Probabilistic Finality in Blockchain: How It Works and Why It Matters

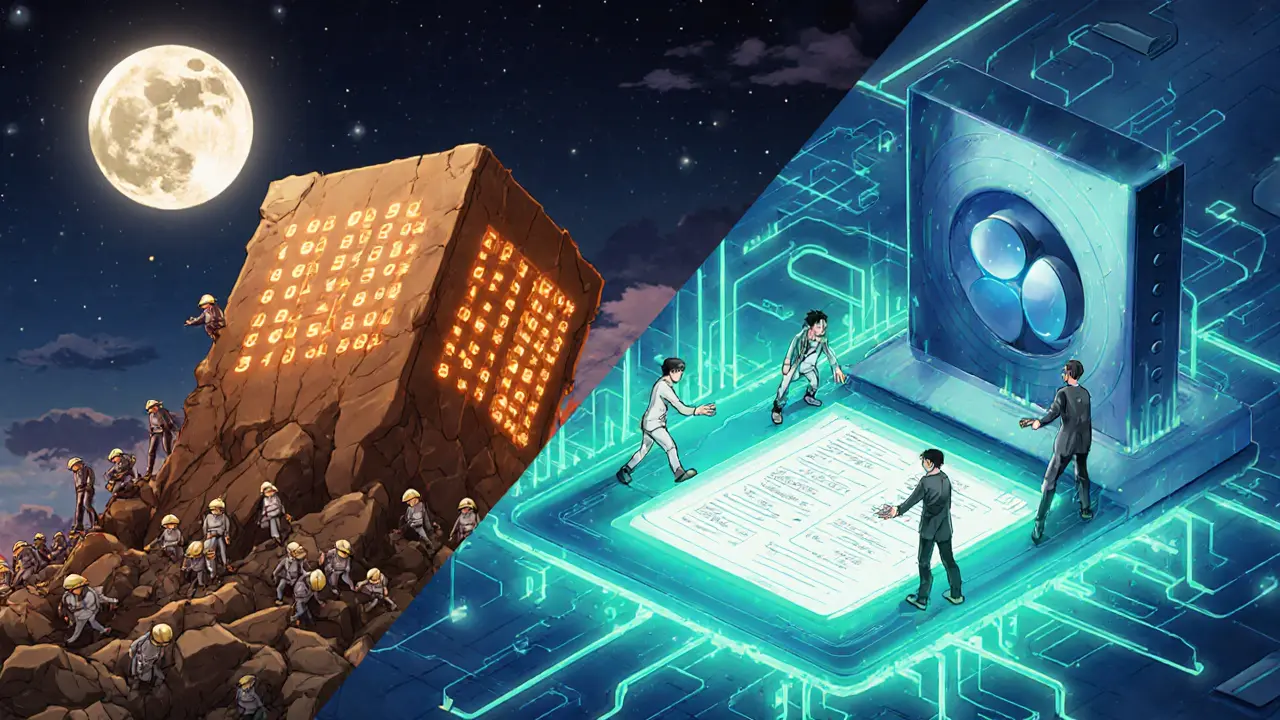

When working with Probabilistic Finality, a method where transaction confirmation becomes increasingly certain as more blocks are added to a chain. Also known as probabilistic confirmation, it relies on statistical confidence rather than an absolute finality point. The concept lives inside blockchain consensus protocols and often works with finality gadgets that help reduce the impact of network latency. Probabilistic Finality is especially useful for public networks that need to stay open while still giving users confidence in transaction finality.

Key Factors That Shape Probabilistic Finality

Think of probabilistic finality as a confidence meter. The core entity—Probabilistic Finality—has a few critical attributes: confidence level, required block depth, and security trade‑off. The values you see in practice are often quoted as “99.9% certainty after six blocks” for Bitcoin or “99.99% after twelve blocks” for slower PoW chains. This relationship creates a semantic triple: *Probabilistic Finality* **requires** *block depth* to reach a *desired confidence level*. Another triple links *finality gadgets* **enhance** *security* by shortening the *effective block depth* needed under high *network latency*. In real‑world terms, a validator set that uses a finality gadget like Tendermint can claim finality within a few seconds, while a pure PoW chain leans on statistical odds. The trade‑off is clear—speed versus absolute certainty—and projects choose the balance that matches their user base and threat model.

Why should you care if you’re reading exchange reviews or airdrop announcements? Because the underlying consensus mechanism determines how quickly and safely tokens move across a network. A token listed on an exchange that runs a probabilistic finality model may experience longer withdrawal windows, while a platform built on a fast finality gadget can offer near‑instant deposits. Regulations that target “crypto security” often reference the reliability of transaction finality, especially when assessing systemic risk. In the articles below you’ll see how airdrop timings, exchange fee structures, and even privacy‑coin regulations intersect with the confidence guarantees provided by different finality approaches. Understanding these connections helps you evaluate risk, choose the right platform, and spot opportunities before they become mainstream.