Crypto Trading Restrictions: What They Are and Why They Matter

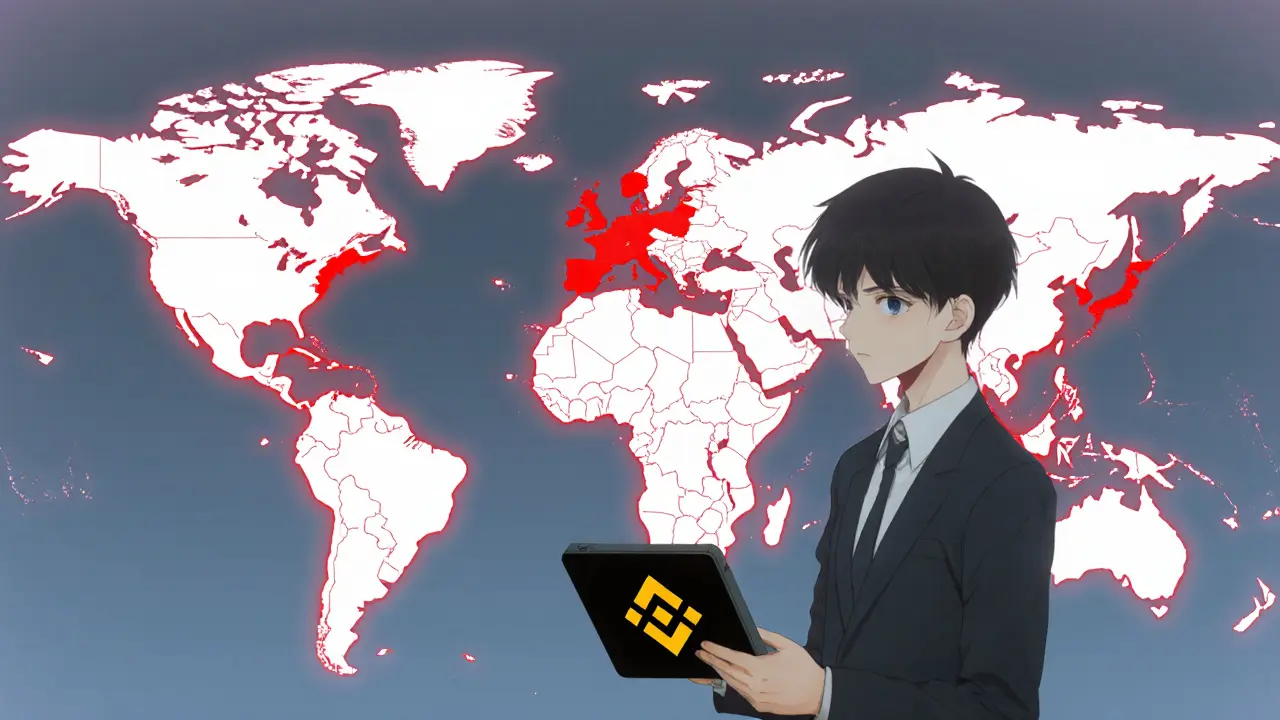

When dealing with crypto trading restrictions, rules that limit how, where, or when you can buy, sell, or move digital assets. Also known as cryptocurrency trading limits, these restrictions shape every decision you make on an exchange, a DeFi platform, or a peer‑to‑peer trade. Crypto trading restrictions encompass everything from government‑imposed bans to platform‑level KYC rules, and they often require you to verify identity, stay within geographic limits, or avoid sanctioned assets. In practice, a trader must understand which jurisdictions block certain tokens, how sanctions affect wallet addresses, and which compliance steps keep an account safe from freeze or fine.

Key players that shape the landscape

One of the biggest forces behind these limits is OFAC sanctions, the U.S. Treasury's Office of Foreign Assets Control list that targets wallets, DAOs, and DeFi protocols. When a wallet appears on the SDN list, any exchange that processes a trade involving that address must block the transaction – a direct example of how crypto trading restrictions require real‑time compliance checks. Another hot spot is Kazakhstan crypto mining restrictions, post‑2025 rules that cap energy usage, impose licensing fees, and limit which coins miners can run. Although mining isn’t trading per se, the limits on production affect market supply, which in turn tightens trading rules for assets sourced from Kazakh miners. Finally, privacy coin regulations, global efforts to curb anonymous tokens like Monero and Zcash, illustrate how governments aim to reduce illicit flows; many exchanges now block or delist these coins, adding another layer to the trader’s compliance checklist. Together, these entities create a web where regulatory bans influence exchange policies, exchange policies influence trader behavior, and trader behavior feeds back into market dynamics – a classic semantic triple that drives the whole ecosystem.

Understanding the interaction among these rules helps you stay ahead of potential freezes, account closures, or unexpected fee spikes. For example, if you’re planning to move L‑BTC from the Liquid Network, you’ll need to verify that the destination exchange isn’t subject to OFAC restrictions on sidechain tokens. If you hunt for high‑yield staking in regions with strict privacy‑coin bans, you’ll want to double‑check whether the staking platform complies with local AML directives. The articles below break down each of these scenarios: from how the OFAC list targets wallets, to the specifics of Kazakhstan’s post‑crisis mining caps, to the latest privacy‑coin compliance tools. Armed with that knowledge, you’ll be able to pick the right exchange, set up the proper KYC workflow, and avoid costly compliance missteps. Dive into the collection and see how each piece fits into the broader picture of crypto trading restrictions.