Binance Compliance: Rules, Risks, and Real‑World Tips

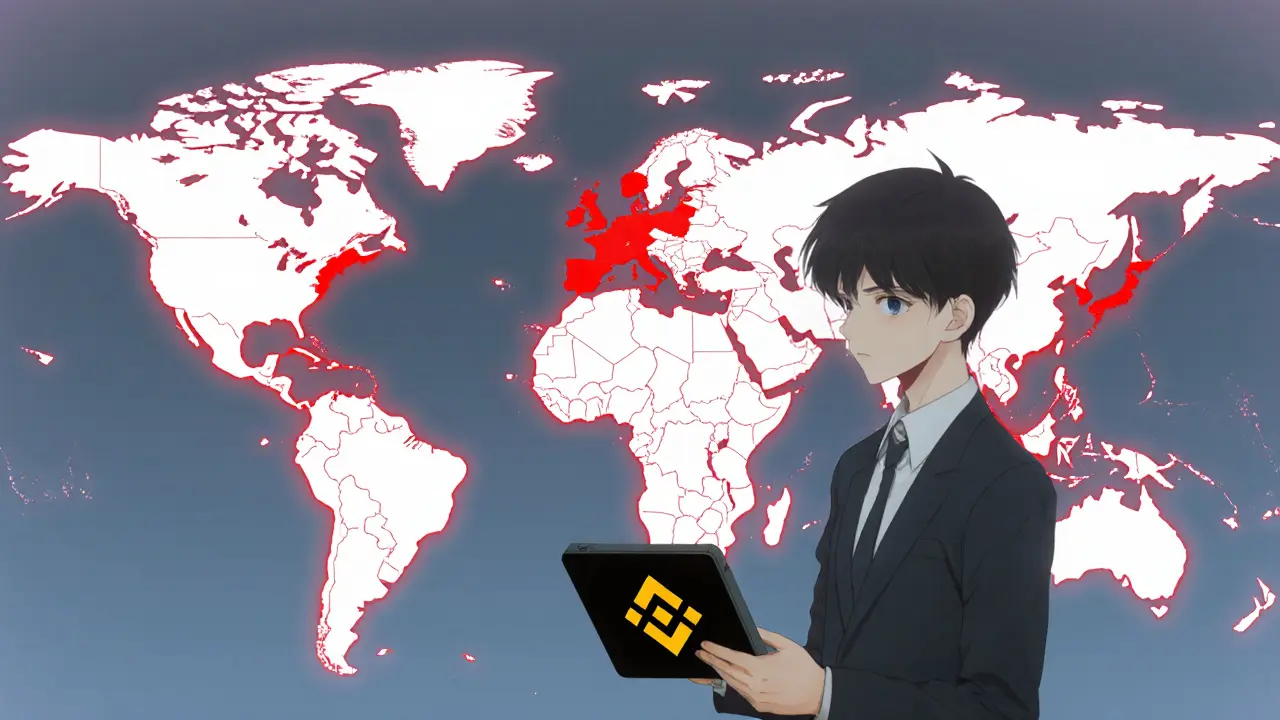

When dealing with Binance compliance, the set of policies Binance follows to obey international financial laws. Also known as exchange compliance, it covers everything from KYC checks to transaction monitoring. A major influence is OFAC sanctions, the U.S. Treasury list that flags prohibited wallets and entities, which force Binance to block or freeze certain accounts. Another driver is crypto exchange regulation, the global framework of rules that govern how exchanges operate and report. Finally, privacy coin regulations, new rules limiting the use of anonymized tokens like Monero and Zcash shape Binance's token listings. Together these entities create a compliance web where Binance compliance must align AML procedures, sanctions screening, and reporting duties.

One key semantic link is that Binance compliance encompasses anti‑money‑laundering (AML) controls, which in turn require robust customer verification. OFAC sanctions influence the design of Binance’s transaction monitoring system, forcing real‑time checks against the SDN list. Crypto exchange regulation demands regular audits and data sharing with authorities, while privacy coin regulations limit the range of assets Binance can safely list without breaching compliance thresholds. These relationships mean that any change in one area ripples across the whole compliance architecture.

What You’ll Find in This Collection

Below you’ll discover a curated mix of guides, analyses, and case studies that illustrate how Binance handles compliance challenges. Topics include the latest OFAC crypto sanctions, practical steps for meeting global exchange regulations, and the impact of privacy‑coin rules on token offerings. Whether you’re a trader, developer, or compliance officer, the articles break down complex legal jargon into actionable steps you can apply today.

Ready to see how these rules play out in real scenarios? Dive into the posts to learn how Binance adapts to shifting sanctions, how to audit your own compliance posture, and what upcoming regulatory trends mean for the broader crypto market. The insights ahead will give you a clearer picture of the compliance landscape and help you stay ahead of the curve.