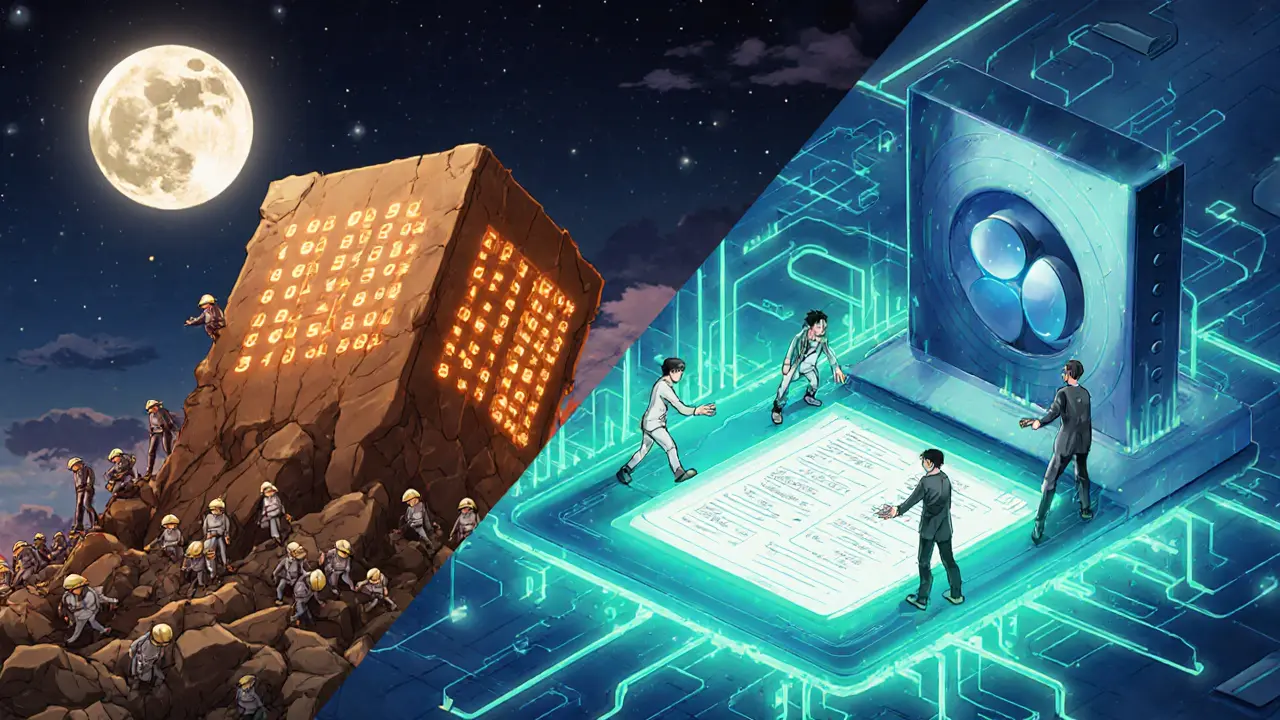

Transaction Settlement

When handling transaction settlement, the process that moves assets from one party to another and confirms that every obligation is met. Also known as settlement, it acts as the final bridge between an order and actual ownership transfer. Clearinghouses serve as neutral intermediaries that match and net trades before they reach settlement play a crucial role, especially in high‑volume crypto exchanges. Meanwhile, smart contracts automated code snippets that execute settlement rules on a blockchain simplify the hand‑off, cutting down manual reconciliation and reducing error risk. In plain terms, transaction settlement requires a reliable network, clear rules, and a way to verify that assets truly change hands. It encompasses clearing, it needs smart contracts, and it is influenced by blockchain technology, creating a seamless flow from trade initiation to final ownership.

Core Elements That Drive Modern Settlement

The rise of blockchain settlement has reshaped how we think about clearing and finality. Because every block records a tamper‑proof ledger entry, participants can trust that a trade is final once the block is confirmed. This trust lowers the need for lengthy settlement windows that traditional finance uses, where funds might sit in limbo for days. Crypto exchanges, such as those detailed in our reviews, rely on rapid settlement to keep users confident and to meet regulatory expectations. Payment gateways also benefit: when an e‑commerce site processes a crypto payment, the settlement layer instantly moves the coin to the merchant’s wallet, eliminating chargebacks common in card payments. Airdrop distributions follow the same logic; the smart‑contract‑driven settlement ensures each eligible address receives tokens without manual bookkeeping. Across all these use cases, the common thread is a clear set of rules, an impartial intermediary (whether a clearinghouse or code), and a transparent ledger that confirms the transfer.

Understanding these mechanics sets the stage for the deeper dives below. In the list that follows you’ll find exchange reviews that judge how fast and secure their settlement processes are, guides on protecting private keys that guard settled assets, and analyses of regulatory trends that shape settlement standards worldwide. Whether you’re tracking a new airdrop, evaluating a trading platform, or simply curious about how your crypto moves from point A to B, the articles ahead give you practical insight and actionable tips to navigate the settlement landscape with confidence.