Binance Regulations Explained

When navigating Binance regulations, the set of rules Binance must follow to stay legal in each jurisdiction. Also known as Binance compliance framework, it covers everything from user KYC to anti‑money‑laundering (AML) procedures. In plain terms, Binance regulations require the exchange to match local financial laws, adhere to international standards, and constantly update its policies as new rules emerge. This means traders need to watch for policy changes that could affect deposits, withdrawals, or available trading pairs.

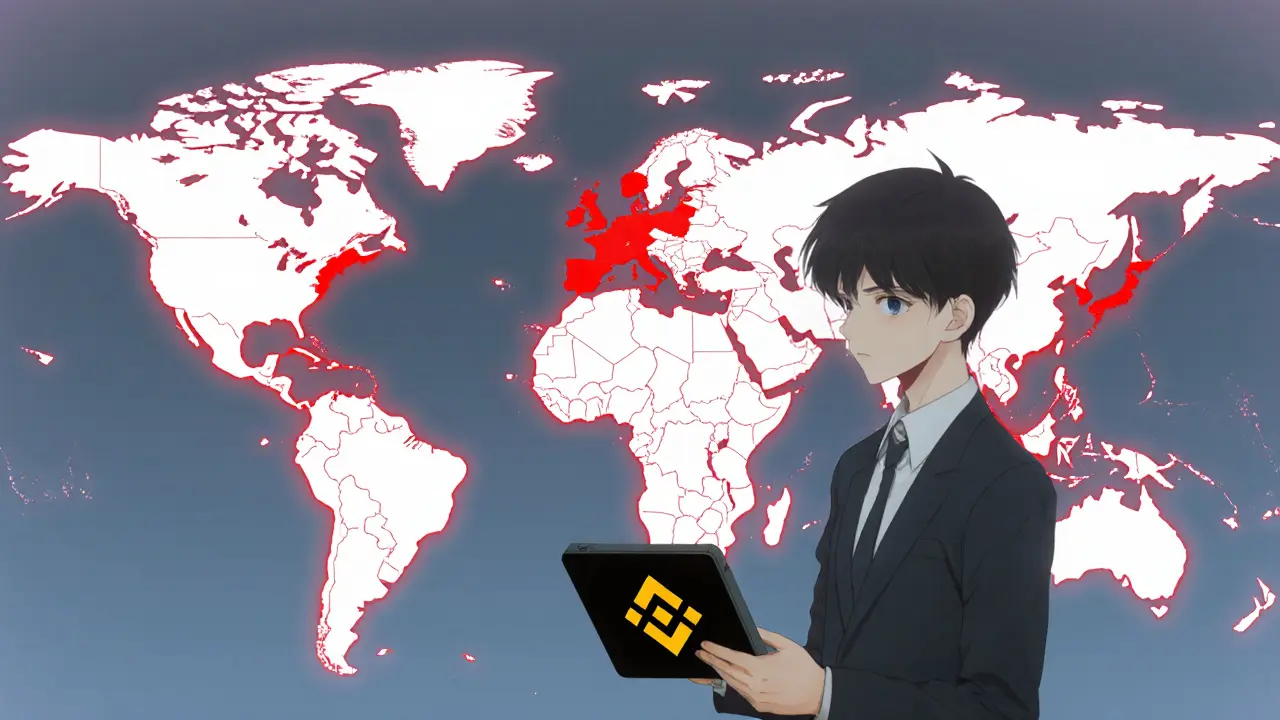

How Global Rules Shape Binance's Approach

One key piece of the puzzle is OFAC crypto sanctions, the U.S. Treasury's list that blocks wallets and entities tied to illicit activity. Binance must screen every address against the OFAC list, which directly influences its AML checks. Another major influence is the global crypto regulation trends, the shifting legal landscape across the U.S., EU, and Asia from 2024‑2025. These trends push Binance to adapt quickly, adding new compliance layers whenever a country adopts stricter licensing or reporting requirements. The interplay is clear: Binance regulations encompass OFAC sanctions, while global trends dictate the speed and scope of those adaptations.

Beyond sanctions, privacy coin regulations are tightening worldwide, especially for assets like Monero and Zcash. Binance’s policy on listing privacy coins now reflects these restrictions, often limiting trading or requiring extra verification. Meanwhile, broader crypto exchange compliance standards—such as the EU's MiCAR framework—force Binance to reshape its user agreements, data handling, and token issuance processes. Understanding these connections helps traders anticipate which services might be paused or altered. Below, you’ll find a curated set of guides that break down each regulation, show real‑world impacts on Binance, and offer tips to stay compliant while trading.