The Philippines froze $150 million in cryptocurrency assets in 2025 - not because of a hack, not because of a scam, but because the government finally said: no more unlicensed exchanges.

What Exactly Got Frozen?

The money wasn’t stolen. It wasn’t hidden in offshore wallets. It was sitting in accounts on 20 crypto platforms that never asked for permission to operate in the Philippines. These weren’t shady offshore shells - many were local-facing platforms with thousands of Filipino users. They accepted pesos, offered peso withdrawals, ran ads on Facebook, and even had customer service teams in Manila. But they never registered with the Securities and Exchange Commission (SEC), which in January 2025 made it clear: if you’re offering crypto services as a business in the Philippines, you need a license. The $150 million was mostly stablecoins - USDT and USDC - making up 68% of the total. Bitcoin accounted for 22%, and smaller altcoins made up the rest. These funds were spread across Ethereum (45%), Binance Smart Chain (30%), and Tron (15%). The SEC didn’t just shut down websites. They worked with internet providers to block access, froze wallet addresses on-chain, and prevented any withdrawals or transfers.Why Now? The Three-Year Wait

This wasn’t sudden. For three years, the Bangko Sentral ng Pilipinas (BSP) had put a hold on issuing new licenses to crypto exchanges. That moratorium, announced in September 2022, was meant to give regulators time to catch up. But while the BSP waited, crypto adoption exploded. By early 2025, Filipinos had invested over ₱6 trillion - roughly $107 billion - in digital assets. Coins.ph alone had over 20 million users. Most people didn’t know the difference between a licensed and unlicensed platform. They just wanted to buy Bitcoin with their mobile load or send money to family overseas faster than banks allowed. The SEC stepped in because the gray zone was getting dangerous. In the first half of 2025 alone, global crypto crime hit $2.17 billion in losses, according to Chainalysis. The Philippines, ranked 8th in global crypto adoption, was becoming a target. Scammers used unlicensed platforms to launder money. Others ran fake yield farms. Some simply disappeared with user funds. The SEC saw the writing on the wall: if they didn’t act, the damage would be far worse.Who Got Hurt?

The freeze didn’t just hit the exchanges. It hit ordinary people. A Reddit thread titled “My $15k frozen in Bitget PH - What now?” had over 1,200 upvotes and nearly 400 comments. Users described panic. Some had saved for years. Others used crypto to pay rent. One man in Cebu lost his life savings - $22,000 - because he trusted a platform that looked legit. He didn’t know it wasn’t registered. He just saw it had a local phone number and a Facebook page with 50,000 followers. Trustpilot ratings for the blacklisted platforms crashed from 4.2 stars to 1.3 in under two months. The top complaints? “Funds frozen without warning” and “No clear way to get them back.” The Philippine Consumer Welfare Association received over 3,200 formal complaints in just six months. The average loss per person? $4,670.

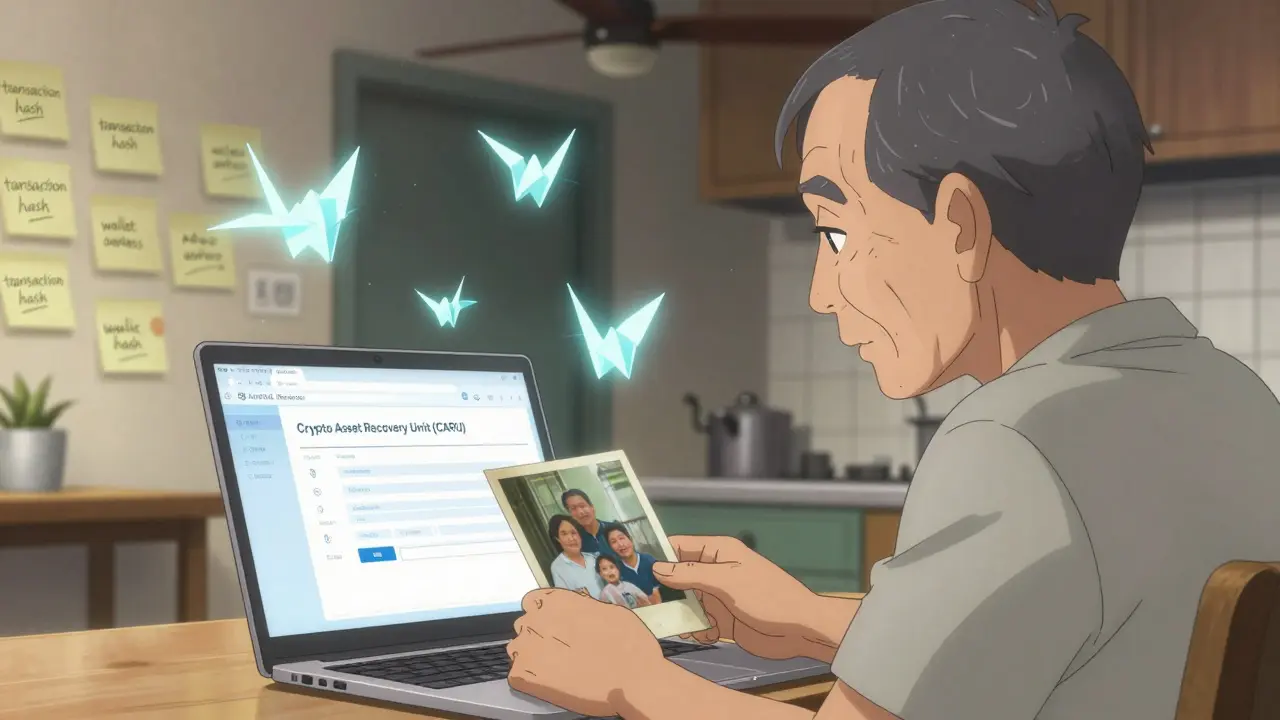

The Recovery Process - And Why So Few Got Their Money Back

The SEC created the Crypto Asset Recovery Unit (CARU) to help users get their money back. Sounds fair, right? Except the process was brutal. To apply, you needed:- A government-issued ID

- Proof of ownership - blockchain transaction hashes, wallet addresses, screenshots of deposits

- A sworn statement that your funds weren’t from illegal activity

- Access to a computer and the internet to submit everything online

What Did People Think?

Public opinion was split. A survey by the Association of Cryptocurrency Enthusiasts of the Philippines found 62% supported the crackdown. “Better to freeze suspicious funds than let scammers operate freely,” one user wrote on Facebook. That sentiment was shared by 27% of respondents. But 78% of users didn’t even know what licensing rules existed. They weren’t breaking the law - they just didn’t know it existed. The SEC didn’t run a public awareness campaign before the freeze. No TV ads. No SMS alerts. No school workshops. Just a legal notice buried in a PDF on their website. Dr. Maria Santos, a financial regulation professor at the University of the Philippines, put it bluntly: “The SEC sent a message. But they didn’t teach people how to hear it.”

What Happens Next?

The BSP’s three-year license freeze ends on September 1, 2025. On September 15, the first applications for official crypto licenses open. The SEC also launched a Regulatory Sandbox - a testing zone for 10 vetted platforms to operate temporarily while the full rules are finalized. The SEC says it plans to release verified funds starting November 1, 2025. But legal battles are brewing. Bitget and Bybit - both international exchanges with Philippine users - are challenging the freeze in court, arguing their users were never warned. If they win, the SEC could be forced to unfreeze funds before verifying legitimacy. Meanwhile, the government is drafting a new law: House Bill No. 4792. If passed, it would create the National Council on Digital Assets and Tokenized Investments (NCDATI) - a single body to oversee all crypto regulation, from licensing to consumer protection.What This Means for You

If you’re in the Philippines and use crypto:- Only use platforms listed on the SEC’s official registry. If it’s not there, it’s not legal.

- Don’t assume a platform is safe just because it has a local phone number or a flashy website.

- Keep records. Save your transaction IDs, wallet addresses, and deposit confirmations.

- Check the SEC website monthly. The list of approved platforms changes.

- Don’t assume Philippine users are low-risk. They’re some of the most active crypto adopters in the world.

- If you’re building a crypto product for them, register with the SEC before launching.

- Don’t wait for a crackdown. The Philippines is no longer a wild west.

The Bigger Picture

This isn’t just about the Philippines. It’s a preview of what’s coming everywhere. Crypto adoption is growing fast in emerging markets - Nigeria, India, Vietnam, Brazil. But regulation is lagging. The Philippines showed that you can’t let the market run wild forever. Eventually, governments step in. And when they do, the cost is high - for users, for exchanges, for trust. The $150 million frozen isn’t just a number. It’s the price of a market growing too fast, without rules. The question now isn’t whether regulation is needed. It’s whether the system can recover - fairly - for the people who believed in it.Why were $150 million in crypto assets frozen in the Philippines?

The Philippine Securities and Exchange Commission (SEC) froze $150 million in crypto assets in 2025 because they belonged to 20 unlicensed cryptocurrency exchanges operating illegally in the country. These platforms offered trading, custody, and conversion services without registering under SEC Memorandum Circular No. 4-2025 and No. 5-2025, which required all Crypto-Asset Service Providers (CASP) to obtain official authorization before serving Filipino users.

What types of crypto assets were frozen?

The frozen assets were mostly stablecoins - USDT and USDC - accounting for 68% of the total. Bitcoin made up 22%, and other altcoins like Ethereum, Solana, and Dogecoin accounted for the remaining 10%. The funds were spread across blockchain networks: 45% on Ethereum, 30% on Binance Smart Chain, and 15% on Tron.

Can users get their money back?

Yes, but only if they go through the SEC’s Crypto Asset Recovery Unit (CARU) process. Users must submit proof of identity, transaction history, and evidence that their funds were not from illegal activity. As of July 2025, only 12% of affected users completed the process successfully. Applications take an average of 47 days to process, and 34% are rejected due to incomplete documentation.

How many people were affected by the freeze?

Approximately 32,000 individual users were affected by the freeze, based on SEC data. The average loss per person was $4,670. The Philippine Consumer Welfare Association received 3,215 formal complaints between January and June 2025. However, only around 3,840 users successfully applied for fund recovery by July 2025.

Is it safe to use crypto in the Philippines now?

It’s safer - but only if you use SEC-licensed platforms. As of September 2025, the Bangko Sentral ng Pilipinas (BSP) lifted its three-year moratorium on Virtual Asset Service Provider (VASP) licenses. The first wave of licensed exchanges began operating in mid-September. Always verify a platform’s status on the SEC’s official registry before depositing funds. Unlicensed platforms remain illegal and risky.

What’s the difference between the Philippine crypto freeze and the US OFAC freeze?

The U.S. OFAC freeze in 2024 targeted crypto tied to sanctioned individuals or entities, like terrorist groups or drug cartels. The Philippine freeze targeted domestic platforms that never applied for a license - even if they weren’t involved in crime. The goal wasn’t punishment for wrongdoing, but enforcement of licensing rules. It was about regulation, not sanctions.

Robert Mills

January 26, 2026 AT 14:32Sunil Srivastva

January 27, 2026 AT 10:19Gurpreet Singh

January 27, 2026 AT 23:19Ramona Langthaler

January 29, 2026 AT 20:54Jerry Ogah

January 30, 2026 AT 14:24Andrea Demontis

January 31, 2026 AT 14:59Joseph Pietrasik

February 2, 2026 AT 11:09Richard Kemp

February 3, 2026 AT 13:04