When you trade Bitcoin for Ethereum on Binance, you’re not just swapping two coins-you’re engaging with a trading pair. That simple pairing-BTC/ETH-is the foundation of every arbitrage opportunity in crypto. Without trading pairs, arbitrage wouldn’t exist. They’re the map that shows where prices are out of sync, and where money is left on the table.

Arbitrage isn’t magic. It’s math. It’s the act of buying an asset cheap on one exchange and selling it dear on another. But you can’t do that unless there’s a clear, measurable relationship between two assets. That’s where trading pairs come in. They define the exchange rate, the price ratio, the very link between two assets that lets you spot a mistake in the market.

Exchange Arbitrage: The Simplest Way to Profit

The most basic form of arbitrage happens when the same trading pair has different prices on two exchanges. Say Bitcoin is trading at $49,800 on Kraken but $50,100 on Binance. You buy BTC on Kraken, send it to Binance, and sell. Profit: $300 per BTC, minus fees and network costs.

But here’s the catch: it’s not as easy as it sounds. Transferring Bitcoin takes time. Network congestion can delay your transaction. If the price moves while you’re waiting, your profit vanishes-or turns into a loss. That’s why successful exchange arbitrage relies on speed. Traders use bots that monitor dozens of exchanges in real time, executing trades in milliseconds. Manual trading? Almost never works anymore.

Exchange arbitrage works best with high-volume pairs like BTC/USDT, ETH/USDT, or SOL/USDT. These pairs have deep liquidity, so you can move large amounts without moving the price. Low-volume pairs? Forget it. Slippage eats your profit before you even click "sell."

Triangular Arbitrage: The Hidden Game Inside One Exchange

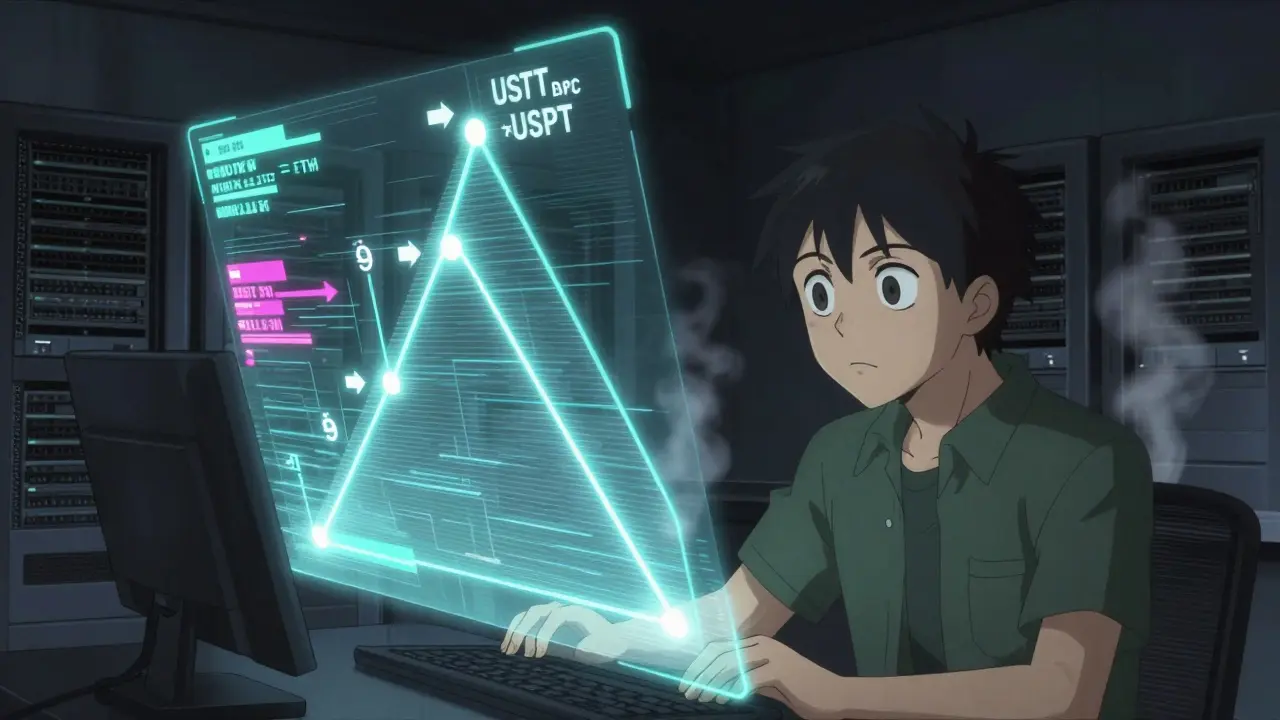

What if you don’t want to move coins between exchanges? There’s another way: triangular arbitrage. This happens within a single exchange when three trading pairs get out of sync.

Here’s how it works: Imagine you have $10,000 in USDT. You trade it for ETH on Binance. Then you trade that ETH for BTC. Then you trade BTC back to USDT. If the math adds up right, you end up with more than $10,000. That’s the triangle: USDT → ETH → BTC → USDT.

It sounds impossible, right? But it happens. Why? Because market makers on exchanges don’t always update all three pairs at the same time. One pair lags. The price of ETH/BTC shifts before BTC/USDT adjusts. That tiny delay creates an opening.

Triangular arbitrage is harder to spot than exchange arbitrage. You need to track three prices at once. And you need to calculate the exact path. A 0.3% edge sounds small, but with $1 million in capital, that’s $3,000 in one trade. Bots do this constantly. Humans? Rarely.

Pairs Trading: When Two Assets Move Together

Now let’s shift gears. Not all arbitrage is about buying low and selling high. Some strategies are about betting on relationships. Pairs trading is one of them.

This strategy started in stock markets. You find two companies that historically move together-say, Coca-Cola and Pepsi. If Coca-Cola suddenly rises 5% while Pepsi stays flat, you sell Coca-Cola and buy Pepsi. You’re not betting on the market. You’re betting that their relationship will return to normal.

In crypto, pairs trading works with similar assets. BTC and ETH often move in tandem. If BTC rises 8% in a day but ETH only goes up 2%, you might short BTC and go long ETH. You’re not trying to predict which coin will win. You’re betting that the gap will close.

This strategy relies on cointegration. That’s a fancy word for a statistical relationship that holds over time. If two assets are cointegrated, their price difference stays within a predictable range. When it breaks out, you trade. When it snaps back, you profit.

Backtests show that well-built crypto pairs trades can generate 5-8% annual returns with low volatility. But they require deep analysis. You can’t just pick any two coins. You need historical data, correlation metrics, and statistical tests like the Augmented Dickey-Fuller test to confirm the relationship is real.

Decentralized Arbitrage: AMMs vs. Order Books

Decentralized exchanges (DEXs) like Uniswap and SushiSwap don’t use order books. They use automated market makers (AMMs). These platforms price assets based on the ratio of tokens in a liquidity pool. If someone buys a lot of ETH from the ETH/USDC pool, the price of ETH goes up-automatically.

This creates a gap between DEX prices and CEX prices. If ETH is $3,200 on Binance but $3,180 on Uniswap, you can buy ETH on Uniswap and sell it on Binance. Simple. Right?

Not quite. DEX prices change every second. Liquidity shifts. Slippage is high. And gas fees? They can wipe out small profits. That’s where flash loans come in.

Flash loan arbitrage lets you borrow millions of dollars-no collateral-just for a few seconds. You use that money to exploit a price difference across DEXs, execute the trade, repay the loan, and pocket the profit-all in one blockchain transaction. If the math doesn’t work, the whole transaction fails. No risk of loss. Just zero profit.

Flash loans made headlines in 2021 and 2022. They’re still active. But the easy ones are gone. Now you need custom bots, real-time price feeds, and smart contract audits to even compete.

Derivative and Spot Arbitrage: The Funding Rate Trick

Perpetual futures contracts on exchanges like Bybit and OKX have something called a funding rate. It’s a fee paid every 8 hours between long and short traders to keep the futures price close to the spot price.

When the funding rate is high and positive, perpetual contracts trade above spot. That means you can short the perpetual and buy the spot asset. You’re essentially collecting funding payments while holding a neutral position. If the price stays flat, you still make money.

This is arbitrage disguised as hedging. You’re not betting on price direction. You’re betting on the spread between spot and futures. It works best with high-volume pairs like BTC/USDT and ETH/USDT.

But watch out. If the market moves hard in one direction, your hedge can fail. That’s why traders use delta-neutral bots that adjust position sizes automatically.

P2P Arbitrage: The Wild West of Peer-to-Peer Trading

On P2P platforms like LocalBitcoins or Paxful, individuals set their own prices. One seller might offer BTC at $49,500. Another asks $50,500. Meanwhile, the global average is $50,000.

Here’s the trick: you can set both a buy and a sell order. Offer to buy BTC at $49,800 and sell BTC at $50,200. If someone takes your buy order, you get BTC at $49,800. If someone takes your sell order, you sell BTC at $50,200. Either way, you make $400 profit.

This works because P2P markets are fragmented. Buyers and sellers don’t talk to each other. Liquidity is thin. Trust is manual. That’s why these inefficiencies persist longer than on centralized exchanges.

But there’s risk. Scams happen. Payments get reversed. You need to use escrow and verified traders. This isn’t bot territory. It’s human territory. And it’s messy.

Why Most People Lose at Arbitrage

Arbitrage sounds like free money. But it’s not. Most traders fail because they ignore the hidden costs.

- Transaction fees: Every trade, every transfer, every gas fee adds up.

- Slippage: If you try to trade $100,000 in a thin market, the price moves against you.

- Execution delay: Even 500 milliseconds can mean the difference between profit and loss.

- Account limits: Exchanges freeze accounts that look "too profitable."

- Regulatory risk: Some countries ban arbitrage bots.

Successful arbitrage isn’t about finding opportunities. It’s about surviving them. You need a system. You need buffers. You need to calculate your breakeven point before you even start.

For example: If your total cost per trade is $120 (fees, gas, slippage), you need at least a 0.25% price difference to break even. Anything less? You’re losing money.

The Future of Arbitrage

Markets are getting smarter. Algorithms are faster. Liquidity is deeper. But inefficiencies never disappear-they evolve.

Right now, the biggest opportunities are between:

- Centralized and decentralized exchanges

- Spot markets and perpetual futures

- P2P platforms and CEXs

- Low-liquidity altcoin pairs and major pairs

And as new blockchains launch, new trading pairs emerge. Solana, Polygon, and Arbitrum each have their own token ecosystems. That’s more pairs. More opportunities.

But the rules haven’t changed. Arbitrage still depends on one thing: the structure of trading pairs. The better you understand how those pairs connect, the more money you can make.

Can you make money with arbitrage today?

Yes, but not easily. The easy arbitrage opportunities from 2020-2022 are gone. Today, you need automated bots, access to multiple exchanges, low-latency connections, and deep knowledge of trading pair dynamics. Profit margins are thin-often under 0.5%-so volume and precision matter more than ever.

Is triangular arbitrage still profitable?

It can be, but only on high-volume exchanges with tight spreads. Pairs like BTC/ETH, ETH/USDT, and BTC/USDT are the best candidates. Profitability depends on execution speed. Manual traders rarely succeed. Bots that monitor price ratios in real time and execute in under 200 milliseconds still find small edges daily.

Do I need to use a crypto arbitrage bot?

For exchange and triangular arbitrage, yes. The time window for profit is often less than a second. Human reaction times are too slow. Bots can monitor dozens of pairs across 10+ exchanges simultaneously. Popular tools include 3Commas, CryptoArbitrageBot, and custom Python scripts using API feeds from Binance, Bybit, and KuCoin.

What’s the biggest risk in arbitrage?

Execution risk. If you buy on one exchange but the price moves before your sell order fills, you lose money. Network delays, high gas fees, or exchange downtime can turn a profit into a loss. That’s why risk management-like setting maximum trade sizes, using limit orders, and avoiding illiquid pairs-is more important than finding the opportunity itself.

Can pairs trading work with cryptocurrencies?

Absolutely. BTC and ETH have shown strong cointegration over the last five years. Other pairs like SOL/ETH and AVAX/NEAR also work. The key is backtesting. You need to prove the pair’s price spread stays within a predictable range. Once confirmed, you trade the deviations. This strategy works well in sideways markets and reduces exposure to broad crypto crashes.