Operating a crypto exchange in Germany isn’t just about setting up a website and accepting Bitcoin. It’s a tightly regulated process that demands serious preparation, legal clarity, and ongoing compliance. If you’re thinking about launching or using a crypto exchange in Germany, you need to understand the rules - because the consequences of getting it wrong are real. In 2025, Germany shut down Ethena GmbH’s operations over its USDe stablecoin, forcing users to redeem tokens through a government-appointed representative. That wasn’t a warning. It was a message: Germany’s crypto rules are enforceable, and they’re not going away.

Who Controls the Rules? BaFin and MiCAR

The Federal Financial Supervisory Authority, known as BaFin, is the single point of control for all crypto exchange licensing in Germany. It doesn’t just oversee banks and insurance companies - it now has full authority over crypto asset services. Since December 30, 2024, BaFin has been enforcing the EU’s Markets in Crypto-Assets Regulation (MiCAR), which replaced fragmented national rules with a unified framework across all 27 EU member states. But Germany didn’t just adopt MiCAR. It built on top of it. In February 2025, two new laws came into effect: the Finanzmarktdigitalisierungsgesetz (FinmadiG) and the Kryptomärkte-Aufsichtsgesetz (KMAG). These laws filled in the gaps MiCAR left open, especially around tax reporting, IT security, and how to classify different types of crypto assets. BaFin didn’t wait for the EU to catch up - it moved first.What Do You Need to Get Licensed?

If your business wants to offer crypto trading, custody, or exchange services in Germany, you need BaFin’s formal authorization. No exceptions. Even if you’re based in another EU country, if you’re targeting German customers, you must get licensed by BaFin. The application isn’t a form you fill out in an afternoon. It’s a multi-month process that requires:- A detailed business plan showing how you’ll manage risk, handle customer funds, and prevent fraud

- Proof of sufficient capital - at least €125,000 in equity, with more required if you’re holding client assets

- Robust IT systems with encryption, multi-factor authentication, and cold storage for digital assets

- A compliance officer who understands both German law and MiCAR

- Documentation proving your team has no criminal record or history of financial misconduct

How Are Crypto Assets Classified? (It Matters)

Not all crypto assets are treated the same in Germany. BaFin classifies them into three main groups, and each group triggers different rules:- Financial instrument tokens - These behave like stocks or bonds. If a token gives you rights to profits, voting, or repayment, it’s regulated under MiFID II. You need a full investment services license.

- Security-like tokens - These are similar to traditional securities. Issuing them requires a prospectus approved by BaFin, just like selling shares in a company.

- Capital investment tokens - These represent ownership in a fund or project. They fall under the German Capital Investment Act and require additional disclosures.

Anti-Money Laundering: The Travel Rule Is Active

Germany enforces the Financial Action Task Force’s (FATF) "travel rule" - and it’s not optional. The KryptoWTransferV law, effective since 2020 and strengthened under MiCAR, requires every crypto exchange to collect and transmit identifying information for every transfer over €1,000. That means:- For every transaction, you must record the sender’s name, address, and wallet address

- You must send that same data to the receiving exchange or wallet provider

- You must keep this data for at least five years

What About Taxes? The 2025 Update Changed Everything

Germany’s tax rules for crypto have always been strict, but the March 2025 circular from the Federal Ministry of Finance made them clearer - and more demanding.- All crypto transactions must be tracked with daily market rates, not average prices

- Staking rewards are now clearly classified as taxable income, not capital gains

- DeFi interactions - like lending on Aave or swapping tokens on Uniswap - are now subject to capital gains tax if you profit

- Exchanges must provide users with annual transaction summaries by January 31

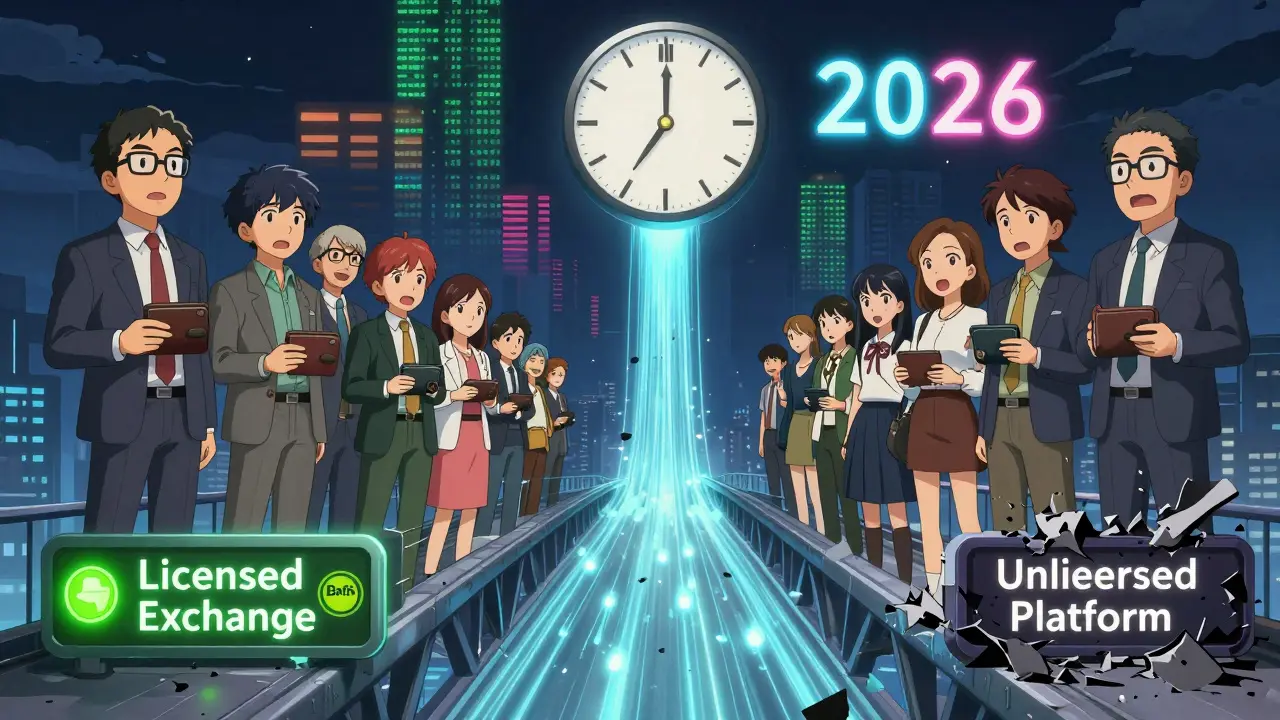

Grandfathering: What If You Were Already Operating?

If your exchange was already active before December 29, 2024, you had a grace period to transition to MiCAR compliance. That period ended on December 31, 2025. Any company still operating under an old license without MiCAR approval is now illegal. Some institutions - like banks or investment firms already licensed under German financial law - could offer limited crypto services without a new license. But they still had to notify BaFin by June 30, 2025. If they didn’t, they lost their exemption. There’s no more hiding behind "we’ve been here since 2021." The clock ran out.Why Germany Is Different

Many countries either ban crypto or ignore it. Germany does neither. It’s one of the few places where crypto is legal, regulated, and actively encouraged - as long as you play by the rules. The benefits are real:- Access to 82 million consumers in the EU’s largest economy

- Double taxation treaties with 90 countries, making it easier for international businesses to operate

- Government grants for blockchain R&D, especially in DeFi and tokenization

- Strong legal protection for licensed businesses - if you’re compliant, BaFin defends you

What’s Next? DeFi and the Future

The March 2025 tax circular was the first time Germany officially addressed DeFi. That’s a signal. Regulators aren’t waiting for DeFi to fade - they’re preparing to regulate it. Expect new rules soon on:- Automated market makers (AMMs)

- Lending protocols and yield farming

- Tokenized real-world assets (RWAs)

Can I run a crypto exchange in Germany without a BaFin license?

No. Any business offering crypto trading, custody, or exchange services to German customers must have a BaFin license. Operating without one is illegal and can result in fines, asset seizures, or criminal charges. Even if you’re based outside Germany, targeting German users triggers licensing requirements.

How long does it take to get a BaFin crypto license?

The process typically takes 6 to 12 months. BaFin reviews the application in stages: legal structure, IT security, compliance systems, and capital adequacy. Delays often happen when documentation is incomplete or when the business model doesn’t clearly align with MiCAR categories. Starting early and using a legal advisor familiar with German crypto law can cut months off the timeline.

Do I need to register if I only trade crypto for myself?

No. Personal crypto trading - buying, selling, or holding crypto for your own portfolio - doesn’t require a license. The rules only apply to businesses offering services to others. However, you still need to report capital gains on your personal tax return. The exchange you use must provide you with a transaction summary for tax purposes.

What happens if I don’t comply with the travel rule?

Non-compliance with the travel rule can lead to immediate suspension of your license. BaFin has already fined multiple exchanges for failing to collect or transmit sender and recipient data. In severe cases, assets are frozen, and operators face criminal investigations. The rule applies to all transfers over €1,000 - no exceptions for "small" transactions.

Is staking crypto taxable in Germany?

Yes. Since March 2025, staking rewards are treated as ordinary income, not capital gains. You must report the euro value of rewards on the day you receive them. This applies whether you stake through an exchange, a DeFi protocol, or a validator node. The tax rate depends on your personal income bracket, up to 45%.

Can I use a non-German exchange like Binance or Coinbase in Germany?

You can use them, but they must be licensed by BaFin to serve German customers. As of 2026, only a few international exchanges - like Bitpanda and Kraken - have obtained full BaFin licenses. Others, including Binance, have restricted access to German users. If you use an unlicensed platform, you’re at risk of losing access to your funds if BaFin intervenes - as happened with Ethena in 2025.

george haris

January 23, 2026 AT 02:25Also, the tax stuff about staking rewards being ordinary income? Huge. I thought it was still capital gains. Game changer for my portfolio strategy.

Mark Estareja

January 24, 2026 AT 23:43David Zinger

January 26, 2026 AT 01:30They banned crypto ATMs and now they want you to submit white papers for every token like it's 1999?

Meanwhile in the US we just let people trade and tax them later. At least we don't turn finance into a bureaucratic horror movie 🇺🇸🔥

Sara Delgado Rivero

January 26, 2026 AT 13:42carol johnson

January 27, 2026 AT 15:02Also why does BaFin get to be the final arbiter of what’s a ‘security-like token’? Who authorized them to be the crypto pope? 🙃

Heather Crane

January 28, 2026 AT 12:05Yes it’s a lot of work. But look at the upside - access to 82 million people, legal clarity, government grants for DeFi research. This isn’t a wall. It’s a runway.

Kevin Pivko

January 30, 2026 AT 01:26Who’s really protecting consumers here? The guy with the license or the guy who’s just… not getting caught?

Jessica Boling

February 1, 2026 AT 00:06And yes - it’s a pain. But if you’re building something that moves value, you owe it to users to be accountable. No free passes.

Tammy Goodwin

February 1, 2026 AT 13:33Now I’m kind of scared to use anything else. What if my funds get frozen because some small exchange didn’t file the right form? I don’t even know who to trust anymore.

Andy Simms

February 3, 2026 AT 00:28Bonnie Sands

February 3, 2026 AT 04:20