Crypto Private Key Storage Comparison Tool

Storage Method Comparison

| Method | Security Level | Cost | Setup Complexity | Best For |

|---|---|---|---|---|

| Hardware Wallet | High - tamper-evident secure element | $50-$200 | 1-2 hours | Individual investors, hobbyists |

| HSM (Enterprise) | Very High - FIPS-140-2, non-exportable keys | $10,000-$50,000+ | Weeks-months, requires crypto expertise | Institutions, custodial services |

| MPC Distributed Shares | Very High - no single point of compromise | $1,000-$5,000 per node | 2-4 hours for basic setup | Teams that need shared control |

| Paper/Steel Seed Backup | Medium - vulnerable to physical loss | ~$30 for steel plate | Minutes to write, then store safely | Long-term archival, disaster recovery |

Security Assessment

How secure is your current setup?

Security Analysis Result

When you own crypto, the single most critical thing you protect is the private key security that unlocks your funds. Unlike a bank account, there’s no password reset or recovery service; lose the key, lose the money. This guide walks you through the entire lifecycle of a private key - from generation, to safe storage, to backup and daily use - using real‑world tools that people actually trust.

What a Private Key Really Is

Private Key is a 256‑bit cryptographic secret that proves ownership of a blockchain address. It never appears in plain text during normal transactions; instead, the key signs a message inside a secure environment, producing a digital signature that the network can verify. Because the key is the only thing that can move the coins, every extra layer of protection matters.

Generate the Key in a Trusted Way

The first job is creating a truly random key. Most modern hardware wallets include a certified random number generator that complies with NIST standards. If you’re using a software wallet, run it on an air‑gapped computer - a machine that has never touched the internet - and use a trusted entropy source like a dice roll or a hardware RNG dongle.

- Never copy‑paste the key; manual transcription introduces hidden characters.

- Validate the generated checksum (BIP‑39) before writing it down.

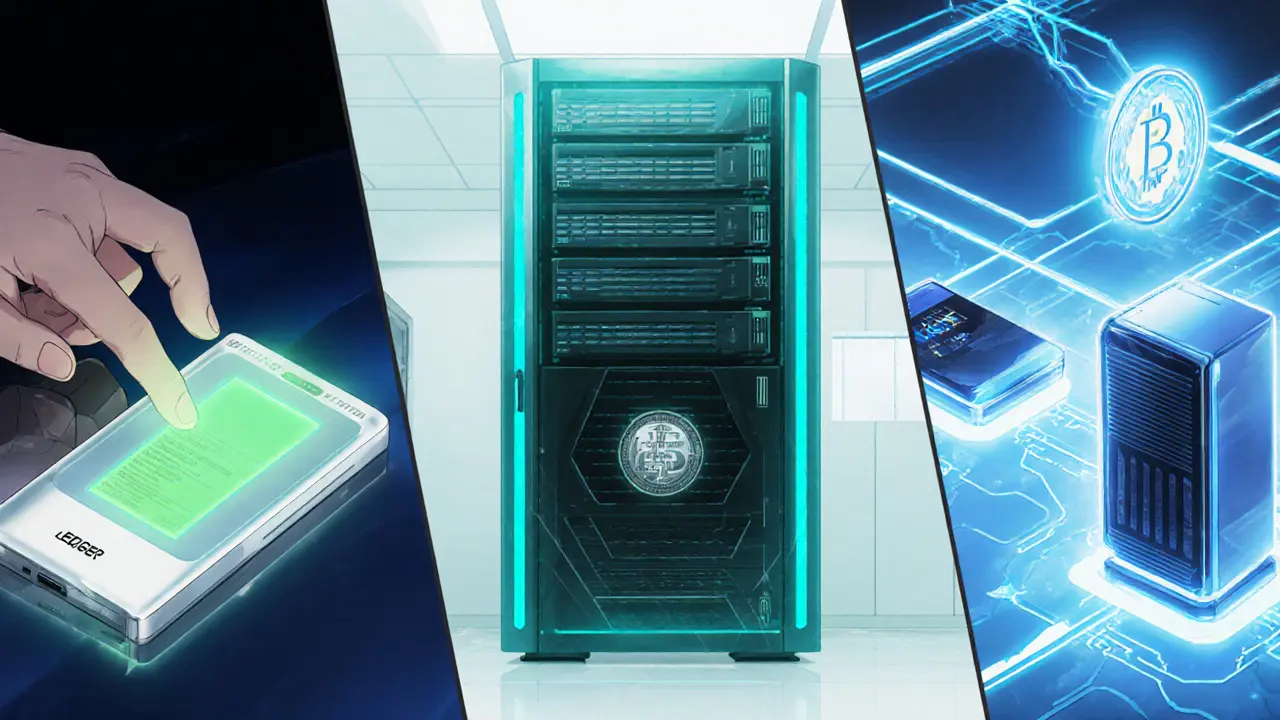

Store the Key Offline with a Hardware Wallet

Hardware Wallet is a consumer‑grade device that stores private keys in a tamper‑evident secure element. Popular models like Ledger Nano X and Trezor Model T keep the key isolated from your computer, allowing you to approve transactions with a physical button. Setup usually takes under two hours and involves three steps:

- Initialize the device and generate a seed phrase.

- Update the firmware to the latest version.

- Perform a test transaction to confirm the workflow.

Because the key never leaves the device, even malware on your laptop can’t steal it.

Enterprise‑Grade Protection: Hardware Security Modules (HSMs)

Hardware Security Module (HSM) is an appliance used by institutions to store private keys in a fully encrypted, non‑exportable enclave. HSMs provide FIPS‑140‑2 certification, tamper‑detect sensors, and built‑in key lifecycle management. While a single HSM can cost tens of thousands of dollars, it eliminates the single‑point‑of‑failure risk that a personal wallet faces.

Typical HSM workflow:

- Generate the key inside the HSM using a certified RNG.

- Configure the key as "non‑exportable" so it can only be used for signing.

- Integrate with a multi‑sig policy that requires quorum approval.

Distributed Trust with Multi‑Party Computation (MPC)

Multi‑Party Computation (MPC) splits a private key into encrypted shares that reside on three or more devices. No single device ever holds the full key, and a transaction only succeeds when the required number of shares combine their partial signatures. This approach is gaining traction among custody providers because it removes the "one device equals total loss" scenario.

- Typical quorum: 2‑of‑3 or 3‑of‑5 shares.

- Shares are stored on hardware wallets, smartphones, or dedicated servers.

- Compromise of one share reveals nothing.

Backup Strategies You Can Trust

The community consensus is clear: always have offline, immutable backups of your seed phrase.

- Seed Phrase is a 12‑, 18‑, or 24‑word mnemonic that encodes the master private key. Write it on a fire‑proof, water‑proof material, then store the paper in a safe.

- For extra durability, imprint the phrase onto a Steel Backup Plate, which resists fire, flood, and crushing forces.

- Distribute copies across geographically separate locations - a home safe, a safety‑deposit box, and a trusted family member’s freezer (yes, it works!).

Never photograph the seed or keep a digital copy in cloud storage. Even end‑to‑end‑encrypted services can be subpoenaed.

Layered Defense: Multi‑Signature Wallets & Access Controls

Combine hardware wallets with a Multi‑Signature Wallet to require multiple independent approvals for any outgoing transaction. This reduces the chance that a stolen device can drain your funds.

- Assign different roles: one device for daily spending < 0.5BTC, another for large moves > 0.5BTC.

- Implement Role‑Based Access Control (RBAC) so auditors can view logs without signing.

- Enforce the principle of least privilege: only devices that truly need to sign can sign.

Checklist: Daily Habits for Private Key Safety

- Keep firmware updated on every hardware wallet.

- Verify the checksum of any downloaded wallet software.

- Test recovery with a backup seed at least once a year.

- Use a hardware authentication token (YubiKey, Google Titan) for any admin console.

- Never share your seed phrase, even with “trusted” contacts.

Comparison of Storage Options

| Method | Security Level | Typical Cost | Setup Complexity | Best For |

|---|---|---|---|---|

| Hardware Wallet | High - tamper‑evident secure element | $50‑$200 | 1‑2hours | Individual investors, hobbyists |

| HSM (Enterprise) | Very High - FIPS‑140‑2, non‑exportable keys | $10,000‑$50,000+ | Weeks‑months, requires crypto expertise | Institutions, custodial services |

| MPC Distributed Shares | Very High - no single point of compromise | $1,000‑$5,000 per node | 2‑4hours for basic setup | Teams that need shared control |

| Paper/Steel Seed Backup | Medium - vulnerable to physical loss | ~$30 for steel plate | Minutes to write, then store safely | Long‑term archival, disaster recovery |

Next Steps & Troubleshooting

If you’re just starting, grab a reputable hardware wallet, write down the seed on a steel plate, and store two copies in separate safes. Test the recovery process by rebuilding the wallet on a fresh device - this simple drill catches most human‑error bugs before they cost you.

For power users who hit a snag (e.g., firmware bricking, lost seed), follow these steps:

- Contact the wallet manufacturer’s support - they can guide you through a device reset without exposing the key.

- If the seed is missing, check any secure offline notes you might have made; the key is unrecoverable otherwise.

- For HSM or MPC failures, consult the provider’s incident response plan; most services have a “key escrow” only for regulatory compliance, never for user access.

Remember: the goal is zero‑trust - you assume every component could be compromised and build layers that keep the private key isolated.

Frequently Asked Questions

Can I store my private key on a cloud drive if it’s encrypted?

No. Even strong encryption can be forced open with legal orders or a compromised device. Private keys belong in offline, tamper‑resistant hardware.

What’s the difference between a hardware wallet and an HSM?

A hardware wallet is a consumer device designed for personal use, typically costing under $200. An HSM is an enterprise‑grade appliance that meets strict certification standards, never exports keys, and integrates with audit and compliance tools.

How many backup copies should I keep?

At least three copies in different locations: a home safe, a bank safety‑deposit box, and a trusted family member’s secure place. Rotate them every few years to avoid degradation.

Is Multi‑Party Computation ready for everyday users?

MPC is maturing quickly. Several custodial services now offer plug‑and‑play MPC wallets, but the setup still requires multiple devices and a basic understanding of quorum policies.

What should I do if my hardware wallet stops working?

Do not panic. Use the seed phrase on a fresh device to restore access. Only contact the manufacturer if you suspect a hardware fault; never share the seed with anyone.

Somesh Nikam

February 24, 2025 AT 07:39Great rundown! 👍 Keeping keys offline is the best defense.

Jan B.

February 26, 2025 AT 15:12Hardware wallets are a solid entry point for most users.

Parker Dixon

February 28, 2025 AT 08:52I’m really digging the step‑by‑step guide. Using a steel plate for the seed phrase is a game‑changer – fire, flood, even a rogue cat can’t mess with it. 😺

Also, the reminder to test recovery every year saved me from a scary situation last quarter. Keep the firmware updates coming; they’re the unsung heroes of security.

Richard Herman

March 1, 2025 AT 18:12The comparison table is super helpful. I appreciate the clear breakdown between consumer hardware wallets and enterprise HSMs – many newcomers don’t realize how different the threat models are. If you’re starting out, a Ledger or Trezor plus a steel backup is more than enough.

Stefano Benny

March 3, 2025 AT 06:19Sure, hardware wallets are “high security”, but let’s not forget the attack surface of the supply chain. A compromised device out of the box can leak seeds the moment you initialize it. For truly paranoid ops, consider a zero‑trust firmware build or an air‑gapped HSM clone. Otherwise you’re just buying a fancy paperweight.

Bobby Ferew

March 4, 2025 AT 21:12This guide hits almost every angle you need to think about when protecting private keys, and it does so with a level of thoroughness that’s rare online. First, the emphasis on true randomness cannot be overstated – a weak RNG is the single weakest link in the chain, and many software wallets still rely on poor entropy sources. Second, the hardware‑wallet workflow is spot‑on: generate the seed, update firmware, and perform a test transaction. Skipping any of those steps invites disaster. Third, the section on HSMs clarifies why enterprises pour tens of thousands of dollars into them; the FIPS‑140‑2 certification and non‑exportable keys are not just buzzwords, they are real mitigations against insider threats. Fourth, the MPC explanation demystifies a technology that’s often boxed into “custodial solutions”. Splitting the key into three shares with a 2‑of‑3 quorum eliminates the single‑point‑of‑failure problem, but you still need solid operational security around each device. Fifth, the backup strategies are pragmatic – fire‑proof paper, steel plates, and geographically dispersed storage locations are all best‑practice. I especially love the reminder to rotate backups every few years; metal can corrode, and paper can degrade. Sixth, the multi‑signature layer is a perfect example of defense‑in‑depth – requiring two independent approvals for large moves drastically reduces the risk of a stolen device draining the entire balance. Seventh, the daily‑habit checklist reads like a security SOP; updating firmware, verifying checksums, and testing recovery at least once a year should be non‑negotiable. Eighth, the troubleshooting section pre‑empts common pain points – bricked firmware, lost seeds, and HSM failures are all covered with clear next steps. Finally, the FAQ addresses the most ubiquitous myth: “Can I encrypt my key and store it in the cloud?” The answer is a resounding no; even the strongest encryption can be forced open under legal duress. All in all, this post is a masterclass in private‑key lifecycle management. Following these steps will put you in a position where any single compromise is unlikely to result in a total loss.

Courtney Winq-Microblading

March 5, 2025 AT 11:05That was an impressive deep‑dive. Even if you’re skeptical about MPC, the idea of no single device holding the whole key is worth a glance.

katie littlewood

March 6, 2025 AT 17:39I’ve been collecting crypto tips for years, and I must say this article is one of the most comprehensive pieces I’ve read. The author does a fantastic job of balancing technical depth with practical advice, which is something you rarely see. Starting with the random‑number‑generator discussion, it’s clear that the foundation of any secure system is entropy, and the emphasis on hardware RNGs or even dice‑rolling for air‑gapped setups is spot‑on. The hardware‑wallet section feels like a checklist that anyone can follow: generate the seed, update firmware, run a test transaction, and you’re essentially bullet‑proof against most malware. When the piece moves to enterprise‑grade HSMs, it captures the stark cost vs. security trade‑off in a way that institutional readers can easily digest, while still being accessible to hobbyists who might be curious about the technology. I also love the breakdown of Multi‑Party Computation (MPC): explaining quorum policies, the notion that no single share reveals any useful data, and how the shares can be distributed across hardware wallets, smartphones, or dedicated servers. It demystifies a concept that is often shrouded in jargon. The backup strategy section is where the guide truly shines. Using steel plates for seed phrases, storing copies in geographically diverse locations, and the vivid suggestion of a family member’s freezer are both practical and memorable. The warning against cloud‑based encrypted backups, even with end‑to‑end encryption, is a necessary reality check in today’s legal climate. The multi‑signature wallet advice adds an extra layer of defense, turning a single‑signature wallet into a collaborative security model. Finally, the daily habits checklist reads like a security SOP that any crypto holder should adopt. Overall, this is a gold‑standard resource that should be bookmarked and revisited often.

Debby Haime

March 7, 2025 AT 01:59Love how the guide turns the intimidating world of crypto security into an approachable to‑do list. I’ve already set a reminder to test my seed recovery this weekend.

Jenae Lawler

March 8, 2025 AT 00:12While the article is thorough, one must question the practicality of suggesting steel plates for everyday users. The cost and effort may deter novices from adopting any form of backup at all, thereby paradoxically increasing risk.

Chad Fraser

March 8, 2025 AT 19:39Yo, solid stuff! If you’re just getting started, grab a Ledger, write that seed on a steel card, and you’re good to go. Keep it chill and stay safe.

Jayne McCann

March 9, 2025 AT 12:19Storing keys on a cloud drive, even encrypted, is a bad idea. Simpler is better.

celester Johnson

March 10, 2025 AT 13:19In the grand tapestry of digital sovereignty, the private key is the singular thread that weaves identity, trust, and value. To neglect its guardianship is to invite entropy into our most cherished constructs.

Mark Camden

March 11, 2025 AT 00:25While the poetic framing is appreciated, let us anchor the discussion in concrete best practices: enforce multi‑factor authentication on any device interfacing with the wallet, and employ a documented incident‑response plan for key compromise scenarios.

Nathan Blades

March 12, 2025 AT 04:12Alright folks, let’s get dramatic for a second – imagine waking up to find your stash of BTC vanished because you stored the seed on a sticky note. 😱 That’s why the layered approach in this guide is the superhero cape for your crypto. Hardware wallets, steel backups, multi‑sig – each is a shield. Skip any and you’re basically handing the villain the keys.

Sidharth Praveen

March 12, 2025 AT 23:39Optimistic vibe! Even if you’re new, start simple – a hardware wallet and a steel backup will keep you safe for the long haul.

Sophie Sturdevant

March 13, 2025 AT 13:32Deploying a hardware wallet without a proper key‑derivation function (KDF) is akin to using a paper lock on a bank vault – absolutely insufficient. Ensure PBKDF2 or Argon2 is in the mix.

MARLIN RIVERA

March 13, 2025 AT 21:52The guide overstates the necessity of multi‑signature for hobbyists; the added complexity outweighs marginal security gains.

emmanuel omari

March 14, 2025 AT 06:12Anyone ignoring the supply‑chain risks in hardware wallets is willfully blind; source verification is non‑negotiable for serious custodians.

Somesh Nikam

March 14, 2025 AT 14:32Well said.