Blockchain Finality: Why It Matters for Secure Transactions

When working with blockchain finality, the moment a transaction is considered irreversible and cannot be altered. Also known as finality, it forms the bedrock of trust for any blockchain‑based system because users need assurance that their moves stay permanent. Without clear finality, exchanges would hesitate to list assets and DeFi platforms could face constant re‑orgs. Blockchain finality therefore isn’t just a technical term—it’s the safety net that lets you treat crypto like cash.

Core Building Blocks Behind Finality

The first major piece is a consensus algorithm, the set of rules nodes follow to agree on the next block. Consensus determines how quickly and securely finality is reached, linking the abstract idea of finality to practical network behavior. In simple terms, blockchain finality requires a consensus algorithm that can lock in blocks once a majority of participants have validated them. This relationship creates the first semantic triple: *Blockchain finality* – *requires* – *consensus algorithm*.

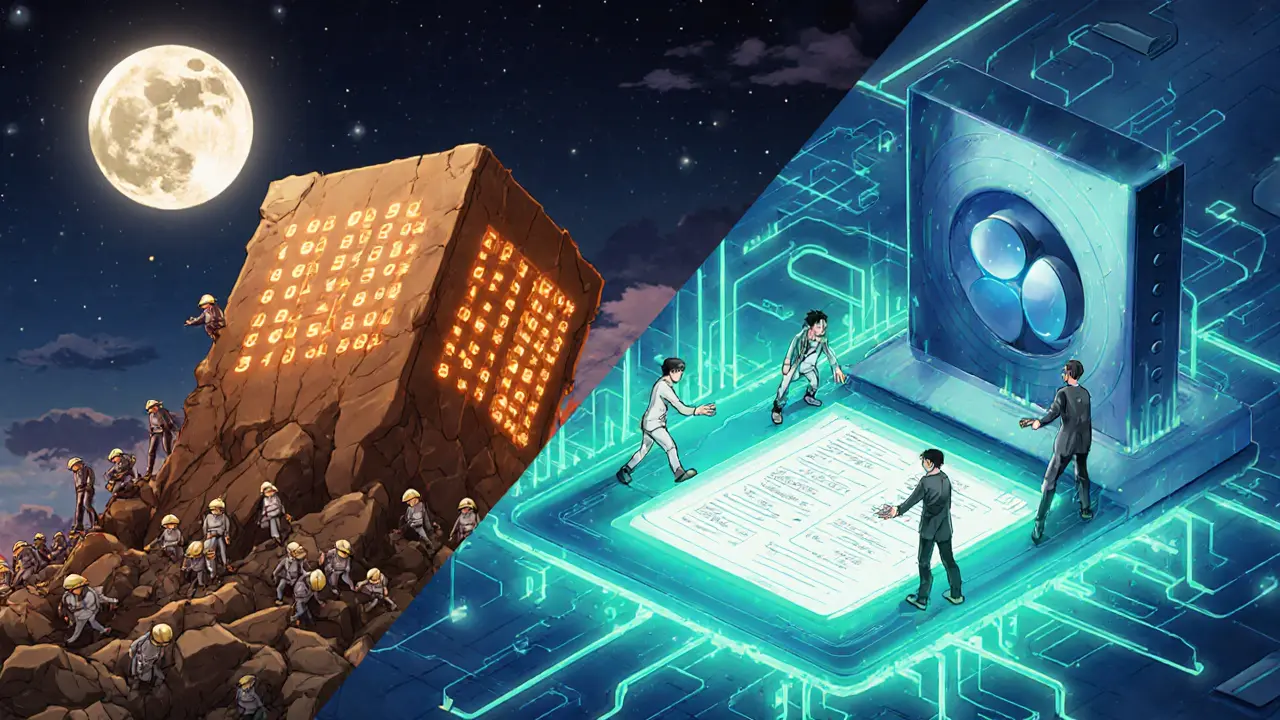

Two dominant consensus styles shape finality speed: Proof of Work (PoW) and Proof of Stake (PoS). Proof of Stake, a system where validators lock up tokens to earn the right to propose blocks typically offers faster finality because the validator set is fixed and can quickly reach agreement. By contrast, PoW demands miners solve cryptographic puzzles, meaning finality may take several minutes as the network waits for enough hash power to converge. The difference shows another triple: *Proof of Stake* – *improves* – *finality speed* compared to *Proof of Work*.

Behind many PoS chains sits a finality gadget, an extra protocol layer that finalizes blocks in just a few seconds. Examples include Ethereum’s Casper FFG and Polkadot’s GRANDPA. These gadgets work hand‑in‑hand with the underlying consensus to convert “soft” agreement into “hard” finality, turning a probabilistic guarantee into a deterministic one. The connection can be expressed as: *Finality gadget* – *enables* – *deterministic finality* within a PoS network.

Many finality solutions also rely on Byzantine Fault Tolerance, the ability of a system to reach consensus even if some nodes act maliciously. BFT mechanisms let a blockchain tolerate up to a third of faulty or adversarial validators while still delivering finality. This resilience is essential for high‑value DeFi contracts, where even a brief window of uncertainty could be exploited. The triple here reads: *Byzantine Fault Tolerance* – *supports* – *secure finality* in hostile environments.

Why does all this technical detail matter to you? Because finality directly impacts user experience, risk, and cost. Faster finality means quicker withdrawals from decentralized exchanges, lower exposure to front‑running attacks, and smoother cross‑chain bridges. On the other hand, weaker finality can inflate gas fees as users bounce transactions until they’re sure the chain won’t roll back. Understanding the interplay between consensus, staking, and BFT helps you pick the right platform for trading, lending, or building smart contracts.

Below you’ll find a curated set of guides, reviews, and deep dives that unpack each of these concepts. From a side‑by‑side comparison of PoW versus PoS finality speeds to practical tips on evaluating a blockchain’s finality gadget, the articles are designed to give you actionable insights. Dive in to see how the theory translates into real‑world decisions for traders, developers, and anyone who wants their crypto moves to stay final.