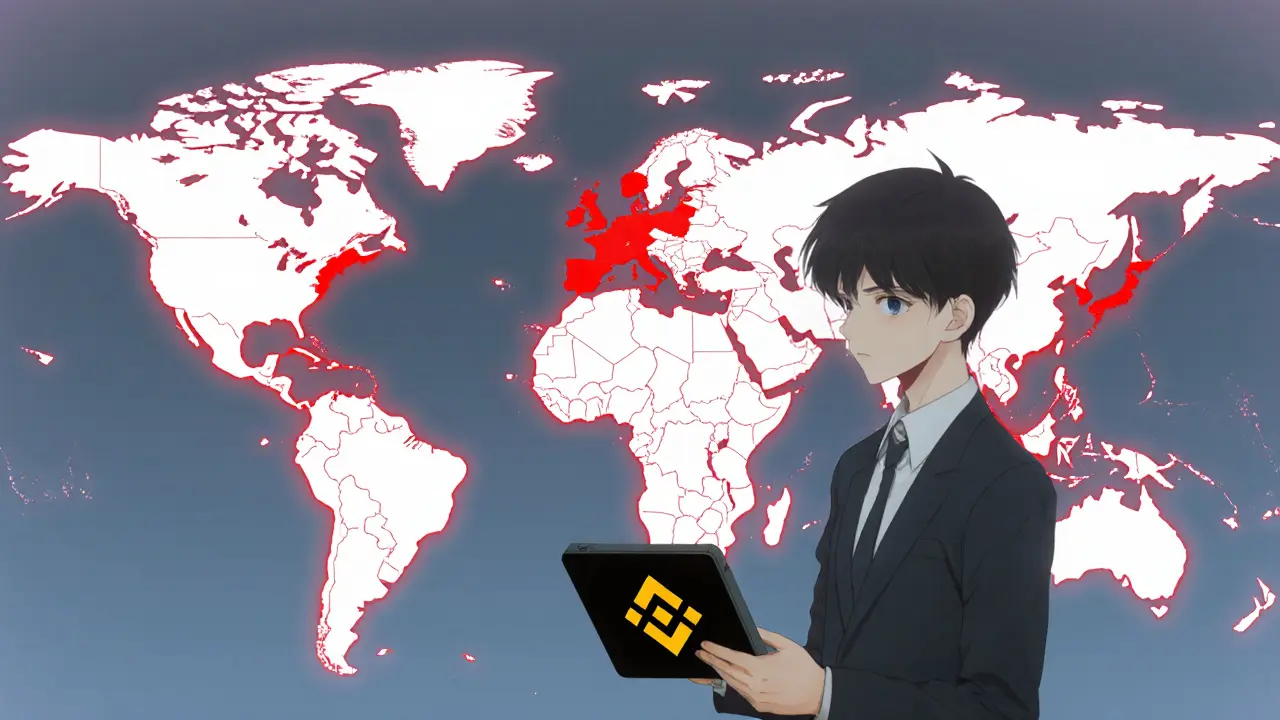

Binance Restricted Countries – What You Need to Know

When navigating Binance restricted countries, the list of nations where Binance cannot offer full services because of local laws, sanctions or licensing rules. Also called Binance blacklisted regions, this concept sits at the intersection of cryptocurrency regulations, government rules that define how digital assets can be traded, held or advertised and OFAC crypto sanctions, the U.S. Treasury's list that blocks certain wallets, entities and whole countries from accessing US‑linked services. In short, Binance restricted countries encompass regulatory blocks that directly influence whether the platform can legally operate in a given jurisdiction.

Why does Binance pull the plug in some places? First, local regulators may require a domestic license that Binance hasn’t secured, or they may outright ban crypto trading. Second, the U.S. Office of Foreign Assets Control (OFAC) adds another layer: if a nation appears on the SDN list, any service tied to the U.S. financial system must shut down access to avoid hefty fines. Third, broader global crypto regulation trends, such as the EU’s MiCAR framework or Asia’s sandbox approaches, push exchanges to err on the side of caution. The result is a patchwork of “service unavailable” messages that can confuse even seasoned traders.

For a user in a restricted region, the impact goes beyond a blocked login page. Withdrawal limits may be lowered, certain token pairs removed, and advanced features like futures or earn programs disabled. Some traders turn to VPNs, but that often violates Binance’s Terms of Service and can lead to account freezing. A safer route is to check the exchange’s official country list before signing up, and to keep an eye on local news about licensing changes. When a jurisdiction updates its stance—say, by granting a crypto‑friendly license—Binance typically restores service within weeks, as seen in recent roll‑outs across parts of Africa and the Middle East.

How to Verify Your Access and Stay Compliant

First, visit Binance’s “Supported Countries” page and compare your residency. If you’re unsure, tools like IP‑based geography checkers can confirm whether your IP falls inside a blocked zone. Next, review any privacy coin regulations, rules that specifically target coins like Monero or Zcash because of their anonymity features. Some restricted countries ban these assets outright, meaning even if the exchange operates there, you won’t see the privacy‑coin market tabs. Finally, look at independent exchange reviews—Bitunix, CRXzone or SAFEX often publish up‑to‑date compliance charts that highlight which jurisdictions are safe for trading.

Keeping tabs on regulatory shifts helps you avoid surprise account closures. For example, when the U.S. tightened OFAC sanctions in early 2024, many exchanges instantly removed services to the newly listed countries. By following the news on crypto‑regulation bodies, subscribing to official Binance announcements, and checking third‑party compliance reports, you can plan ahead and move your assets to a friendly platform before any downtime hits.

Below you’ll find a curated collection of articles that dig deeper into each of these areas—sidechain tech, token airdrops, staking calculators, and more. Whether you’re trying to understand why Binance is blocked in your home country or you want practical steps to stay compliant, the posts here give you the context, tools, and actionable insights you need to trade confidently across the global market.