Blockchain Finality Comparison Tool

Select your use case scenario to see which finality model works best:

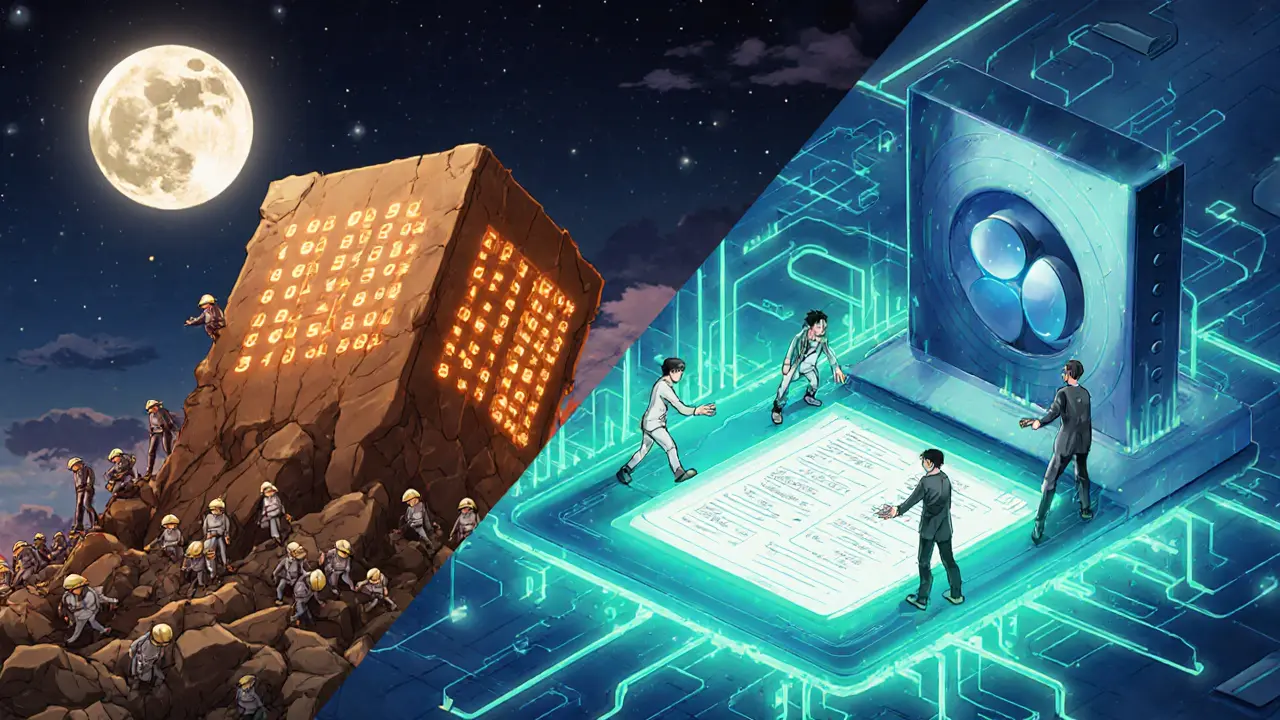

Probabilistic Finality

Uses increasing confirmations to reduce reversal risk

- Bitcoin, Ethereum PoS

- 6 confirmations ≈ 60 minutes

- High security through decentralization

- Energy intensive

Absolute Finality

Transaction settles immediately upon consensus

- Ripple, Algorand, Cosmos

- Seconds to sub-second settlement

- Lower energy consumption

- Smaller validator sets

Recommended Finality Model

When you send crypto, you want to know the moment it’s truly yours. Two schools of thought answer that question: blockchain finality that’s probabilistic, and finality that’s absolute. Both promise “settled” transactions, but they get there in very different ways. This guide breaks down the math, the tech, and the real‑world trade‑offs so you can decide which model fits your use case.

TL;DR

- Probabilistic finality (e.g., Bitcoin, Ethereum PoS) secures a transaction by adding more blocks on top; 6 Bitcoin confirmations ≈ 60minutes.

- Absolute finality (e.g., Ripple, Algorand) locks a transaction the moment it’s committed; settlement takes seconds.

- Probabilistic systems boast massive decentralization and security budgets, but they sacrifice speed and energy efficiency.

- Absolute‑finality networks deliver high throughput and low energy use, yet they rely on smaller validator sets.

- Hybrid solutions (Casper FFG, Lightning Network) try to give you the best of both worlds.

Below is a step‑by‑step look at how each type works, the trade‑offs you’ll face, and the scenarios where one shines over the other.

What is Finality?

Finality is the point at which a transaction can no longer be rolled back. In traditional finance, a cleared check is “final.” In blockchains, the definition splits into two camps.

Probabilistic finality is a model where each new block added on top of a transaction reduces the odds of reversal, but never eliminates them completely. The security curve is exponential: after a few confirmations the chance of a successful 51% attack becomes negligible.

Absolute finality (also called deterministic finality) is a model where a transaction is irrevocably settled the instant a consensus round finishes. No probability, no “waiting for confirmations.”

How Probabilistic Finality Works

Most people associate probabilistic finality with Bitcoin’s proof‑of‑work (PoW) system. Here’s the flow:

- Miners solve a cryptographic puzzle and propose a new block.

- When a block is added, the transactions it contains gain one “confirmation.”

- Each subsequent block adds another confirmation, making the original block exponentially harder to replace.

The math is simple: if an attacker controls less than 50% of the hash power, the probability of overtaking the honest chain after n confirmations drops roughly as 2⁻ⁿ.

Bitcoin is the first PoW blockchain, launched in 2009, and uses probabilistic finality. Six confirmations (≈60minutes) are the de‑facto standard for high‑value transfers.

Ethereum, after its move to proof‑of‑stake (PoS), still relies on probabilistic finality for regular blocks. Validators are randomly chosen to propose and attest to blocks; the more attestations a block gathers, the lower the reversal risk.

Ethereum shifted to PoS in 2022, keeping a probabilistic security model where finality improves with each epoch of attestations.

How Absolute Finality Works

Absolute finality leans on Byzantine Fault Tolerance (BFT) algorithms. The core idea: a set of validators runs several coordinated voting rounds. If two‑thirds (or another predefined threshold) agree, the block is locked forever.

Ripple uses a federated consensus model where trusted validator groups reach agreement in a matter of seconds, delivering immediate finality.

Stellar employs a similar federated BFT protocol, allowing fast cross‑border payments with instant settlement.

More decentralized BFT implementations include Cosmos and Algorand.

Cosmos relies on Practical Byzantine Fault Tolerance (PBFT) for its Tendermint core, providing deterministic finality after a few voting rounds.

Algorand uses Pure Proof‑of‑Stake (PPoS) with a cryptographic sortition process that yields immediate finality while keeping the validator set large and random.

Probabilistic vs Absolute: The Trade‑offs

The choice isn’t about “better” - it’s about what matters most to your application. Below is a side‑by‑side snapshot.

| Attribute | Probabilistic | Absolute |

|---|---|---|

| Confirmation time | Minutes to hours (e.g., 6 Bitcoin confirmations ≈ 60min) | Seconds (typically <5s) |

| Decentralization | Thousands of nodes (Bitcoin ~15,000 reachable nodes in 2024) | Hundreds‑to‑low‑thousands (Cosmos, Algorand) |

| Throughput | ~7tps (Bitcoin) to ~30tps (Ethereum PoS) | ~1,000tps (Algorand) to >2,000tps (modern BFT chains) |

| Energy use | ≈150TWh/yr (PoW mining) | Orders of magnitude lower (validator staking) |

| Security model | Economic cost > reward; 51% hash‑rate attack needed | Less than 1/3 malicious validators can be tolerated |

| Typical use case | Store‑of‑value, high‑value settlement, censorship‑resistance | DeFi, instant payments, cross‑chain swaps |

Real‑World Scenarios

High‑value, trust‑averse transfers - Think buying a house with Bitcoin. Users accept the wait because the network’s economic security budget (≈$15bn annually) makes a reversal practically impossible.

Fast DeFi trades - A trader on an Algorand‑based DEX needs the swap to settle instantly; any delay could cause slippage or arbitrage loss. Here absolute finality is a must.

Cross‑border remittances - Ripple and Stellar power real‑time payments between banks, capitalizing on seconds‑level finality to meet regulatory AML/KYC reporting windows.

Hybrid Approaches and the Future

Hybrid designs try to capture the security of probabilistic models while delivering instant user experience.

- Casper FFG is Ethereum’s “finality gadget,” adding epoch‑level absolute finality on top of PoS blocks.

- The Lightning Network is a layer‑2 solution for Bitcoin that provides instant settlement for small payments while the backbone still uses probabilistic finality.

- Research into “fractional finality” proposes adjustable security thresholds - you could pick 2‑thirds consensus for low‑value swaps and wait for 99.999% certainty for big transfers.

Regulators are also weighing in. Some jurisdictions prefer the audit trail of absolute finality for compliance, while others value Bitcoin’s censorship‑resistance even if it means longer settlement windows.

Choosing the Right Finality for Your Project

Use the checklist below to match your needs with the appropriate model.

- Do you need instant user feedback? If yes, look at BFT‑based chains or layer‑2s.

- Is decentralization a non‑negotiable factor? PoW chains excel here.

- How much value are you securing per transaction? Larger sums favor probabilistic security.

- What is your energy budget? PoS/BFT options consume far less power.

- Are you operating in a regulated environment? Absolute finality often eases compliance.

Most modern applications end up using a mix: core settlement on a probabilistic chain for security, plus a fast‑finality layer for user experience.

Frequently Asked Questions

Can a transaction ever be reversed on a Bitcoin network?

In theory, a 51% attack could rewrite history, but the cost of acquiring >50% of the global hash rate is astronomically high. After six confirmations the economic incentive to attack drops to near‑zero for most users.

Why do BFT networks need smaller validator sets?

BFT consensus requires multiple communication rounds among validators. With thousands of participants, latency and message‑overhead would make the protocol impractical. Keeping the set to a few hundred allows sub‑second finality while still maintaining security against up to one‑third malicious actors.

Is “absolute finality” truly absolute?

From a protocol standpoint, once a BFT round reaches the required threshold the block cannot be undone without >1/3 of validators colluding. In practice, software bugs or network splits could still cause temporary halts, so the term is best understood as "practically irreversible" rather than mathematically impossible.

How does the Lightning Network achieve instant finality?

Lightning opens a payment channel where both parties lock funds on‑chain. Inside the channel, they exchange signed balance updates off‑chain. The final state is settled on‑chain only when the channel closes, giving users instant confirmation for each hop while the underlying Bitcoin chain still provides probabilistic security for the channel’s opening transaction.

Which finality model should a new DeFi protocol adopt?

If the protocol relies on rapid liquidation or price oracle updates, a BFT chain like Algorand or Cosmos is often preferable. For assets that require maximal censorship resistance, a probabilistic chain with an L2 shortcut (e.g., Optimistic Rollups on Ethereum) can offer a balanced solution.

Debby Haime

August 14, 2025 AT 03:02Let’s dive in! Probabilistic finality gives you that rock‑solid security vibe, but you won’t have to wait forever – just a few minutes for most DeFi moves. If you’re building something that needs user confidence fast, think about mixing in a layer‑2 for that instant feel.

emmanuel omari

August 21, 2025 AT 01:42Exactly, the math is crystal clear – a 51% attack on Bitcoin would cost more than the GDP of many small nations, so the probabilistic model is unbeatable for true decentralisation. Anything that trades speed for security is simply compromising the core ethos of blockchain.

Andy Cox

August 28, 2025 AT 00:22i guess it all comes down to what you value more you want the peace of mind or instant gratification it’s a trade off that each project has to weigh.

Courtney Winq-Microblading

September 3, 2025 AT 23:02The philosophical underpinnings of finality echo the age‑old debate between certainty and probability – one offers an absolute seal, the other a growing confidence. In practice, the choice mirrors how societies balance safety nets with the hunger for immediacy. Both models, when understood, become tools rather than dogmas.

katie littlewood

September 10, 2025 AT 21:42When you sit down to weigh probabilistic versus absolute finality, it’s not just a technical checklist; it’s a narrative about risk, speed, and trust that unfolds across many dimensions. First, consider the security pedigree – probabilistic chains like Bitcoin and Ethereum PoS derive strength from massive, globally distributed hash power or stake, making a 51% attack a financial black hole; the cost escalates exponentially with each new confirmation, creating a mathematical guarantee that after six confirmations the odds of reversal are astronomically low. Second, think about latency – six confirmations on Bitcoin translate to roughly an hour, which is acceptable for high‑value, low‑frequency transfers such as real‑estate deals, but it becomes a barrier for everyday commerce where users expect sub‑second feedback. Third, energy consumption cannot be ignored; proof‑of‑work consumes terawatt‑hours of electricity annually, raising sustainability concerns, whereas absolute‑finality BFT networks like Algorand or Ripple achieve consensus with orders of magnitude less energy by rotating a validator set in a proof‑of‑stake or federated model. Fourth, decentralization depth – probabilistic systems often boast thousands of nodes, providing censorship resistance that is hard to replicate in smaller validator sets typical of BFT designs, which may rely on a few hundred vetted entities to keep communication overhead manageable. Fifth, regulatory friendliness – many regulators find the audit trail and deterministic finality of BFT chains easier to monitor, making compliance smoother for financial institutions. Sixth, ecosystem maturity – the tooling, wallets, and developer support around Bitcoin and Ethereum are far more extensive, offering a robust ecosystem for building on top of probabilistic security models. Seventh, the user experience – absolute finality delivers the “instant payment” feeling users have come to expect from Visa or PayPal, which can be a decisive competitive advantage in the DeFi space where slippage and arbitrage risks are real threats. Eighth, hybrid possibilities – solutions like Lightning for Bitcoin or Casper FFG on Ethereum attempt to marry the best of both worlds, providing near‑instant settlement backed by an underlying probabilistic safety net. Ninth, the economic incentive structures differ: miners or validators in probabilistic chains are rewarded per block and can be bribed via hash‑power purchases, while BFT validators stake capital that can be slashed for malicious behavior, aligning incentives in a different but equally potent way. Tenth, community philosophy – some projects prioritize absolute sovereignty and will accept slower finality for that, whereas others prioritize mass adoption and thus favor speed. Eleventh, network effects – the more users a chain has, the more valuable its security becomes, which is a virtuous cycle for probabilistic networks that have been around longer. Twelfth, developer ergonomics – writing smart contracts on deterministic finality chains often simplifies state‑transition logic because you can assume finality at the end of each block. Thirteenth, cross‑chain interoperability – some bridges require deterministic finality to trigger lock‑ups securely, making BFT chains attractive for hub‑spoke architectures. Fourteenth, economic modeling – the cost of waiting for additional confirmations can be modeled precisely, allowing businesses to price risk, while absolute finality typically treats risk as negligible after consensus. Fifteenth, future scalability – BFT protocols are advancing with technologies like sharding and optimistic BFT, promising higher throughput without sacrificing finality. In short, the decision hinges on which of these facets aligns with your project’s core mission, risk tolerance, and user expectations.

Jenae Lawler

September 17, 2025 AT 20:22While the exposition extols the virtues of assured settlement, one must not overlook the inherent centralisation risks introduced by a restricted validator cohort. In the name of speed we may inadvertently erode the very decentralisation that underpins blockchain’s promise.

Chad Fraser

September 24, 2025 AT 19:02Yo, if you’re building a DEX, you’ll love the instant finality of Algorand – no waiting, no stress. Pair it with a solid UI and users will stay hooked.

Jayne McCann

October 1, 2025 AT 17:42Speed beats security any day.

Richard Herman

October 8, 2025 AT 16:22Both models have merit, and the optimal solution often lies in a hybrid approach that leverages the security of probabilistic chains while providing user‑friendly finality via a layer‑2. It’s all about finding the right balance for your use case.

Parker Dixon

October 15, 2025 AT 15:02Great breakdown! 👍 For anyone new, remember that the choice isn’t binary – you can use Bitcoin’s security and add a Lightning channel for instant payments. That way you get the best of both worlds. 🚀

Stefano Benny

October 22, 2025 AT 13:42In reference to @emmanuel’s point, the throughput gains of BFT protocols are non‑trivial – sub‑second finality, sub‑millisecond latency, and the ability to sustain >5k TPS without sacrificing consensus safety. That’s a game‑changer for high‑frequency trading platforms.

Bobby Ferew

October 29, 2025 AT 11:22Sure, the long‑form essay is impressive, but most developers just need a quick answer – do I wait an hour or get seconds?

celester Johnson

November 5, 2025 AT 10:02The discourse often forgets that finality is also a philosophical construct – a snapshot of consensus that we choose to accept as immutable. When we label a block as final, we are imposing a temporal certainty onto a decentralized reality, which is inherently fluid. This tension is why hybrid models feel like a more honest reflection of the underlying system.

Prince Chaudhary

November 12, 2025 AT 08:42Respectfully, the decision matrix you outlined is spot on; aligning business needs with network characteristics is the pragmatic path forward.

John Kinh

November 19, 2025 AT 07:22Meh, sounds like over‑engineering to me.

Mark Camden

November 26, 2025 AT 06:02It is ethically irresponsible to ignore the environmental impact of proof‑of‑work systems when viable, low‑energy alternatives exist. Developers have a moral duty to prioritize sustainability without compromising security. By choosing BFT or PoS, we can uphold the principles of decentralisation while mitigating climate concerns.

Evie View

December 3, 2025 AT 04:42The market will punish any chain that drags its feet on finality – speed is power, and we’re not here to wait.

Sidharth Praveen

December 10, 2025 AT 03:22Totally agree, a swift settlement can be the difference between user adoption and abandonment. Keep the focus on latency, and the community will follow.

Sophie Sturdevant

December 17, 2025 AT 02:02From a coaching standpoint, blend the robustness of probabilistic finality with the agility of BFT to train developers for any scenario.

Nathan Blades

December 24, 2025 AT 00:42Listen, the drama of waiting for confirmations is a relic; modern users demand instant confirmation, and the technology is finally catching up. Harness the security of PoS while deploying a fast‑finality overlay, and you’ll have a solution that sings.