Kazakhstan Crypto Mining Compliance Checker

When talking about Kazakhstan crypto mining restrictions are a set of rules introduced after the 2025 energy crisis to curb the nation’s runaway Bitcoin‑hash power growth. The country went from the world’s top mining hub in 2021 to a heavily regulated environment within a few years. Kazakhstan crypto mining restrictions affect every aspect of a mining operation, from electricity purchase to asset disposition. This article walks you through why the limits exist, what they mean for a mining operation, and how to stay compliant.

What triggered the crackdown?

The 2024‑2025 energy crisis hit Kazakhstan’s grid hard. Illegal farms siphoned electricity equivalent to powering a mid‑size city, causing blackouts in hospitals and residential districts. In August 2025, authorities busted a clandestine operation in East Kazakhstan that devoured over 50MWh - roughly $16million worth of power. The incident exposed how unchecked mining could destabilise a country that relies on a fragile thermal‑plus‑hydro mix.

Who’s in charge?

Multiple bodies now oversee crypto mining:

- National Bank of Kazakhstan (NBK) - sets AML and tax policies.

- Astana Financial Services Authority (AFSA) within the Astana International Financial Centre (AIFC) - runs the mandatory trading platform.

- Ministry of Energy - controls electricity allocation.

- National Association of Blockchain and Data Center Industry - monitors equipment registration and energy use.

Key regulatory pillars

As of 2025, the law requires mining outfits to comply with four pillars:

- Licensing - 84 active licenses have been issued. A miner must apply to the NBK‑AFSA joint committee, provide a technical plan, and pass an AML checklist.

- Taxation - a flat 15% tax on gross mining revenue is levied at source.

- Energy procurement - purchases must go through the state‑run platform, capped at 1MWh per transaction.

- Asset disposition - 75% of mined coins must be sold on AIFC‑approved exchanges, up from 50% in 2024.

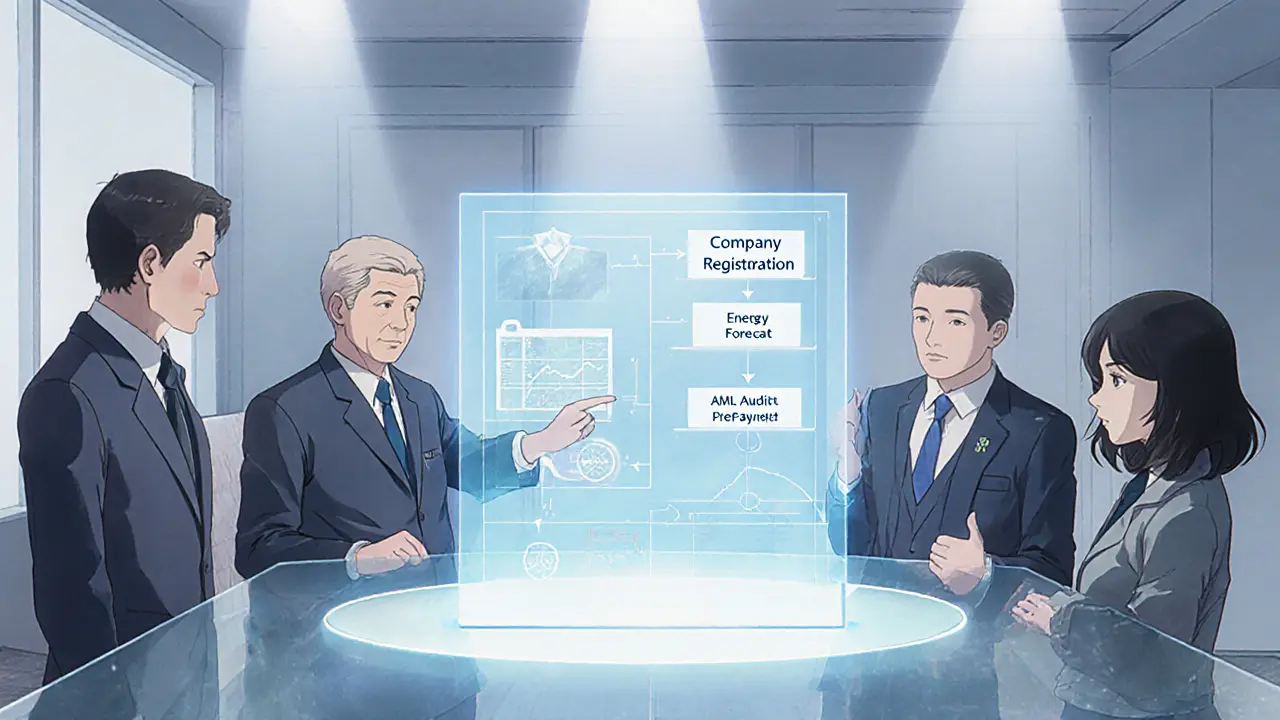

Licensing step‑by‑step

Getting a license is a multi‑stage process:

- Register the company with the National Association of Blockchain and Data Center Industry.

- Submit a detailed energy‑consumption forecast and a mitigation plan for peak‑hour load shedding.

- Undergo an AML/KYC audit conducted by the Financial Monitoring Agency (FMA).

- Pay the 15% mining‑tax pre‑payment and receive a license number valid for three years.

Energy limits and the 70/30 program

To prevent another grid overload, the Ministry of Energy introduced a “70/30” scheme. Foreign investors fund thermal‑power upgrades; 70% of the generated capacity supplies the national grid, while the remaining 30% is earmarked for licensed miners. This arrangement aims to turn miners into flexible demand‑side resources that absorb surplus generation during off‑peak hours.

Enforcement actions you should know

Authorities have taken a hard line on illegal operations. By the end of 2024:

- 36 unregistered exchanges were shut down.

- 4,000 mining rigs were confiscated.

- High‑end apartments and luxury cars bought with illicit proceeds were seized.

The East Kazakhstan case illustrates the scale: a network of utility insiders diverted power for two years, resulting in a $16million loss to the grid.

Practical implications for legitimate miners

If you are planning to start or expand a mining farm in Kazakhstan, keep these points top of mind:

- Cost of electricity - the state platform price is higher than the black‑market rates that fueled the crisis, but the supply is reliable.

- Compliance budget - factor in the 15% tax, licensing fees (approximately $5,000 per megawatt), and the mandatory AIFC sale requirement.

- Risk of shutdown - non‑licensed farms face immediate seizure and criminal prosecution.

- Renewable integration - solar and wind projects receiving preferential tariffs are now eligible for a “green‑miner” rebate of up to 5% on the electricity tax.

Future outlook

Kazakhstan is not abandoning crypto mining; it is reshaping it. The government plans to publish an updated digital‑asset law in early 2026, which will tighten AML reporting but also introduce a “miner‑to‑grid” incentive program. If you can align your operation with the 70% grid‑support goal and adopt renewable sources, you’ll likely enjoy a stable regulatory environment and lower energy costs.

Quick takeaways

- The 2025 energy crisis forced Kazakhstan to impose stringent licensing, tax, and energy‑purchase limits.

- All mining must be licensed, taxed at 15%, and sell 75% of output on AIFC platforms.

- Electricity can only be bought in 1MWh batches through a state platform.

- Illegal mining leads to severe penalties, including asset forfeiture.

- Future policies reward renewable‑powered miners and grid‑supportive operations.

| Requirement | Detail | Effective Date |

|---|---|---|

| License | Apply to NBK‑AFSA committee; 84 licenses issued | Jan2023 |

| Tax | 15% flat on gross mining revenue | Jan2022 |

| Electricity purchase | State platform only, max 1MWh per transaction | Mar2024 |

| Asset sale | 75% of mined coins must be sold on AIFC‑approved exchanges | Jan2025 |

| Renewable rebate | Up to 5% electricity‑tax credit for solar/wind‑powered farms | Jul2025 |

Frequently Asked Questions

Do I need a license to mine in Kazakhstan?

Yes. All mining farms must obtain a license from the NBK‑AFSA joint committee. The process includes registration with the National Association, an AML audit, and a pre‑payment of the 15% tax.

Can I buy electricity directly from local utilities?

No. Since 2024, electricity purchases must go through the Ministry of Energy’s state‑run platform, with a strict 1MWh per‑transaction limit.

What happens if I sell less than 75% on AIFC exchanges?

Non‑compliance triggers fines equal to 200% of the undisclosed amount and may lead to license suspension or criminal prosecution.

Is renewable energy cheaper for miners?

Renewable projects receive a 5% electricity‑tax rebate and often enjoy lower wholesale rates, making them financially attractive compared with the state‑platform tariff.

What are the penalties for illegal mining?

Authorities can confiscate equipment, seize assets worth millions, impose heavy fines, and pursue criminal charges that carry up to five years in prison.

Debra Sears

October 7, 2025 AT 08:20Thanks for laying out the new rules in such detail. It’s clear the government is trying to prevent another blackout, but the miners are facing a steep learning curve. If you’re already licensed, make sure your energy forecasts match the 70/30 scheme, otherwise you could get flagged. Also, keep an eye on the renewable rebate – it can shave a few percent off your electricity tax. Hope everyone can navigate this without too much hassle.

Andrew Lin

October 11, 2025 AT 04:00Look, America’s energy grid is miles ahead of Kazakhstan’s mess. They’re trying to control a "crisis" that never should've happened because these miners were greedy for cheap power. The new licensing is just a bureaucratic circus and the tax is a joke. If they want real progress they should copy US standards, not this half‑baked regulation.

Matthew Laird

October 14, 2025 AT 23:40It’s a shame how quickly profit motives can trample on public welfare. The blackout in hospitals was a wake‑up call that no one seemed to heed until the government stepped in. Mining should serve the country, not hold the lights hostage. Those who ignore the licensing and tax are essentially stealing from citizens. Moral clarity is needed, and it’s good to see the crackdown finally happening.

Caitlin Eliason

October 18, 2025 AT 19:20It’s heartbreaking to see livelihoods put on the line, yet the stakes for the nation are even higher 😢. The 15% tax might sting now, but think of the long‑term stability for everyone involved. Renewable rebates are a golden opportunity – they’ll make mining greener and cheaper 🌱. Let’s hope the miners adapt before more harsh measures roll out. The drama may be over, but the real story is just beginning.

Ken Pritchard

October 22, 2025 AT 15:00Here’s a quick checklist to keep you compliant: 1) Register with the National Association of Blockchain and Data Center Industry. 2) Submit a realistic energy‑consumption forecast that respects the 70/30 split. 3) Pass the AML/KYC audit – have all paperwork ready. 4) Pay the 15% pre‑tax and keep receipts. 5) Buy electricity only through the state platform in 1 MWh chunks. Follow these steps and you’ll stay on the right side of the law.

Bryan Alexander

October 26, 2025 AT 09:40Great points above! If you lock in a renewable source early, you’ll also qualify for that sweet 5% rebate. That can offset the higher state‑platform rates and keep your margins healthy. Stay optimistic – the new regime actually encourages sustainable growth.

Patrick Gullion

October 30, 2025 AT 05:20Sure, the rules sound strict, but they also level the playing field for everyone. Smaller ops get a chance to compete once the big illegal farms are gone. It might feel like extra paperwork now, but it’s a price you pay for a stable grid. In the long run, this could attract more reputable investors.

Jack Stiles

November 3, 2025 AT 01:00Yo, just keep your license up to date and don’t buy cheap power off the market. Stick to the state platform and you’ll avoid headaches. It ain’t rocket science.

Darren Belisle

November 6, 2025 AT 20:40Wow, what a thorough breakdown, the government really has thought this through, the licensing, the tax, the energy caps, the renewable rebates, all designed to keep the grid stable, and at the same time to keep miners honest, it’s a balancing act, and if everyone follows the rules, we might actually see a boom in legit mining, which would be great for the economy.

Heather Zappella

November 10, 2025 AT 16:20From a cultural standpoint, Kazakhstan’s approach mirrors a broader trend toward state‑guided digital economies. By mandating 75% of coin sales on AIFC‑approved exchanges, they ensure traceability and AML compliance. The 1 MWh transaction limit also caps the risk of sudden load spikes. Renewable rebates not only incentivize greener operations but align with global ESG expectations. This framework could serve as a model for other emerging mining hubs seeking to balance growth with grid stability.

Kate O'Brien

November 14, 2025 AT 12:00They’re hiding the real cause of the crisis – it’s all about foreign powers trying to control the crypto flow. That “state platform” is just a front for data collection, and the 75% rule funnels coins into shadow exchanges. The renewable rebate is a distraction, a way to get miners to think they’re doing good while the elites siphon the profits. Stay vigilant, they’re watching every hash.

Ricky Xibey

November 18, 2025 AT 07:40Stick to the state platform or get fined.

Sal Sam

November 22, 2025 AT 03:20From a technical perspective, the new cap of 1 MWh per transaction forces miners to adopt load‑balancing algorithms that integrate demand‑response signals. By synchronizing hash‑rate adjustments with off‑peak intervals, you can maintain ASIC efficiency while staying within the quota. Moreover, the mandated 15% tax at source is best handled via automated escrow contracts to avoid manual reconciliation errors. Utilizing API‑driven energy procurement platforms also ensures compliance logging for audits. Overall, these constraints push the industry toward smarter, more resilient operations.

Marcus Henderson

November 25, 2025 AT 23:00In considering the philosophical dimensions of regulation, one observes a dialectic between freedom and responsibility. The Kazakh authorities, by imposing licensing and tax, are asserting a communal claim over a resource that is, by nature, shared. Yet, the individual miner retains agency through renewable adoption, hinting at a possible synthesis where liberty is exercised responsibly. This narrative aligns with broader Enlightenment ideals of the social contract, albeit rendered in a digital economy. Such a balance, if achieved, may well become a template for future governance of decentralized technologies.

Lara Decker

November 29, 2025 AT 18:40The compliance checklist is exhaustive, but the real issue lies in enforcement consistency. If regional officials apply the rules unevenly, it creates an uneven playing field where some farms prosper while others are strangled. Moreover, the heavy fines for under‑selling on AIFC exchanges could disproportionately affect small operators lacking market access. A transparent appeals process would mitigate these concerns. Without it, the regulation risks becoming another tool for selective pressure.

Anna Engel

December 3, 2025 AT 14:20Oh great, another government memo telling us how to mine. Because what we needed was more paperwork, right? I’m sure the 5% renewable rebate will totally cover the administrative nightmare. And those “strict” limits? Perfect for keeping the industry alive… said no one ever.

manika nathaemploy

December 7, 2025 AT 10:00i totally feel your pain about the new rules, its a lot to take in. the tax and licensing can be scary, but its good that they are trying to protect the grid. try to look at the renewable rebate as a chance to go greener, it might even help your costs. keep an eye on the 1MWh limit, and dont forget to file your paperwork on time. hope everything works out for you!

Mark Bosky

December 11, 2025 AT 05:40To address the concerns raised, it is advisable to adopt a structured compliance workflow. First, establish a dedicated compliance officer responsible for monitoring licensing status and tax obligations. Second, integrate an automated reporting system that logs every electricity purchase transaction, ensuring adherence to the 1 MWh limitation. Third, allocate a portion of your operational budget to explore renewable energy contracts that qualify for the 5 % rebate. Finally, maintain open communication with the Ministry of Energy to stay informed of any regulatory amendments. Implementing these measures will markedly reduce the risk of penalties.

Brian Lisk

December 15, 2025 AT 01:20When you first read through the new Kazakhstan mining framework, it can feel overwhelming, but breaking it down into actionable steps makes it manageable. The primary obligation is to secure a valid license from the NBK‑AFSA joint committee; this involves registering your company with the National Association of Blockchain and Data Center Industry, which is the first gatekeeper. After registration, you must present a detailed energy‑consumption forecast that aligns with the 70/30 scheme, proving you will not exceed the allocated surplus capacity. The next phase is an AML/KYC audit conducted by the Financial Monitoring Agency; having all corporate documents, ownership structures, and source‑of‑funds records ready will smooth this process. Once you pass the audit, you pay the 15 % mining‑tax pre‑payment, which acts as a financial guarantee of compliance. It is essential to keep receipts and maintain a ledger of these payments for future audits. With the license in hand, you can now purchase electricity only through the state‑run platform, respecting the 1 MWh per transaction cap; this protects the grid from large, sudden loads. To further optimize costs, consider integrating renewable energy sources, because the government offers a 5 % rebate on the electricity tax for solar or wind‑powered farms, which can significantly improve your margins. Additionally, you must ensure that at least 75 % of mined coins are sold on AIFC‑approved exchanges; this requirement is enforced heavily, and non‑compliance results in fines equal to double the undisclosed amount. To monitor this, employ an automated asset‑sale tracker that reports daily transaction volumes to the regulatory body. Lastly, maintain regular communication with the Ministry of Energy; any changes in the national grid’s capacity or in the 70/30 allocation should be reflected in your operational plan promptly. By following these comprehensive steps-licensing, tax pre‑payment, regulated electricity procurement, renewable integration, and compliant asset disposition-you position your mining operation for long‑term stability within Kazakhstan’s evolving regulatory landscape.

Richard Bocchinfuso

December 18, 2025 AT 21:00Man, stop skipping the license and you’ll avoid a massive fine. Do it right or you’ll be in trouble.