Energy Blockchain Use Case Calculator

By 2025, the marriage of blockchain technology and the energy industry has moved from pilot projects to a backbone of transparent and resilient power systems. Stakeholders-from utility giants to community solar co‑ops-are using distributed ledgers to cut fraud, lower transaction costs, and open new revenue streams. This article walks through the latest trends, real‑world applications, and the hurdles that still need clearing before blockchain can fully reshape how we produce, distribute, and consume power.

What blockchain brings to the energy world

Blockchain is a shared, immutable ledger that records transactions across a network of computers, ensuring that each entry is cryptographically secured and visible to all authorized participants. In the energy sector, this means every kilowatt‑hour, every carbon credit, and every asset transfer can be tracked in real time without a central administrator. The result is three core benefits:

- Transparency: All parties see the same data, reducing disputes over billing or grid balancing.

- Decentralization: Power can be traded peer‑to‑peer, bypassing traditional intermediaries.

- Automation: Smart contracts execute payments, incentives, or grid‑balancing actions automatically when predefined conditions are met.

According to market forecasts, the global blockchain‑energy market will grow from $6.43billion in 2024 to well over $12billion by 2028, highlighting strong commercial momentum.

Modular blockchain architectures: the backbone of scalability

Early blockchain deployments struggled with scaling, especially for high‑frequency energy data. The solution emerging in 2025 is modular blockchain designs that separate consensus, data availability, and execution layers. This lets energy projects pick the optimal combination of speed, privacy, and cost.

Key platforms driving this shift include:

- Celestia - a data availability network that lets developers launch execution layers without building a full Layer‑1.

- Polygon 2.0 - integrates zero‑knowledge (ZK) proofs and multichain coordination for fast, low‑cost settlements.

- EigenLayer - enables re‑staking of ETH to secure modular services, reducing the need for separate token economies.

These tools have lowered the barrier to entry for startups and utilities alike, cutting infrastructure spending by up to 45% compared with monolithic blockchains.

Six real‑world use cases gaining traction

By the end of 2025, six applications have proven commercial viability:

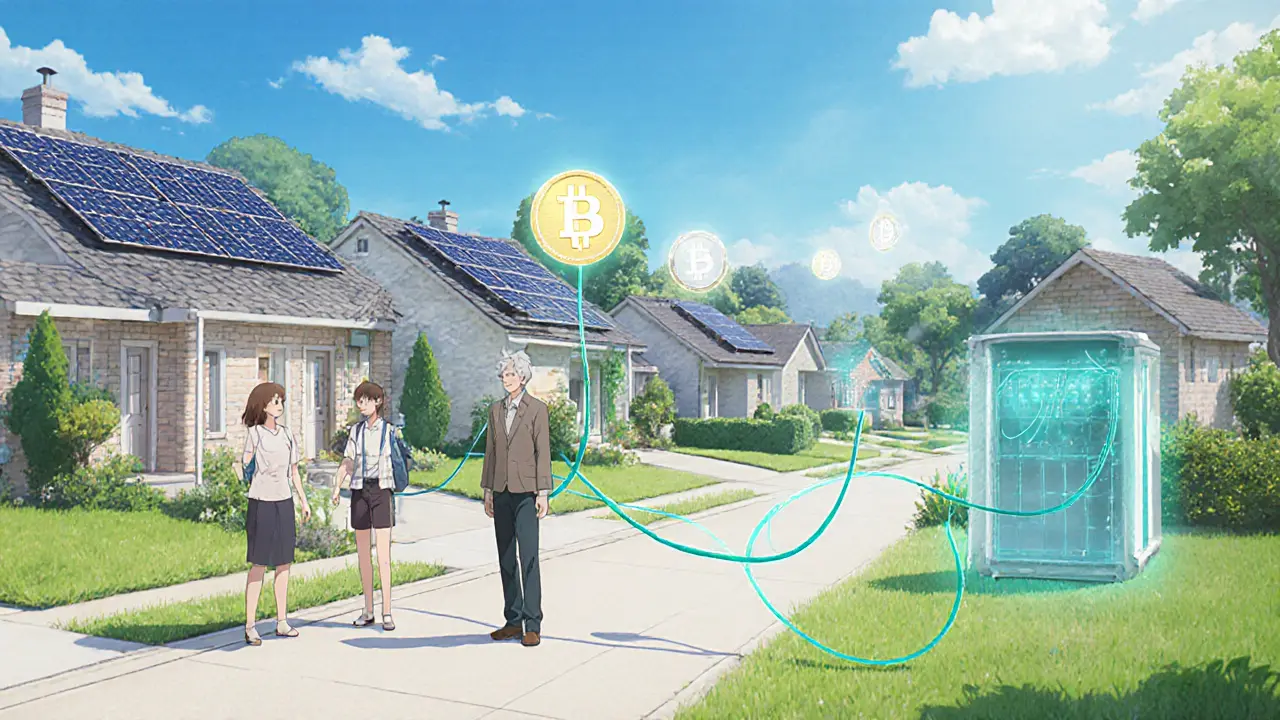

- Peer‑to‑peer (P2P) energy trading - Homeowners with rooftop solar sell excess power directly to neighbors via blockchain‑mediated contracts. Projects in Germany and Australia report up to 12% higher earnings for prosumers.

- Carbon credit tokenization - Verified carbon sequestration from farms or reforestation projects is minted as tokens, allowing instant global trade and financing for smallholders.

- Green crypto mining - In regions with surplus renewable generation (e.g., Icelandic geothermal), miners convert excess electricity into cryptocurrencies, monetizing otherwise wasted power.

- Smart grid automation - Sensors feed real‑time data to smart contracts that automatically dispatch storage, curtail loads, or trigger demand‑response events without human intervention.

- Tokenized energy assets - Investors buy fractional tokens representing ownership in solar farms, receiving proportional revenue streams via automated payouts.

- Lifecycle tracking for batteries - From raw material sourcing to end‑of‑life recycling, each step is recorded on a ledger, improving traceability and boosting recycling rates by up to 30%.

These examples show blockchain moving from hype to infrastructure that solves concrete pain points-price opacity, asset financing, and grid stability.

Regional landscape: who’s leading the charge?

Europe commands the largest share (35%) of blockchain‑energy deployments, driven by aggressive renewable targets and supportive policy frameworks. The United States holds roughly 16%, with strong activity in California’s microgrid projects and Texas’s tokenized wind investments. Asia‑Pacific, especially China, is rapidly scaling renewable capacity and experimenting with blockchain for battery logistics, though regulatory clarity varies.

Despite the U.S. policy shift after the Inflation Reduction Act repeal, private capital continues to pour into blockchain‑enabled platforms, attracted by the promise of lower operational costs and new monetization models.

Key challenges and how the industry is tackling them

Even with promising pilots, several hurdles remain:

- Regulatory uncertainty: Jurisdictions differ on how to classify tokenized assets and carbon credits. Collaborative sandboxes in Singapore and the EU help iron out compliance pathways.

- Energy consumption of proof‑of‑work (PoW) chains: Environmental concerns have spurred a shift toward proof‑of‑stake (PoS) and other low‑energy consensus mechanisms. Modular designs allow energy firms to choose PoS‑based execution layers.

- Interoperability: Multiple blockchains (public, private, consortium) need to speak to each other. Standards bodies like the International Energy Agency (IEA) are drafting cross‑chain communication protocols.

- Technical expertise: Deploying secure smart contracts requires specialized skills. Firms are partnering with blockchain‑as‑a‑service (BaaS) providers to outsource development and audits.

Addressing these issues is essential for moving from isolated pilots to nationwide, grid‑scale solutions.

Comparison of blockchain deployment models

| Model | Governance | Transparency | Scalability | Typical Use Cases |

|---|---|---|---|---|

| Public (e.g., Ethereum) | Open, community‑driven | High - anyone can audit | Medium - limited by gas fees, mitigated by Layer‑2s | Carbon credit tokens, green mining |

| Private (e.g., Hyperledger Fabric) | Consortium‑controlled | Moderate - permissioned access | High - optimized for enterprise throughput | Asset tokenization, utility‐internal trading |

| Consortium (e.g., Energy Web Chain) | Hybrid - select validators | High - transparent among members | High - tailored consensus | Smart grid automation, P2P trading |

Choosing the right model depends on regulatory requirements, desired privacy levels, and transaction volume. Many projects now adopt a hybrid approach, using a private execution layer anchored to a public data‑availability network like Celestia.

Future outlook: where is blockchain headed in the energy ecosystem?

Looking ahead to the next five years, three trends are set to dominate:

- AI‑enhanced smart contracts: Machine‑learning models will predict price spikes, weather‑driven demand, and grid constraints, feeding those forecasts directly into contract clauses for automatic hedging.

- Full‑life‑cycle tokenization: From renewable project financing to end‑of‑life decommissioning, every stage will be represented by digital tokens, creating a seamless financing pipeline.

- Policy‑driven standardization: International bodies will publish compliance frameworks that align blockchain data structures with carbon accounting standards, making cross‑border trade smoother.

When these pieces fall into place, blockchain could become the nervous system of a carbon‑neutral grid, delivering real‑time data, secure settlements, and trustworthy provenance for every megawatt generated.

Frequently Asked Questions

How does blockchain improve transparency in energy trading?

Every transaction is recorded on an immutable ledger that all authorized participants can view. This eliminates hidden fees, reduces disputes, and makes it easy to audit the flow of electricity from producer to consumer.

What is the difference between public and private blockchains for energy applications?

Public blockchains are open to anyone and offer maximum transparency but may suffer from higher transaction costs. Private blockchains restrict participation to known entities, delivering higher throughput and lower costs, but with limited external auditability.

Can blockchain help reduce the carbon footprint of cryptocurrencies?

Yes. By moving mining operations to regions with excess renewable energy and by adopting proof‑of‑stake or other low‑energy consensus mechanisms, blockchain can drastically cut its own emissions while also enabling "green crypto mining" projects.

What regulatory hurdles should a startup expect when launching a tokenized solar farm?

Startups must navigate securities law (whether the token is considered a security), local energy market rules, and tax treatment of token revenues. Engaging with a jurisdiction that offers a sandbox, such as Singapore or the EU’s Innovation Hub, can streamline compliance.

How realistic is peer‑to‑peer energy trading for average households?

In regions with supportive net‑metering policies and smart meters, P2P trading platforms are live and allow homeowners to earn 5‑15% more from surplus solar. The main barrier remains the need for an easy‑to‑use app and clear local regulations.

Nathan Van Myall

October 10, 2025 AT 08:10Modular blockchain designs are finally addressing the scalability choke points that plagued early energy pilots. By decoupling consensus from data availability, projects can pick a low‑latency layer for real‑time meter data while anchoring proofs on a robust availability network. This architecture reduces transaction latency and operational costs, making peer‑to‑peer trading more viable at grid scale. The ability to swap execution layers without rebuilding the whole stack also future‑proofs deployments against evolving regulatory requirements.

debby martha

October 18, 2025 AT 19:32idk if all this hype is worth the cost.

Ted Lucas

October 27, 2025 AT 05:54Listen up, the energy‑grid is about to get a turbo boost thanks to zero‑knowledge rollups and tokenized assets! Smart contracts will automate demand‑response in milliseconds, cutting overhead and spurring a new wave of green finance :) The jargon may sound heavy, but the payoff is crystal clear.

ചഞ്ചൽ അനസൂയ

November 4, 2025 AT 17:16Hey folks, let’s remember that tech is only as good as the people who use it. Blockchain can act like a wise teacher, showing transparent records for every kilowatt that flows. If we keep an open mind and share lessons, the grid can become more resilient together. Think of it as a community garden for energy, where each plant is tracked and nurtured.

Orlando Lucas

November 13, 2025 AT 04:38When we contemplate the philosophical underpinnings of a decentralized ledger, we see a mirror of the broader energy transition. The ledger’s immutability offers a form of trust that traditional centralized utilities have struggled to provide. Yet, optimism must be tempered with realistic assessments of integration costs and regulatory landscapes. In practice, a hybrid model-combining private execution with public data availability-delivers both privacy and transparency. Ultimately, the goal is a harmonious coexistence of technology and policy, guiding us toward a sustainable future.

Philip Smart

November 21, 2025 AT 16:01Sure, the hype train is leaving the station, but the actual savings are still a bit fuzzy. Most pilots report only marginal cost reductions once you factor in the overhead of smart contract audits. In short, it's not a magic bullet.

Jacob Moore

November 30, 2025 AT 03:23Great to see the momentum building! If you need help figuring out which modular layer fits your use case, just shout – I’ve been testing a few on testnets. The community vibe is really encouraging and it’s awesome to watch.

Manas Patil

December 8, 2025 AT 14:45From a regional perspective, the interplay between blockchain interoperability standards and local renewable incentives is crucial. Leveraging cross‑chain bridges can align tokenized carbon credits with existing carbon markets in Asia‑Pacific. This synergy not only accelerates financing but also cultivates a culturally resonant narrative around clean energy. The jargon may be dense, but it unlocks real‑world impact.

Annie McCullough

December 17, 2025 AT 02:07Everyone's singing praises of P2P trading it sounds great but real world conditions are messy the latency issues persist and regulatory gray zones remain the hype often ignores the messy implementation details :D

Carol Fisher

December 25, 2025 AT 13:29We shouldn't let foreign blockchain frameworks dictate our energy future 🇺🇸💪. Our own innovators can build sovereign solutions that keep profits home. 🌟🚀

Melanie Birt

January 3, 2026 AT 00:51The tokenization of solar assets typically follows a three‑step process: asset registration, smart‑contract issuance, and automated revenue distribution. Each step must comply with SEC guidelines to avoid being classified as an unregistered security. By incorporating on‑chain KYC/AML checks, platforms can streamline compliance while maintaining user privacy. Use of standardized token schemas also simplifies integration with existing portfolio tools. 😊

mark noopa

January 11, 2026 AT 12:13Ah, the grand tapestry of blockchain in energy is nothing short of a modern epic, woven with threads of ambition, regulation, and raw technological might. One cannot simply glance at a single pilot and claim mastery; each deployment is a microcosm of the broader socio‑economic landscape. The allure of immutable ledgers promises a utopia where every kilowatt‑hour is accounted for with divine precision, yet the reality is peppered with latency hiccups and integration headaches. When we talk about data availability layers like Celestia, we must acknowledge the steep learning curve that comes with mastering Merkle proofs and rollup mechanics. Moreover, the tokenization of carbon credits, while theoretically elegant, is plagued by jurisdictional disputes that can halt a transaction mid‑flight. Critics often point to the energy consumption of legacy proof‑of‑work chains, a valid concern that drives the migration toward proof‑of‑stake ecosystems. However, the transition is not merely a technical swap; it demands cultural shifts within organizations accustomed to legacy workflows. The modular approach, separating consensus from execution, offers a palette of choices, yet it also introduces a combinatorial explosion of configuration possibilities. Investors, dazzled by the buzzwords, sometimes overlook the necessity of rigorous smart‑contract audits, leading to costly exploits that erode trust. On the bright side, cross‑chain communication protocols are emerging, promising interoperability that could finally knit together the fragmented tapestry of energy platforms. In practice, a hybrid model-public data anchoring paired with private execution-strikes a balance between transparency and performance. The scalability gains from layer‑2 solutions can reduce transaction fees by an order of magnitude, unlocking new business models like real‑time demand response markets. Nonetheless, policymakers lag behind, crafting regulations that are either too vague or overly prescriptive, stifling innovation. Communities that embrace open‑source collaboration and shared governance can navigate these choppy waters more nimbly than monolithic corporations. In the end, the journey toward a blockchain‑enabled carbon‑neutral grid is less a sprint and more a marathon, demanding patience, perseverance, and a dash of audacious optimism 😊.

Rama Julianto

January 19, 2026 AT 23:35Yo, if you're looking to launch a tokenized solar farm, start with a solid legal framework-don't skimp on the SEC compliance paperwork. The smart contract should include on‑chain KYC/AML modules, otherwise you risk a costly shutdown. Also, test the system on a public testnet before going live, it saves a ton of headaches later. 👍

Helen Fitzgerald

January 28, 2026 AT 10:57Love seeing all these innovative ideas come together! Keep the conversation friendly and inclusive – everyone's voice matters in shaping the future.

Jon Asher

February 5, 2026 AT 22:19Blockchain can help make energy trading clearer. It also can lower costs for everyone.

Scott Hall

February 14, 2026 AT 09:42Seeing the community share resources and insights is really uplifting. When we help each other troubleshoot, the whole ecosystem gets stronger. Keep the good vibes flowing.

Jade Hibbert

February 22, 2026 AT 21:04Oh great, another buzzword fest. Sure, let's just trust a code line to save the planet.