hours before it activates. This gives the community time to spot a malicious update.

- Circuit breakers - If a token’s price suddenly drops 30% in 30 seconds, trading pauses. This stopped a $6.8 million exploit on Velocore in June 2024.

- Multi-sig wallets - Governance changes require 4 out of 7 team members to sign off. No single person can drain funds.

But here’s the problem: these protections are only on the biggest DEXs. Uniswap, PancakeSwap, and Curve have them. Smaller DEXs? Not even close. And even the big ones can’t stop you from making a dumb mistake.

Worse, regulatory pressure is forcing changes. The EU’s MiCA law now requires DEXs to offer optional KYC for EU users. The SEC is pushing for registration if a DEX has centralized governance. That means the “fully decentralized” label is becoming a myth. Most DEXs now have a team, a website, and a Discord channel. That’s not decentralization. That’s just a startup with blockchain tech.

What You Can Do to Stay Safe

Here’s the hard truth: you can’t outsmart every hacker. But you can avoid 90% of losses by doing these five things.

- Check approvals with Revoke.cash - Go to revoke.cash, connect your wallet, and see every token you’ve ever approved. Revoke anything you don’t actively use. This alone prevents 8 out of 10 losses.

- Set slippage to 0.5% or less - Never go above 1%. If a trade fails because of low slippage, it’s better than losing half your balance.

- Only use trusted DEXs - Stick to platforms with over $1 billion in daily volume. Uniswap, PancakeSwap, Curve, and 1inch. Avoid new DEXs with no audit reports or anonymous teams.

- Use DEX aggregators - 1inch and Matcha scan 14+ DEXs to find the best price. They also warn you about fake tokens and high slippage. They don’t fix everything, but they add a layer of safety.

- Never connect your wallet to unknown sites - If you don’t know the team, don’t connect. If the site has a .xyz or .io domain, double-check the URL. Bookmark the real ones.

And if you’re new? Spend 8-10 hours learning before you trade. Watch tutorials on wallet setup, gas fees, and token approvals. Read the documentation. Georgia Tech found users who did this were 5x less likely to lose money.

The Future of DEX Security

The good news? Exploits are getting rarer. In 2024, there were 47 major DeFi exploits. In 2023, there were 75. That’s a 37% drop. Why? Because protocols are investing in formal verification-mathematical proof that code works as intended. Bug bounties are now worth $147 million across top DEXs. Cybersecurity insurance for DEXs jumped from 12% to 49% in just one year.

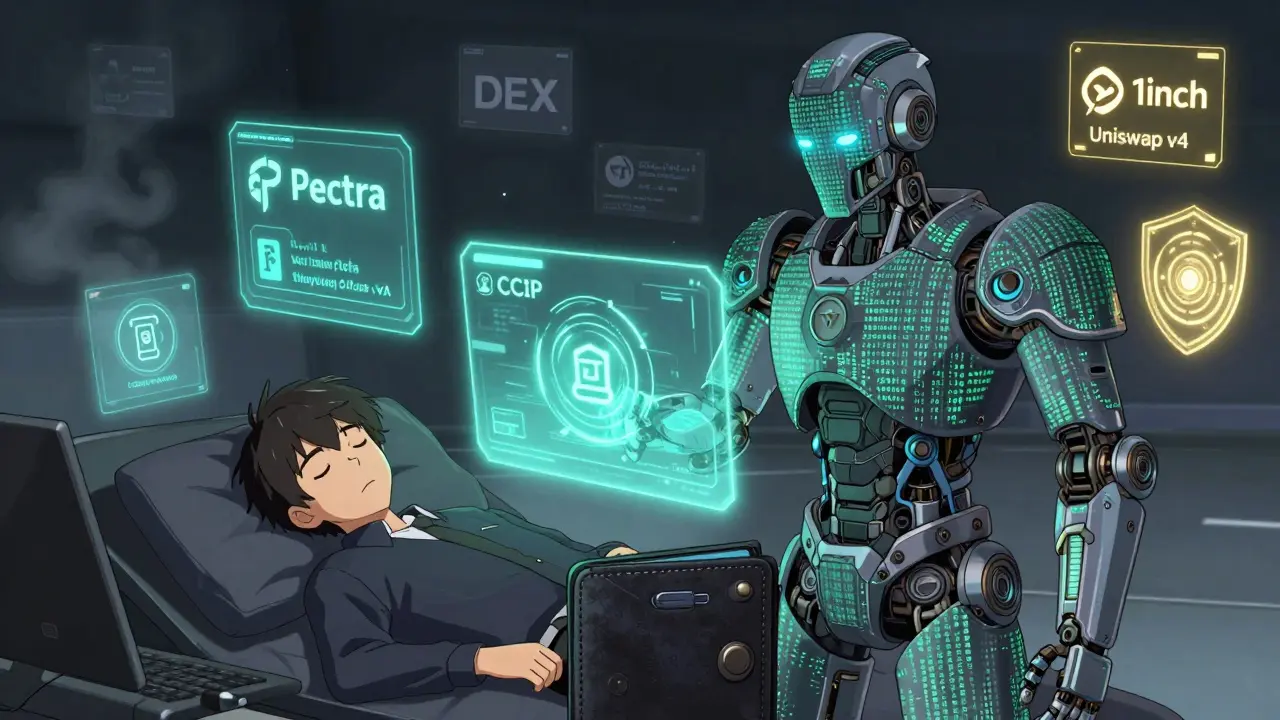

The Ethereum Pectra upgrade in May 2025 introduced account abstraction, letting wallets have built-in security rules like “block all infinite approvals” or “only allow swaps under $500.” That’s huge. It means your wallet could start protecting you-even if you’re clueless.

Uniswap’s v4 launch in late 2025 will let developers plug in custom security modules. Think of it like antivirus software for your trades. And Chainlink’s CCIP protocol, launching in early 2026, will make cross-chain swaps safer by verifying messages across blockchains.

But here’s the reality: DEXs will never be as easy as PayPal. They’re not supposed to be. They’re financial infrastructure. And like any infrastructure, safety comes from understanding how it works-not hoping it works.

Is a DEX Right for You?

If you’re looking for quick, simple crypto trading with customer support? Use a centralized exchange. If you want full control, privacy, and no middlemen? Then a DEX is for you.

But if you’re okay with handing over your keys for convenience, you’re giving up the whole point of crypto. DEXs aren’t for everyone. They’re for people who want to be their own bank. And that means accepting responsibility-for every transaction, every approval, every gas fee.

The future of finance isn’t centralized. It’s decentralized. But only if you’re smart enough to protect yourself.

Are DEXs safer than centralized exchanges?

DEXs are safer in one way: they don’t hold your funds. No custodial hacks like Mt. Gox or FTX can happen. But they’re riskier in another: 63% of losses come from user errors and smart contract bugs, not theft. Centralized exchanges lose money to hackers. DEXs lose money because users accidentally approve infinite token access or set 10% slippage. So yes and no-it depends on your skill level.

What’s the most common way people lose money on DEXs?

By granting infinite token approvals. Many users approve a DEX to spend their USDT or ETH once, then forget about it. Later, a malicious app connects to their wallet and drains their balance. Revoke.cash lets you see and cancel all these approvals in seconds. Always use it.

Can I trust DEXs like Uniswap and PancakeSwap?

Yes, but with caution. These are the most audited, highest-volume DEXs. They’ve been exploited before, but they’ve also fixed vulnerabilities quickly and paid out large bug bounties. Still, no DEX is immune. Always check token approvals, set low slippage, and never connect your wallet to a site you didn’t bookmark yourself.

Do I need to use a hardware wallet with a DEX?

Not required, but highly recommended if you hold over $5,000 in crypto. Hardware wallets like Ledger or Trezor add a physical layer of security. They still need to connect to MetaMask or Phantom, but they prevent malware from stealing your private key. For small amounts, a strong software wallet with 2FA is enough.

Why do gas fees vary so much on DEXs?

Gas fees depend on network congestion. On Ethereum, fees dropped from $4.22 in late 2024 to $1.85 in early 2025 thanks to EIP-4844. But if everyone is swapping at once, fees spike. Layer 2s like Arbitrum and Optimism have much lower fees-often under $0.10. If you trade often, use a Layer 2 DEX.

Is it safe to use DEX aggregators like 1inch?

Yes, and they’re often safer than direct swaps. 1inch scans multiple DEXs to find the best price and flags suspicious tokens. But they’re not foolproof. In September 2024, 1inch itself was exploited for $3.2 million due to a flaw in its routing logic. Always check the contract address before approving any transaction-even on aggregators.

What should I do if I accidentally send crypto to the wrong address?

Nothing. Blockchain transactions are irreversible. No one can undo them-not the DEX, not the blockchain, not the police. That’s why double-checking addresses and using wallet aliases (like naming your own addresses) is critical. Always test with small amounts first.

Can I get my money back if a DEX gets hacked?

Only if the DEX has a reimbursement fund or insurance. Most don’t. Some, like Uniswap, have community-managed treasury funds that may reimburse users in rare cases-but it’s not guaranteed. Never assume you’ll get your money back. Assume it’s gone. That’s the only way to trade safely.