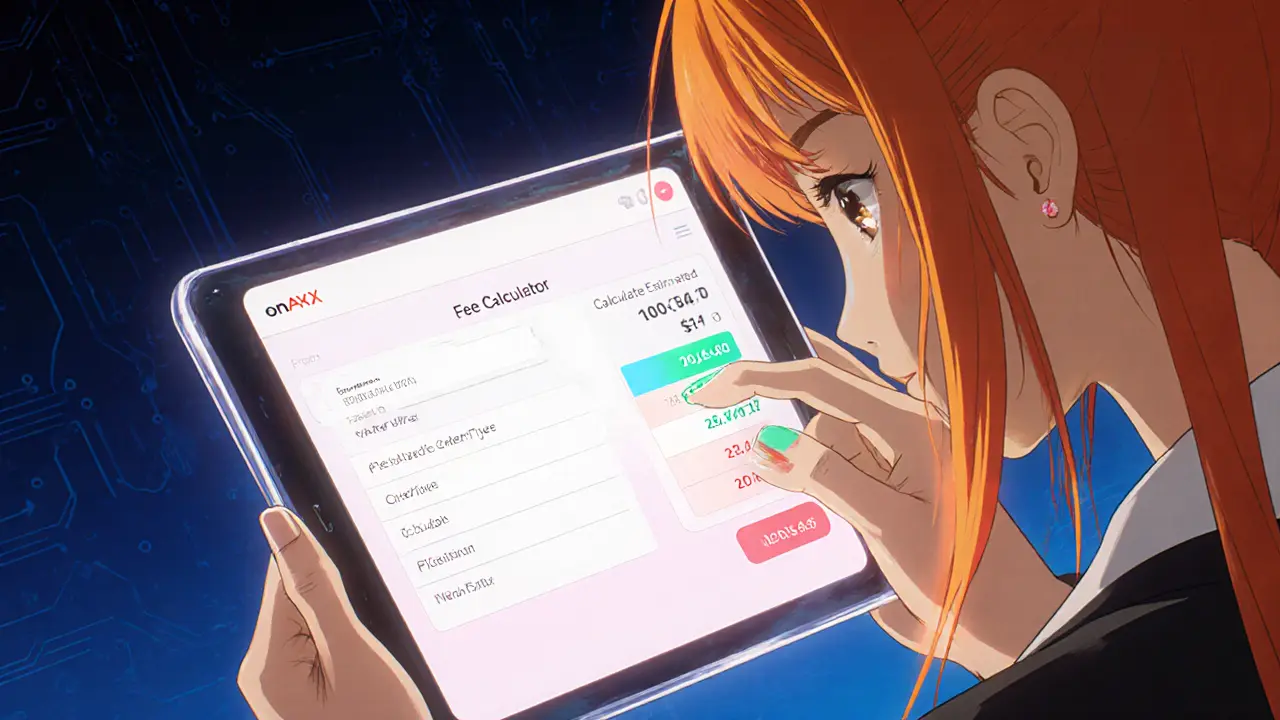

onAVAX Fee Calculator

Fee Estimator for onAVAX Exchange

Estimate your trading costs on onAVAX based on order type and volume.

Estimated Trading Costs

Trade Amount:

Order Type:

Fee Rate:

Estimated Fee:

Net Value After Fees:

Comparison with Other Exchanges:

onAVAX Fee Structure Overview

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| onAVAX | 0.10% | 0.20% | 0.001 AVAX (~$0.02) |

| Trader Joe (DEX) | 0% | 0.15% | Network gas (~$0.001) |

| Binance | 0.02% | 0.04% | 0.005 AVAX (~$0.10) |

| Coinbase | 0.05% | 0.10% | 0.006 AVAX (~$0.12) |

Key Insights:

- onAVAX's fees are competitive for traditional order-book traders.

- Maker fees are higher than pure DEXs but lower than most centralized exchanges.

- Low gas fees due to Avalanche's Octane upgrade make onAVAX efficient for frequent traders.

Looking for an Avalanche-native platform to trade AVAX and its growing DeFi assets? onAVAX crypto exchange claims to blend low‑fee trading with built‑in staking tools, but how does it actually stack up in 2025? This review breaks down the exchange’s core features, costs, security posture, and where it sits against established players like TraderJoe, Binance and Coinbase.

Quick Takeaways

- onAVAX runs on the Avalanche C‑Chain, benefiting from the Octane upgrade’s sub‑cent gas fees.

- Fees are 0.10% maker / 0.20% taker, lower than most centralized platforms but higher than pure DEXs.

- KYC is optional for low‑volume accounts; higher limits require standard identity verification.

- Security relies on multi‑sig hot wallets and third‑party audits completed in Q22025.

- Liquidity is decent for major AVAX pairs but thin for niche tokens; users may need to route through TraderJoe for best prices.

What Is onAVAX?

When we first encounter onAVAX is a cryptocurrency exchange built specifically for the Avalanche ecosystem. Launched in early 2024, the platform markets itself as a hybrid solution: it offers a web‑based order‑book interface common to centralized exchanges while keeping trades on‑chain to preserve transparency.

Because onAVAX settles every transaction on Avalanche’s Contract Chain (C‑Chain), users avoid the costly bridge steps that plague cross‑chain services. The exchange also integrates the network’s native staking module, letting traders earn sAVAX rewards directly from their order‑book balances.

How the Avalanche Ecosystem Powers onAVAX

The underlying blockchain, Avalanche is a high‑throughput platform composed of three interoperable chains: the X‑Chain for asset creation, the P‑Chain for validator coordination, and the C‑Chain for smart contracts. In October2025, the network completed the Octane upgrade (ACP‑176), introducing a dynamic‑fee mechanism that pushed average gas costs below $0.001. This fee collapse is a key advantage for onAVAX, allowing the exchange to keep transaction fees low while still covering operational costs.

AVAX, the native token, serves as both gas and governance fuel. Its price has hovered around $19‑$20 in 2025, with quarterly TVL growth of roughly 62% across DeFi protocols. The robust liquidity pool makes onAVAX a viable gateway for both retail traders and institutions seeking exposure to Avalanche‑based assets.

Fee Structure Compared to the Competition

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee (AVAX) | KYC Requirement |

|---|---|---|---|---|

| onAVAX | 0.10% | 0.20% | 0.001AVAX (≈$0.02) | Optional for ≤5BTC; mandatory >5BTC |

| TraderJoe (DEX) | 0% | 0.15% | Network gas only (≈$0.001) | None |

| Binance | 0.02% | 0.04% | 0.005AVAX (≈$0.10) | Full KYC for all users |

| Coinbase | 0.05% | 0.10% | 0.006AVAX (≈$0.12) | Full KYC for all users |

onAVAX’s fee schedule is competitive for users who value a traditional order‑book experience but still want on‑chain settlement. The maker fee is higher than pure DEXs like TraderJoe, which charge zero maker fees, yet lower than most centralized services that impose uniform fees across all order types.

Security Measures and Audits

Security is a top concern for any exchange. onAVAX employs a multi‑signature hot wallet architecture that requires at least two of three keys to approve withdrawals. The cold‑storage vault holds 95% of user funds, segregated by asset type.

In March2025, Quantstamp completed a comprehensive audit of onAVAX’s smart‑contract suite, flagging only a low‑severity issue that was patched within a week. The exchange also runs regular penetration tests with third‑party firms and participates in Avalanche’s bug‑bounty program, awarding up to $50,000 for critical findings.

On the regulatory front, onAVAX follows a “tiered KYC” model. Users staying under the 5BTC equivalent limit can trade without identity verification, preserving privacy. Once they cross that threshold, the platform requests standard documents (government ID, proof of address) and runs AML checks through a reputable screening service.

Liquidity, Asset Coverage, and Trading Pairs

Liquidity is where onAVAX shows both strength and limitation. The exchange lists the top 30 AVAX‑based tokens, including USDC‑AVAX, sAVAX, avUSD, and the newly launched EURC on Avalanche. For high‑volume pairs like AVAX/USDT or AVAX/ETH, onAVAX aggregates order books from multiple market makers, achieving spreads within 0.5% of the mid‑price.

However, niche assets (e.g., newly issued NFTs or low‑market‑cap DeFi tokens) often suffer from shallow depth. In those cases, traders can route through TraderJoe or other DEX aggregators to capture better pricing.

User Experience: Interface, Mobile App, and Support

The web UI mirrors familiar centralized platforms: candlestick charts, order‑book depth, and instant order entry. Mobile users can download the onAVAX iOS/Android app, which offers push notifications for order fills and a streamlined wallet view.

Customer support operates 24/7 via live chat and email. Response times average 3minutes for chat and under 2hours for email tickets. The knowledge base includes step‑by‑step guides on staking AVAX, setting limit orders, and withdrawing to external wallets.

Pros, Cons, and Best‑Fit Users

- Pros:

- On‑chain settlement preserves transparency.

- Low gas fees thanks to the Octane upgrade.

- Integrated staking rewards for AVAX holders.

- Tiered KYC offers privacy for small traders.

- Cons:

- Liquidity gaps on obscure tokens.

- Maker fees higher than pure DEXs.

- Platform still relatively new; community size <5k active users.

- Best for: Retail traders who want an order‑book feel, want to keep trades on Avalanche, and value the ability to earn sAVAX without moving funds to a separate staking portal.

How onAVAX Stacks Up Against Alternatives

When deciding where to trade AVAX, users typically compare three categories:

- Centralized Exchanges (CEXs) - Binance, Coinbase, Kraken. They offer deep liquidity, fiat on‑ramps, and regulatory compliance, but charge higher fees and require full KYC.

- Decentralized Exchanges (DEXs) - TraderJoe, Pangolin. They provide zero‑KYC, on‑chain settlement, and the lowest fees, yet lack order‑book features and can have higher slippage on large trades.

- Hybrid Platforms - onAVAX. They aim to blend the best of both worlds: order‑book UI with on‑chain execution, moderate fees, and optional KYC.

For a trader moving $10,000‑$50,000 per month, onAVAX’s fee advantage over CEXs becomes noticeable, while its UI advantage over DEXs speeds up decision‑making. However, for institutional players needing fiat gateways and comprehensive AML reporting, a big CEX remains the safer bet.

Final Verdict

onAVAX fills a niche that’s been missing from the Avalanche ecosystem: a user‑friendly, on‑chain exchange that doesn’t force full KYC on every user. Its fee structure, staking integration, and reliance on the cheap‑gas environment created by the Octane upgrade make it an attractive option for active AVAX traders. The main caveats are limited liquidity for obscure tokens and the platform’s still‑growing user base.

If you trade the major AVAX pairs, value on‑chain transparency, and appreciate the ability to earn sAVAX without extra steps, onAVAX is worth a try. Keep a small amount of capital on a trusted DEX like TraderJoe for exotic assets, and consider a major CEX for fiat on‑ramps or very large orders.

Frequently Asked Questions

Is onAVAX a decentralized exchange?

No. onAVAX operates a hybrid model: it uses a traditional order‑book UI but settles every trade on the Avalanche C‑Chain, keeping the process on‑chain and transparent.

What are the fees for withdrawing AVAX?

The standard withdrawal fee is 0.001AVAX (around $0.02 after the Octane upgrade). Larger withdrawals may qualify for a fee discount after completing KYC.

Can I earn staking rewards directly on onAVAX?

Yes. onAVAX offers built‑in staking where AVAX held in the exchange wallet automatically earns sAVAX rewards, which are credited daily.

Is KYC mandatory for small trades?

No. Users can trade up to the equivalent of 5BTC without submitting identity documents. Exceeding that limit triggers the standard KYC flow.

How does onAVAX compare to TraderJoe on price slippage?

TraderJoe usually offers lower slippage on very large orders because it aggregates liquidity from multiple pools. onAVAX’s order‑book depth is strong for top pairs, but for orders above $100,000 you may see slightly higher slippage.

Prince Chaudhary

January 13, 2025 AT 07:29onAVAX’s fee schedule is pretty solid for anyone looking to stay on Avalanche while keeping costs low. The maker rate of 0.10% is competitive compared to most centralized platforms, and the taker fee at 0.20% still beats many older exchanges. Plus, the withdrawal fee of just 0.001 AVAX means you’re not bleeding cash on every exit. Overall it’s a respectable balance between liquidity and affordability.

John Kinh

January 19, 2025 AT 07:29Looks like another generic review 🙄

Mark Camden

January 25, 2025 AT 07:29The article glosses over critical aspects of onAVAX’s regulatory posture, particularly the ramifications of its tiered KYC framework. While the fee comparison appears thorough, it neglects to address how the platform’s compliance measures impact user anonymity. Moreover, the security section fails to quantify the audit findings beyond a vague “low‑severity issue”. A more rigorous analysis would benchmark onAVAX against industry standards for cold‑storage allocation. Additionally, the liquidity discussion omits depth charts for mid‑cap assets, which are essential for traders. In sum, the content provides a surface‑level overview rather than an exhaustive evaluation.

Sophie Sturdevant

January 31, 2025 AT 07:29From a trading‑infrastructure perspective, onAVAX delivers a robust order‑book engine integrated with Avalanche’s consensus layer, which translates to sub‑millisecond execution latency. The platform’s hot‑wallet multi‑sig design mitigates single‑point‑of‑failure risks, while the cold‑vault retains 95% of assets, ensuring capital preservation. Its staking‑rewards module further incentivizes liquidity provision, creating a virtuous cycle of market depth. However, the liquidity silos on niche tokens still need refinement to avoid slippage spikes. Overall, the system architecture aligns well with professional market‑making requirements.

Nathan Blades

February 6, 2025 AT 07:29If you’re on the fence about trying onAVAX, think of it as a stepping stone toward mastering on‑chain trading. The low gas fees, thanks to the Octane upgrade, let you experiment without burning through capital. Combine that with the built‑in staking rewards, and you’re essentially earning while you trade. The interface mirrors familiar CEX layouts, so the learning curve stays shallow. Dive in, start with modest positions, and let the platform’s transparency boost your confidence.

Jan B.

February 12, 2025 AT 07:29onAVAX offers low fees and decent security features.

emmanuel omari

February 18, 2025 AT 07:29From a regional standpoint, African traders will appreciate the minimal withdrawal fee; it’s hardly a barrier compared to global exchanges charging exorbitant rates. The multi‑signature hot wallet architecture provides an extra layer of protection that many local platforms lack. Yet, the platform must expand its fiat on‑ramps to truly serve emerging markets. Otherwise, it remains a niche service for crypto‑savvy users.

Courtney Winq-Microblading

February 24, 2025 AT 07:29The duality of onAVAX-combining decentralized settlement with a user‑friendly UI-creates a fascinating paradox. On one hand, you get the transparency of on‑chain trades; on the other, you retain the comfort of familiar charting tools. It’s like watching a sunrise while sipping coffee: both soothing and invigorating. For anyone who values both security and convenience, this hybrid model can feel like a perfect blend.

Jenae Lawler

March 2, 2025 AT 07:29While the article presents onAVAX as a balanced choice, one must scrutinize the underlying tokenomics with a discerning eye. The modest maker fee, though lower than many CEXs, still imposes an unnecessary friction on high‑frequency liquidity providers. Furthermore, the purported “tiered KYC” merely shuffles compliance obligations without delivering genuine privacy safeguards. In an ecosystem that prizes decentralization, such compromises may be deemed untenable for the discerning investor.

Chad Fraser

March 8, 2025 AT 07:29Hey folks, if you’re hunting for a platform that doesn’t drain your wallet on fees, give onAVAX a shot. The cheap withdrawals and low gas are perfect for daily traders. Plus, the app’s push notifications keep you on top of fills without constant screen‑watching. Jump in, experiment with small trades, and you’ll see how smooth it feels.

Jayne McCann

March 14, 2025 AT 07:29Not sure this is the best exchange out there.

Richard Herman

March 20, 2025 AT 07:29Both the fee structure and the security audits give onAVAX a solid footing, yet it’s clear there’s room for growth, especially around liquidity for smaller tokens. Users who prioritize transparency will appreciate the on‑chain settlement, while those seeking deep order books may still prefer larger CEXs for certain pairs. It’s all about matching the platform to your trading style.

Stefano Benny

March 26, 2025 AT 07:29From a DeFi engineering lens, onAVAX’s integration with Avalanche’s Octane upgrade reduces gas overhead 📉, which is a game‑changer for high‑frequency strategies. The order‑book depth, however, still lags behind top‑tier CEXs for exotic pairs 🧐. Overall, it’s a solid hybrid, but keep an eye on liquidity metrics.

Bobby Ferew

April 1, 2025 AT 08:29The review paints onAVAX with a glossy brush, as if every feature were flawless, which feels disingenuous to seasoned traders. First, the fee comparison table conveniently omits hidden costs associated with network congestion spikes, a factor that can dramatically inflate effective rates. Second, the security narrative glosses over the fact that multi‑signature hot wallets, while better than single‑key solutions, still present an attack surface that’s rarely quantified. Third, the mention of a “low‑severity issue” patched within a week lacks depth – what was the nature of that vulnerability? Fourth, the article’s liquidity section boasts “spreads within 0.5%” without providing raw depth data, leaving readers guessing about slippage on larger orders. Fifth, the staking rewards are highlighted, yet the APR volatility is ignored, which could mislead users seeking stable yields. Sixth, the tiered KYC model is described as privacy‑preserving, but the practical implementation still funnels user data to third‑party providers. Seventh, the user‑experience praise omits any discussion of mobile app bugs reported in recent release notes. Eighth, the support response times cited appear cherry‑picked, ignoring the occasional ticket backlog during peak market events. Ninth, the comparative withdrawal fees are presented without context of varying network fee dynamics across different times of day. Tenth, the article fails to address the regulatory outlook for hybrid exchanges operating on Avalanche, a crucial consideration for institutional participants. Eleventh, the assumption that “on‑chain settlement preserves transparency” overlooks the fact that transaction obfuscation tools are increasingly used on Avalanche. Twelfth, the claim that “low gas fees make onAVAX efficient” is contingent on the Octane upgrade remaining stable, which is not guaranteed. Thirteenth, the lack of a thorough audit of the order‑matching engine raises questions about potential order manipulation. Fourteenth, the sentiment that “onAVAX is relatively new” is a double‑edged sword, offering innovation but also untested resilience. Finally, the overall tone feels more like marketing copy than an unbiased evaluation, which leaves the discerning reader wanting a more critical lens.

celester Johnson

April 7, 2025 AT 08:29One could argue that the very notion of “security” on a blockchain platform is a philosophical paradox: the code is immutable, yet human operators remain fallible. onAVAX’s reliance on third‑party auditors introduces a layer of trust that contradicts the decentralized ethos. In practice, the multi‑sig architecture mitigates risk, but it does not eliminate the possibility of insider collusion. Therefore, the platform’s security claims should be examined through a skeptical, evidence‑based lens rather than accepted at face value.

Evie View

April 13, 2025 AT 08:29Honestly, the review is a half‑baked PR stunt.

Sidharth Praveen

April 19, 2025 AT 08:29Exciting to see an exchange that blends low fees with on‑chain transparency; it could pave the way for broader adoption of Avalanche‑based trading.

Somesh Nikam

April 25, 2025 AT 08:29Great overview! The detailed fee table and security audit summary are especially helpful 😊. It’s encouraging to see clear information that empowers users to make informed decisions.

MARLIN RIVERA

May 1, 2025 AT 08:29The analysis is naive, overlooking the inherent volatility of AVAX and the platform’s susceptibility to flash loan attacks. Anyone taking this at face value is bound to get burned.

Debby Haime

May 7, 2025 AT 08:29Don’t let the technical jargon scare you – the core takeaway is that onAVAX offers affordable trading with solid security measures, making it a viable option for both newbies and pros.

Andy Cox

May 13, 2025 AT 08:29Looks like a decent option, especially for those who want on‑chain trades without crazy gas costs.

katie littlewood

May 19, 2025 AT 08:29Reading through the review felt like embarking on a leisurely stroll through a bustling crypto marketplace, where each stall offers a different flavor of possibility. The fee structure, with its modest maker and taker rates, acts as a gentle breeze that keeps the air fresh for traders hungry for value. Meanwhile, the security section, punctuated by references to multi‑signature hot wallets and a Quantstamp audit, resembles a sturdy lock on a treasure chest, reassuring yet not impervious. The liquidity discussion, though honest about depth gaps, paints a picture of a river that runs strong in its main channels but becomes shallow in tributaries, prompting savvy navigators to chart alternative routes. User experience shines through the description of the intuitive UI and push‑notification‑enabled mobile app, a modern compass guiding users through volatile seas. Support responsiveness, clocking in at mere minutes, adds a comforting safety net for those who might otherwise feel adrift. In the grand tapestry of Avalanche‑based platforms, onAVAX weaves together threads of affordability, transparency, and evolving functionality, creating a fabric that invites both curiosity and confidence.