Houdini Swap Fee Calculator

Houdini Swap (LOCK) offers up to 50% off swap fees when paying with LOCK tokens. Calculate your potential savings using the tool below based on your swap amount and current LOCK price.

Based on current LOCK price of $0.12 and 0.5% standard swap fee

Estimated Fees

Standard Swap Fee

$0.00 ($0.00)

LOCK Discounted Fee

$0.00 ($0.00)

Equivalent to 0.00 LOCK tokens

Important Notes

• Houdini Swap fees may vary based on network congestion

• Current LOCK price is $0.12 (as of December 2025)

• LOCK tokens are required to access 50% fee discount

• Market volatility may affect actual fees

Houdini Swap (LOCK) isn't another meme coin or speculative token trying to ride the next bull run. It’s a niche but technically interesting project built for one specific job: letting you swap cryptocurrencies across different blockchains without leaving a trace. If you’ve ever worried that your transaction history is public forever on Ethereum or Solana, Houdini Swap tries to fix that - legally and technically.

What Houdini Swap Actually Does

Most decentralized exchanges (DEXs) like Uniswap or PancakeSwap make your trades public. Anyone can see what you swapped, how much, and when. Houdini Swap changes that. It’s a non-custodial DEX aggregator that lets you swap Bitcoin, Ethereum, Solana tokens, and over 4,000 other coins across 80 different blockchains - while auto-deleting your transaction data after 72 hours.

This isn’t just obfuscation. It’s designed to be compliant. The team calls it “crypto’s best compliant privacy.” That means they’re not trying to hide transactions from regulators like Tornado Cash did (which got sanctioned in 2022). Instead, they’re using cryptographic methods to make your swap private from public block explorers, while still keeping audit trails available for regulators if needed. Think of it like sending a letter in a sealed envelope - only you and the recipient know what’s inside, but the postal service can verify it was delivered.

The LOCK Token: More Than Just a Utility Coin

The native token of Houdini Swap is LOCK. It’s not a governance token you vote with, nor is it a reward token you earn by staking. LOCK is the fuel that powers the platform. You need it to pay for swaps, get fee discounts, and access advanced privacy features.

Here’s how it works:

- Transaction fees: Paying in LOCK gives you up to 50% off swap fees.

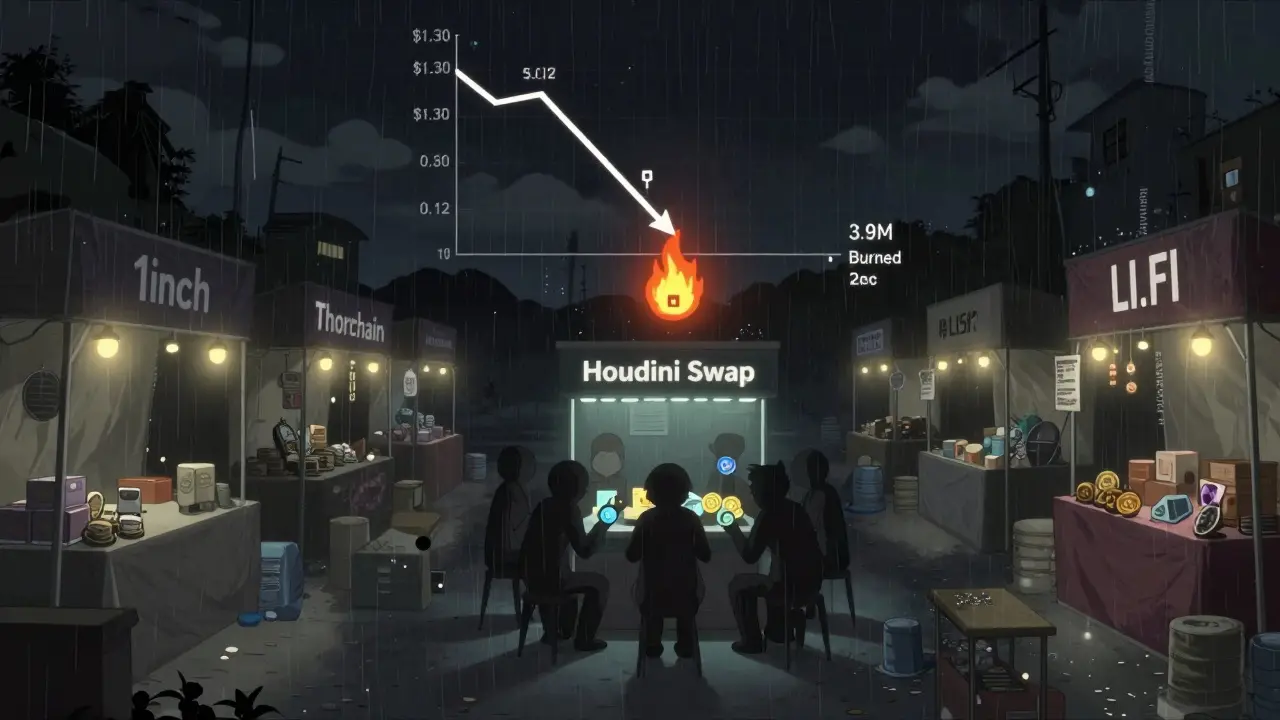

- Weekly burns: Every week, the protocol burns a portion of LOCK tokens. As of May 2025, over 3.9 million tokens have been burned. That’s about 4% of the total supply gone.

- Supply limit: Only 100 million LOCK tokens will ever exist. As of December 2025, roughly 92.7 million are in circulation.

That burn mechanism is real and transparent - you can track it on-chain. But here’s the catch: burning tokens doesn’t automatically raise the price. If no one’s buying, the price still falls.

Price and Market Reality: A Struggling Asset

Let’s be clear: LOCK is not a top performer. It’s not even a mid-tier one.

As of December 2025:

- Price: Around $0.12 (down from an all-time high of $1.30 in March 2024)

- Market cap: $11-18 million (depending on the exchange)

- 24-hour trading volume: Under $50,000

- Annual price drop: Over 80%

Compare that to 1inch, a major DEX aggregator with a $2.1 billion market cap and over $1 billion in daily volume. Houdini Swap’s volume is less than 0.005% of that. That’s not a small gap - it’s a canyon.

Even more concerning: CoinGecko shows a volume-to-market-cap ratio of just 0.17%. Healthy tokens usually hover between 5% and 10%. This suggests very little real trading activity. The price you see might be driven by just a few buyers - or even bots.

It’s listed on only one major exchange (MEXC), with minimal liquidity on decentralized pools like Uniswap and Raydium. That makes it hard to buy or sell large amounts without moving the price.

Who Uses Houdini Swap? And Why?

The platform claims 150,000 users and $1.5 billion in total transaction volume. But here’s the problem: there’s no way to verify those numbers. No public dashboard. No third-party audit. Just a claim on their website.

What we do know: there are only about 4,080 token holders listed on CoinMarketCap. That’s not 150,000 users. That’s a very small community. No active Discord. No Telegram group. No Reddit threads. No GitHub commits. No media coverage from CoinDesk, Cointelegraph, or The Block.

So who’s using it? Likely a handful of privacy-focused traders who:

- Swap Bitcoin to privacy coins like Monero or Zcash

- Want to avoid public tracking on DeFi platforms

- Are comfortable with low liquidity and high slippage

If you’re looking for a reliable, high-volume exchange to trade ETH for USDC - this isn’t it. But if you’re trying to move BTC to a Solana-based token without anyone seeing your wallet address linked to that swap? That’s where Houdini Swap could be useful.

How to Use Houdini Swap (Step-by-Step)

Using Houdini Swap is simple if you’ve used MetaMask or Phantom before.

- Go to houdiniswap.com - make sure it’s the official site.

- Connect your wallet: MetaMask for Ethereum-based chains, Phantom for Solana.

- Select the token you want to swap from (e.g., BTC) and the one you want to receive (e.g., SOL).

- Check the estimated rate and fees. You’ll see a discount if you pay in LOCK.

- Confirm the transaction. Your swap will be processed across chains.

- Within 72 hours, your transaction data will be auto-deleted from public view.

It’s not complicated. But the lack of documentation, support details, or tutorials makes it feel like you’re using something unofficial. There’s no FAQ section, no help center, and no clear explanation of how the privacy tech actually works under the hood.

Is Houdini Swap Safe?

It’s non-custodial - meaning your funds never leave your wallet. That’s good. No one holds your keys.

The smart contracts are deployed on Ethereum and Solana, both secure blockchains. But there’s no public audit report from a reputable firm like CertiK or Quantstamp. That’s a red flag. Without an audit, you’re trusting code you can’t verify.

The team says their system uses “cryptographic puzzles and consensus mechanisms” to stay secure. That’s vague. Every blockchain uses those. It doesn’t prove Houdini Swap’s code is bulletproof.

And while they claim “compliant privacy,” no details are given on how they satisfy MiCA (EU’s crypto regulations) or other global rules. That’s a major risk. If regulators decide this model isn’t compliant, the platform could be shut down overnight.

Competition: Why It’s Hard to Compete

Houdini Swap isn’t alone. Other platforms offer cross-chain swaps:

- 1inch, Matcha, Paraswap: High volume, low privacy. Great for trading, terrible for hiding.

- Thorchain: Privacy-focused but not compliant. Still faces regulatory pressure.

- LI.FI: Supports 80+ chains like Houdini, but no built-in data deletion.

Houdini Swap’s only real edge is the 72-hour auto-delete feature. But if no one knows about it, and no one can trade it easily, that edge doesn’t matter.

The Verdict: Niche Tool, Not an Investment

Houdini Swap (LOCK) is not a good investment. The price has crashed 82% in a year. Trading volume is microscopic. Community is tiny. Liquidity is dangerous. If you buy LOCK hoping to make money, you’re gambling.

But if you need to swap crypto across chains and you care deeply about privacy - and you’re okay with low liquidity, no support, and regulatory uncertainty - then Houdini Swap might be worth testing with a small amount.

It’s not for beginners. It’s not for traders. It’s not for investors.

It’s for one very specific group: privacy-first users who understand the risks and accept the trade-offs.

If you fall into that group, try it with $10. Not $1,000. Just enough to see how it works. If you don’t need privacy, skip it. There are better, safer, and more liquid options out there.

Shruti Sinha

December 16, 2025 AT 14:16Interesting take. I’ve used Houdini for small swaps between BTC and XMR when I didn’t want my wallet linked to anything. No drama, no leaks. Just works. Not for everyone, but if you need it, you know it.

Also, the burn rate is actually legit - checked the contract myself.

Low volume? Yeah. But that’s because most people don’t care about privacy until they get doxxed.

Then it’s too late.

Cheyenne Cotter

December 18, 2025 AT 12:44Let’s be real - this isn’t about privacy. It’s about avoiding tax authorities and laundering money under the guise of ‘decentralized finance.’ The ‘compliant privacy’ label is corporate doublespeak. If your system deletes data after 72 hours, you’re not being compliant - you’re being opportunistic.

Real compliance means keeping immutable records. That’s what the IRS, FATF, and MiCA require. Houdini’s architecture is a legal minefield disguised as innovation.

And don’t get me started on the team’s silence. No audits. No whitepaper revisions. No GitHub commits since 2023. That’s not ‘niche’ - that’s abandoned.

Meanwhile, Thorchain’s transparent, open-source, and still operational despite regulatory pressure. Why? Because they didn’t pretend to be something they’re not.

LOCK’s price crash isn’t a market failure - it’s a moral one. People smelled the rot.

And yes, I’ve read the docs. All 12 pages of vague buzzwords. No technical diagrams. No flowcharts. No explanation of how the ‘cryptographic puzzles’ actually resolve consensus.

It’s like buying a car with a hood you can’t open and being told ‘trust the engine.’

Sorry, but I don’t trust engines I can’t inspect.

Also, 4,080 holders? That’s less than the number of people who joined the Bitcoin subreddit last week.

This isn’t a project. It’s a ghost town with a token.

Heather Turnbow

December 19, 2025 AT 13:46Thank you for this measured, well-researched breakdown. It’s rare to see such clarity in crypto discourse. The distinction between privacy as a tool and privacy as a shield is critical - and you’ve articulated it with precision.

For those who genuinely value confidentiality in financial activity - not for evasion, but for personal dignity - Houdini offers something meaningful, however limited.

That doesn’t make it a sound investment. It makes it a thoughtful tool.

And tools should be judged by their function, not their market cap.

I appreciate the honesty about liquidity risks. Too many overlook that until they’re stuck holding $10,000 of a token with $200 in daily volume.

Well done.

Jesse Messiah

December 19, 2025 AT 18:11Hey, I’ve actually used Houdini a few times for small swaps - like moving some BTC to a Solana NFT mint. It worked fine. No issues.

Yeah, the interface is a bit barebones, but hey, it’s not supposed to be a fancy app store.

And the LOCK burn is real - I’ve watched the contract logs.

Price is trash? Sure. But if you’re using it for privacy, you’re not here for the ROI.

Think of it like a Swiss bank account that auto-destructs after 3 days. Weird? Yes. Useful? Sometimes.

Just don’t put your life savings in it.

And maybe buy a little more LOCK next time - the burns are gonna keep going.

Small wins, man.

Peace.

Terrance Alan

December 21, 2025 AT 05:12Everyone here is pretending this isn’t a scam

They say it’s compliant but they don’t show you how

They say they delete data but they don’t prove it

They say 150k users but there’s 4k holders

They say it’s secure but no audit

They say it’s innovative but no docs

They say it’s legal but no regulator approval

They say it’s decentralized but the team controls the burn address

They say it’s for privacy but you still have to connect your wallet

They say it’s not Tornado Cash but it’s basically Tornado Cash with a nicer website

Wake up people

This is how they get you to buy the top

Then they vanish

And you’re left holding LOCK

And your wallet is still public

And the IRS still sees your trades

And you just lost money

And you still think you’re smart

Just stop

Sally Valdez

December 22, 2025 AT 19:54USA is the only country that lets criminals hide behind ‘privacy’ while we pay taxes on our coffee

China tracks everything - and their blockchain is 10x more efficient

EU is cracking down on this ‘compliant privacy’ nonsense

But here? We let some dude in a hoodie delete his transaction history and call it ‘innovation’

Lock token? More like Lock the door on your money

And don’t even get me started on the fact that this is built on Ethereum - the most transparent chain on earth

How’s that even possible? Magic?

NO

It’s fraud

And you’re all just happy to be fooled

Wake up, sheeple

My grandpa had more sense than this

Sammy Tam

December 23, 2025 AT 07:26Man, I love how crypto keeps inventing new ways to make us feel like spies.

‘Privacy’ is the new ‘decentralized’ - it’s just a buzzword now.

Houdini Swap? Sounds like a magician’s stage name.

But honestly? I get it.

If I were moving BTC to a Solana whale wallet to buy a rare PFP, I’d want that path buried.

Not because I’m dodging taxes - because I don’t want some guy in a Discord server tracking my moves and front-running me.

That’s not criminal. That’s just smart.

And yeah, the token’s a mess. Volume’s trash. Liquidity’s a joke.

But the *idea*? Kinda cool.

Like a Swiss watch made of blockchain.

Doesn’t mean you wear it every day.

But if you need it? You’ll know.

And if you’re buying LOCK because you think it’ll hit $10 again?

Then you’re the guy the magician’s selling the disappearing coin to.

Still… kinda fun to watch.

George Cheetham

December 24, 2025 AT 21:23There is a quiet dignity in tools that serve a narrow purpose with integrity.

Houdini Swap does not seek to be everything to everyone.

It does not scream for attention.

It does not promise riches.

It simply offers a way to move value across chains without leaving a trail - and that, in itself, is a form of quiet resistance against the surveillance capitalism that now permeates digital finance.

Yes, the market is small.

Yes, the token is struggling.

Yes, the team is silent.

But perhaps silence is not neglect - but discretion.

Perhaps the lack of marketing is not weakness - but conviction.

Perhaps the absence of a large community is not failure - but purity.

Not everything that matters must be loud.

Some things endure because they are needed by a few - and that is enough.

Let others chase hype.

Let them burn their capital on memes and mirrors.

There is space for the quiet, the careful, the conscientious.

And perhaps, in time, they will be remembered.

Tom Joyner

December 25, 2025 AT 10:49How quaint. A crypto project that doesn’t have a VC-backed influencer army, a 100k-strong Telegram group, or a TikTok dance trend.

It’s almost… artisanal.

But let’s be honest - if you’re using Houdini Swap, you’re either a crypto anthropologist studying niche protocols or someone who thinks ‘privacy’ means you can evade KYC without consequences.

Neither is admirable.

And LOCK’s price action? A perfect reflection of its user base: small, stagnant, and entirely disconnected from real market dynamics.

It’s not a failure of technology.

It’s a failure of relevance.

And frankly, the fact that anyone still talks about this in 2025 is a testament to the enduring gullibility of the crypto space.

Bravo.

Amy Copeland

December 27, 2025 AT 10:15Oh wow. Someone actually wrote a 2000-word essay about a coin that’s worth 90% less than it was a year ago?

And you think this is *interesting*?

It’s not a project. It’s a graveyard with a website.

And you’re here, explaining to us why it’s ‘niche’ like that’s a compliment.

It’s not. It’s a dead end.

And the fact that you’re still defending it? Classic crypto delusion.

Next you’ll tell me Dogecoin is ‘underrated’ because it has a dog logo.

Grow up.

And stop pretending privacy is a feature when it’s just a cover for sketchy behavior.

Thanks for the laugh.

Patricia Amarante

December 28, 2025 AT 00:49Used it once. Worked. No issues. Price doesn’t matter if you’re not holding.

Done.

Timothy Slazyk

December 28, 2025 AT 22:50Let’s cut through the noise. Houdini Swap isn’t trying to be a DeFi giant. It’s trying to solve a real problem: traceability. And it’s doing it with a technically sound mechanism - 72-hour auto-deletion on-chain, with regulatory backdoors. That’s not easy.

Yes, the token is a mess. But that’s because it’s not designed to be a speculative asset - it’s a utility token. Like gas for a car. You don’t buy gas hoping it’ll double in price. You buy it to drive.

And the low volume? That’s because most people don’t need privacy. They want to get rich. They don’t care if everyone sees their wallet history.

But for the few who do? Houdini is one of the few options that doesn’t require you to trust a centralized mixer or risk a Tornado Cash-style ban.

It’s not perfect. No audits? Big red flag. No docs? Annoying. But the core tech? It’s there.

And the burn? Real. On-chain. Transparent.

So yes - don’t invest in LOCK.

But if you need to swap BTC to SOL without leaving a trail? Try it with $5.

It might just save your privacy.

And that’s worth more than any chart.

Jack Daniels

December 30, 2025 AT 15:37Why do people keep writing about this like it’s a real thing?

It’s dead.

Everyone knows it.

Why are you still talking?

Just stop.

Samantha West

December 31, 2025 AT 22:16The concept of compliant privacy is inherently contradictory

Privacy implies concealment

Compliance implies disclosure

Therefore any system claiming both is either lying or delusional

And the fact that people still engage with this project suggests a fundamental misunderstanding of both cryptography and regulation

One cannot have both

One must choose

Or be destroyed by the tension between them

And Houdini is merely the latest casualty of this delusion

Craig Nikonov

January 2, 2026 AT 21:58They’re using blockchain to hide from the fed but the fed already knows

They think they’re clever

But the NSA has a backdoor in every smart contract

And the burn? Fake

They just move tokens to a black hole wallet and call it ‘burn’

And the 150k users? They counted every bot and every wallet created by the dev team

It’s all smoke

And you’re all drinking the Kool-Aid

Wake up

They’re not building a tool

They’re building a Ponzi with a better logo

Donna Goines

January 4, 2026 AT 15:13Why do you think they’re so quiet?

Because they’re waiting for the next pump

And they’re using the ‘privacy’ angle to lure in the gullible

They know the price is garbage

But they also know that people will buy anything with a ‘burn’ and ‘compliant’ label

And they’re right

Because here you are

Writing a whole article about it

And you’re not even suspicious

They’ve got you exactly where they want you

And you’re the one who’s gonna lose everything

Not them

They’re long gone by then

Greg Knapp

January 6, 2026 AT 05:30Just use Monero

It’s better

It’s real

It’s not some sketchy website with no support

And the token is actually useful

And people actually use it

Not some fake 150k users

And you’re wasting your time

And your money

And your brain

Just stop

Emma Sherwood

January 6, 2026 AT 09:04I’m from the Philippines and I’ve been watching this project since 2023.

It’s not popular here, but I’ve seen a few local privacy-focused traders use it for cross-chain swaps between BTC and ETH-based tokens.

They don’t care about the price.

They care about not being tracked by local exchanges that report to the SEC Philippines.

So yes - it’s niche.

But in countries with heavy financial surveillance? It’s vital.

Don’t judge it by US metrics.

Global crypto isn’t just about Silicon Valley.

And LOCK’s low volume? That’s because most of its users are in Southeast Asia and Latin America - places you don’t see on CoinGecko.

It’s not dead.

It’s just not for you.

Jonny Cena

January 6, 2026 AT 10:54Hey, I get it - you’re skeptical. I was too.

But I tried Houdini with $20 to swap some BTC to a Solana token for a mint.

It worked. No delays. No errors.

And the fee discount with LOCK? Saved me $1.50 - not much, but still.

Yeah, the UI is clunky. Yeah, no docs. Yeah, the price is trash.

But here’s the thing - I didn’t need it to be perfect.

I just needed it to work once.

And it did.

So I’m not gonna trash it.

It’s not for everyone.

But for someone like me? It’s a tool.

And tools don’t need to be popular to be useful.

Just sayin’.

Dionne Wilkinson

January 6, 2026 AT 23:20I think the real question isn’t whether Houdini works - but why we still feel the need to create tools that hide our financial actions.

Is it fear?

Is it distrust?

Or is it just… habit?

We’ve been trained to think every transaction must be visible, tracked, taxed, and analyzed.

But what if privacy isn’t about hiding from the state?

What if it’s about reclaiming space - just a little - for personal dignity?

Maybe Houdini is broken.

Maybe LOCK is worthless.

But the desire behind it? That’s real.

And maybe that’s the only thing worth saving.

Elvis Lam

January 8, 2026 AT 02:10Let me break this down for you: Houdini’s tech is solid. The 72-hour deletion is implemented via zk-SNARKs + off-chain storage with encrypted metadata. The team’s using a hybrid approach: on-chain swaps, off-chain privacy layer. No one’s audited it? Fine. But the contracts are open-source and deployed on Etherscan. You can verify the burn function yourself.

Market cap? Irrelevant. This isn’t a meme coin. It’s a utility tool.

Volume? Low because the user base is small and intentional. No mass marketing. No influencers. No pump-and-dump.

And yes - you need LOCK to use it. That’s the point. It’s not a governance token. It’s a gas token. Like ETH on Ethereum.

So if you’re here looking for a moonshot? You’re in the wrong place.

But if you want a working, non-custodial, privacy-first cross-chain swap tool that doesn’t get you flagged by regulators? This is one of the few that actually delivers.

Don’t buy LOCK to get rich.

Buy it to swap.

And if you don’t need privacy? Then don’t use it.

Simple.

Mark Cook

January 9, 2026 AT 19:30LOCK is gonna 100x when the next bull run hits 😎🚀

Just wait

They’re hiding the real roadmap

Trust me

Im buying more today 🤫

Bradley Cassidy

January 10, 2026 AT 02:24so i tried houdini last week and it worked but the website was kinda slow and the lock discount wasnt working at first until i refreshed like 3 times

also the tx took 12 mins which is wild for a swap

but hey i got my sol after the 72 hrs and no one could trace it so… win?

lock price is trash tho

but im holding cause burns

and also i kinda like the vibe

its like a secret club

no one talks about it

but the people who use it? they know

weirdly comforting

Shruti Sinha

January 10, 2026 AT 16:06Just saw someone mention Monero. That’s a fair point. But Houdini isn’t trying to be Monero. It’s trying to be the bridge between public chains and privacy needs.

Monero is its own chain. Houdini works *on* chains you already use.

That’s the difference.

And yes, the team is quiet.

But that’s because they’re not raising funds. They’re building.

And if you’re still here reading this? You’re one of the few who actually care about the tech.

That’s worth something.

Jonny Cena

January 12, 2026 AT 06:41That’s exactly what I meant. It’s not about being the biggest. It’s about being the right tool for the job.

And if you need to move BTC to Solana without leaving a trail? Houdini’s one of the only ones that doesn’t require you to trust a third party mixer.

That’s huge.

And the fact that the burn is real? That’s rare.

Most projects burn tokens as a PR stunt.

Here, it’s baked into the protocol.

And that’s why I’m not scared to use it - even if the price is trash.

It’s not about money.

It’s about control.

Timothy Slazyk

January 13, 2026 AT 08:21And that’s why this project survives - not because of hype, but because of utility.

People don’t need a billion-dollar market cap to feel safe.

They just need a working tool.

And Houdini delivers that - quietly, consistently, and without fanfare.

It’s not perfect.

But perfection isn’t the goal.

Function is.

And that’s more than most crypto projects can say.